If you are a dividend investor looking to set yourself up with a lifetime of reliable income, consider a real estate investment trust (REIT) like Federal Realty (FRT 0.14%). But its 4.3% dividend yield probably won't interest you nearly as much as the 12% offered by fellow REIT AGNC Investment (AGNC +0.34%). Here's why AGNC could indeed set you up for life -- just not for a life of reliable dividends.

Federal Realty is the REIT king

If you are using dividends to pay for living expenses in retirement, you'll likely find Federal Realty very appealing. Not only is its 4.3% yield nearly four times larger than the 1.1% yield of the S&P 500 index, but it is also a touch above the 3.9% of the average REIT.

NYSE: FRT

Key Data Points

The biggest selling point for this landlord focused on strip malls and mixed-use assets is its dividend history. Federal Realty has increased its dividend every year for 58 consecutive years, making it a Dividend King. That is the longest streak in the REIT sector, and it is the only Dividend King among all REITs.

But you might still be tempted by AGNC Investment's huge 12% yield, which is nearly three times larger than the yield you would collect from Federal Realty.

You have to be very careful when you stretch for yield, however. An extremely large dividend yield is normally a sign that Wall Street thinks the investment is risky. In the case of AGNC Investment, the risk is in the dividend payment.

Image source: Getty Images.

AGNC is good at what it's trying to do

For starters, AGNC is a well-respected mortgage REIT, a niche of the broader REIT sector. It buys mortgages that have been pooled together into bond-like securities, so it operates a bit like a mutual fund, since it is really just managing a portfolio of mortgage securities. That company even reports a figure each quarter that is roughly akin to net asset value (NAV).

However, like many mutual funds, the REIT's primary goal is total return, which assumes dividends are reinvested. If you spend the dividend, you won't achieve the same results.

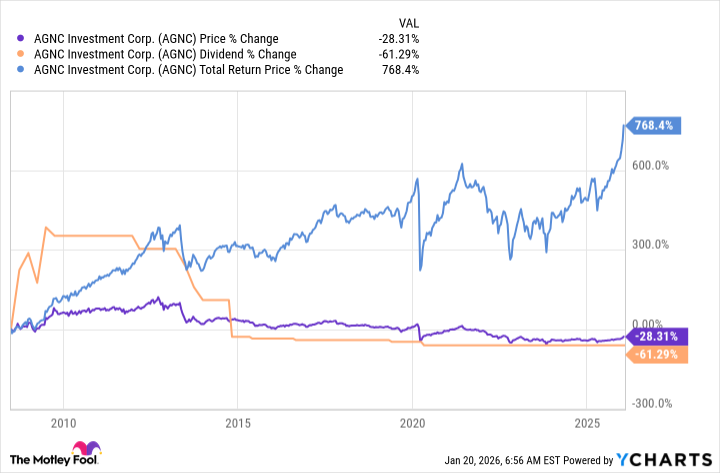

This is where investors need to be careful. From a total-return perspective, AGNC Investment has been very rewarding. The blue line in the graph below highlights this fact.

However, the orange and purple lines tell a very different story. The dividend (the orange line) has been volatile and has been trending lower for more than a decade. The purple line (the stock price) has generally followed the dividend higher and lower.

From a big-picture perspective, if you bought the stock a decade ago and spent the dividends you collected, you would be generating less income today and have less capital. That's not going to be the ideal outcome for most dividend investors.

AGNC can set you up, but for capital appreciation

If you are an investor looking to live off your dividends, AGNC isn't likely to be a good choice for your portfolio. The company's goal simply isn't compatible with yours, which is likely a steady, if not growing, dividend backed by a growing business. If you are an income investor, you should consider stocks like Federal Realty.

AGNC Investment would be a much better option for a long-term investor focused on total return, particularly when used as part of an asset allocation approach. This is a case where the stock could set you up for life, but only if you fully understand what you are buying and why.