Shares of the iShares Semiconductor ETF (SOXX +1.56%) were soaring last year, reflecting the continuing AI boom, and gains in top members like Nvidia (NVDA 0.29%), Advanced Micro Devices (AMD +1.72%), and Broadcom (AVGO +2.53%) helped drive the surge.

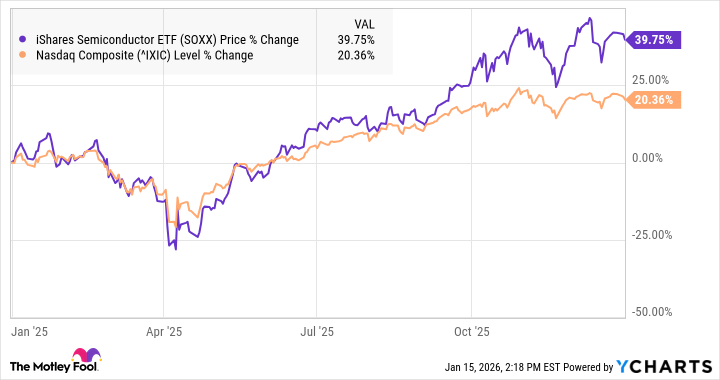

According to S&P Global Market Intelligence, the ETF finished the year up 40%. The chart below shows how the stock moved over the course of the year.

What happened with the SOXX last year

If the chart above looks like a high-beta version of the Nasdaq Composite last year, that's not a coincidence. Nearly all of the SOXX's holdings are traded on the Nasdaq, and some of them make up a significant percentage of the index, including Nvidia and Broadcom.

As you can see, the SOXX started out strong before dipping in March on concerns about tariffs and a weakening economy. It then bottomed out after the "Liberation Day" tariff announcement, and rebounded steadily, surging consistently as the AI trade came back into vogue. Then, toward the end of the year, volatility returned as fears of an AI bubble crept back into the market.

iShares' top three holdings are now Micron (Nasdaq: MU), Nvidia, and AMD, with each one making more than 7% of the fund. Micron had a particularly strong year last year as demand for its high-bandwidth memory (HBM) chips, which are used for AI, has jumped. As a result, sales and profits have soared, and the stock tripled last year.

Image source: Getty Images.

What's the forecast for the SOXX this year

The SOXX has been a longtime outperformer on the market as we've been in a golden age for semiconductors, and the advent of AI has only accelerated demand for chips.

Over the last year, the ETF jumped 1,160%, and it looks poised to continue beating the market as semiconductors are central to virtually every new and existing technology.

2026 is shaping up to be another strong year for the AI sector as Taiwan Semiconductor Manufacturing just reported strong quarterly results, showing that chip demand continues to soar.

An ETF like the SOXX, which tracks the PHLX Semiconductor Index, also rebalances once a year, rotating stocks in and out based on their relevance and other criteria. That arguably gives the ETF an advantage over individual stocks.

Year-to-date, the SOXX is already up 11.8% through Jan. 15, a good sign it's poised to beat the market again. Barring a collapse in the AI boom, the SOXX looks like a winner this year.