Back in December 2024, I named my top 10 stocks for 2025. That group included:

- Taiwan Semiconductor Manufacturing

- ASML

- Meta Platforms (META +1.46%)

- Alphabet

- Amazon (AMZN +0.13%)

- CrowdStrike

- dLoca

- PayPal (PYPL +1.47%)

- MercadoLibre

- Nvidia

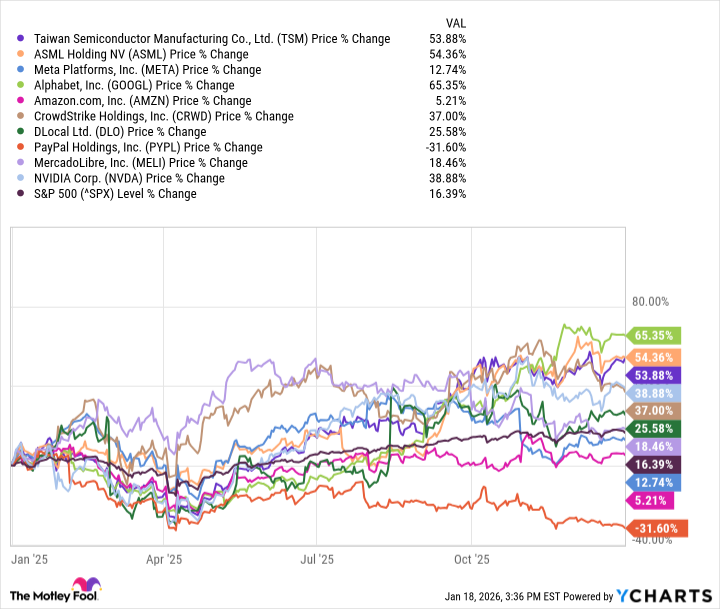

This list wasn't given in any particular order, and for the most part, these stocks crushed it. In fact, only three lost to the market. Considering the S&P 500 (^GSPC +1.16%) had a great 2025, that's not too shabby a call. But are the three that lost still buyable in 2026?

Image source: Getty Images.

The underperformance ranges

There's one large item that stands out when all 10 stocks are graphed versus the broader market: PayPal's terrible performance.

The S&P 500 had an impressive year, rising 16.4%. However, Meta Platforms, Amazon, and PayPal all underperformed. The reasons for their underperformance vary.

Meta Platforms was beating the market until it announced its third-quarter results, giving guidance that it would increase its data center capital expenditures again in 2026. Investors didn't like that and sold the stock off as a result.

Amazon underperformed pretty much throughout the entire year, and its underperformance mostly came from the fact that it had a high premium heading into 2025. Now that the premium has disappeared, it trades at the same price as other big tech stocks. With how strong Amazon's business has looked over the past few quarters, it could be set up for a huge 2026.

NASDAQ: AMZN

Key Data Points

Last is PayPal. PayPal is a turnaround story, and it isn't delivering much growth. However, the stock is incredibly cheap at less than 10 times forward earnings. At some point in time, stocks just become too cheap to ignore, especially one that has as much exposure to global payments as PayPal does.

So, which of these three stocks are buys for 2026?

All three could make a comeback in 2026

I think all three of these stocks are poised to beat the market in 2026. Meta can soar on solid returns on investments in its data center spending. If Amazon maintains the strength of its financial results that it ended 2025 with, then it should also bounce back.

NASDAQ: META

Key Data Points

I have the least confidence in PayPal, as it will take a serious change in market perception for it to do well. However, if PayPal continues repurchasing shares and growing its diluted earnings per share (EPS) at a double-digit pace, I think a turnaround is inevitable.

These three all make for solid picks in 2026, but they are far from a surefire bet.