Artificial intelligence (AI) software solutions have been gaining impressive traction in various industries, and that's not surprising considering the productivity gains delivered by such solutions.

SoundHound AI (SOUN 2.39%) is one such company that provides voice AI solutions that help customers boost productivity. However, the share price of the AI software specialist is down over 41% in the past three months. But a closer look at SoundHound's growth and long-term prospects suggests it could be a long-term winner.

Let's see why that's likely to be the case.

Image source: Getty Images.

SoundHound AI is scratching the surface of a massive opportunity

SoundHound AI customers can create voice assistants and other voice-enabled solutions that can be deployed in applications such as cars, call centers, and restaurants. For instance, restaurants can automate their ordering systems and customer care with SoundHound's voice AI platform. The company's offerings are gaining solid traction in the automotive market, allowing drivers to interact with their vehicles via its intelligent voice assistant.

NASDAQ: SOUN

Key Data Points

SoundHound is also gaining customers in the healthcare and finance markets, with its voice AI agents helping schedule appointments, solve patient queries, and handle loan applications, among other things. Companies can remain in touch with their customers round the clock, thereby enhancing the customer experience.

These advantages explain why the voice AI market is anticipated to clock an annual growth of 28% through 2029, according to a third-party estimate. The voice AI infrastructure market is expected to grow by $12.5 billion between 2024 and 2029, and SoundHound is one of the best ways to capitalize on this growth.

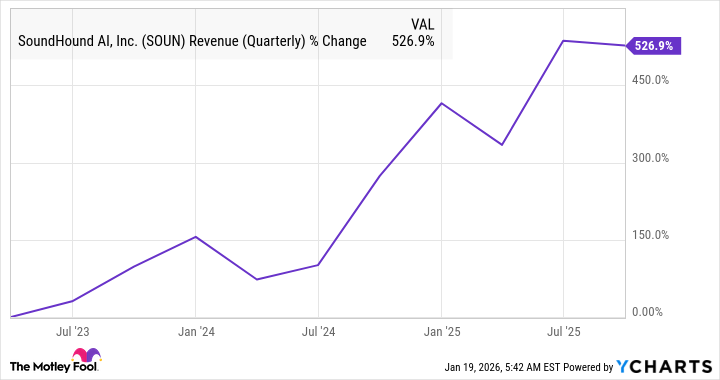

The company has built a solid customer base across various industries. Importantly, SoundHound claims to have more than 400 patents in voice AI, which could ensure it keeps growing at a faster pace than the end market. Moreover, it has partnered with leaders such as Nvidia to improve response times and enhance the accuracy of user interactions. These positives are translating into outstanding revenue growth for the company.

Data by YCharts.

Wall Street is underestimating its growth potential

SoundHound AI's revenue in 2025 is expected to nearly double from the prior year to just over $170 million. The company has yet to release its fourth-quarter results, but it won't be surprising to see its 2026 guidance come in well ahead of expectations.

Analysts expect a smaller increase of 37% in the company's revenue in 2026 to $230 million. However, SoundHound could maintain its terrific growth trajectory on the back of its solid customer base, which allows it to grow at a faster pace than the voice AI market, the fast-growing nature of the market it serves, and a terrific potential revenue backlog of $1.2 billion at the end of 2024.

These factors probably explain why SoundHound AI stock's median 12-month price target of $15.50 points toward potential gains of 40% from current levels. So, the Wall Street sentiment points toward a turnaround in SoundHound's fortunes on the stock market in the coming year. However, don't be surprised to see it deliver bigger gains as the voice AI market is still in its early phase of growth, and SoundHound is well placed to make the most of the lucrative opportunity unfolding here.