For the last three years, the rise of artificial intelligence (AI) has been predominantly displayed in digital environments. Large language models (LLMs) such as ChatGPT and Gemini have transformed the software landscape.

But physical applications are also emerging. Autonomous systems, particularly self-driving cars, are among the most anticipated use cases in the physical AI landscape. Tesla (TSLA +0.19%) has long expressed a vision to be the market leader in autonomous driving. However, the company faces some stiff competition.

While you might think Tesla's biggest headwinds come from other automobile manufacturers, it's actually AI powerhouse Nvidia (NVDA +1.65%) that may pose to be the biggest threat. Let's dig into Nvidia's little-known autonomous driving business and unpack how the company may have just taken a direct blow to Tesla's future.

Image source: The Motley Fool.

What is Nvidia DRIVE?

Nvidia DRIVE is a suite of compute tools designed for autonomous vehicle development. The platform includes AI and deep learning capabilities that train vehicles to perceive and make decisions based on the external environment.

DRIVE Hyperion is Nvidia's turnkey solution for building a self-driving car. Hyperion combines a comprehensive stack of integral parts -- cameras, radar, lidar, microphones -- with safety software that can be seamlessly integrated with different vehicle designs. In essence, Nvidia is building out-of-the-box, end-to-end infrastructure for autonomous vehicles.

Earlier this month, Nvidia CEO Jensen Huang unveiled additions to the DRIVE ecosystem during a keynote at CES 2026. The company's new Alpamayo system has the potential to revolutionize the autonomous driving landscape.

For some time, one of the biggest challenges in developing self-driving technology was training vehicles to recognize their surroundings. This is only one part of the equation, though. Alpamayo uses reasoning-based vision language action (VLA) technology to help vehicles "think" and react. This could prove to be a game changer in critical scenarios featuring complex road designs or erratic human behaviors.

Huang referred to the ability of a car to understand and interact with the real world entirely on its own as the "ChatGPT moment" for physical AI.

NASDAQ: NVDA

Key Data Points

Is Nvidia DRIVE better than Tesla Full Self-Driving (FSD)?

Tesla and Nvidia have taken fundamentally different approaches to autonomous system development.

Tesla's Full Self-Driving (FSD) platform relies heavily on cameras installed in the company's vehicles. In addition, Tesla's cars are equipped with chip architectures designed in-house. While this vertically integrated approach gives Tesla significant control over its value chain, it can also limit the commercial viability of its technology.

By contrast, Nvidia's open-source model lowers the barriers to entry for developing self-driving vehicles. In other words, an automobile manufacturer can quickly partner with Nvidia and its suppliers to build an autonomous vehicle rather than spending years designing, testing, and iterating its own system from scratch.

While Nvidia's DRIVE platform may not yet have the scale of FSD, it has the potential to grow exponentially as competing automakers seek alternative solutions beyond Tesla's licensing.

Is Tesla stock a buy right now?

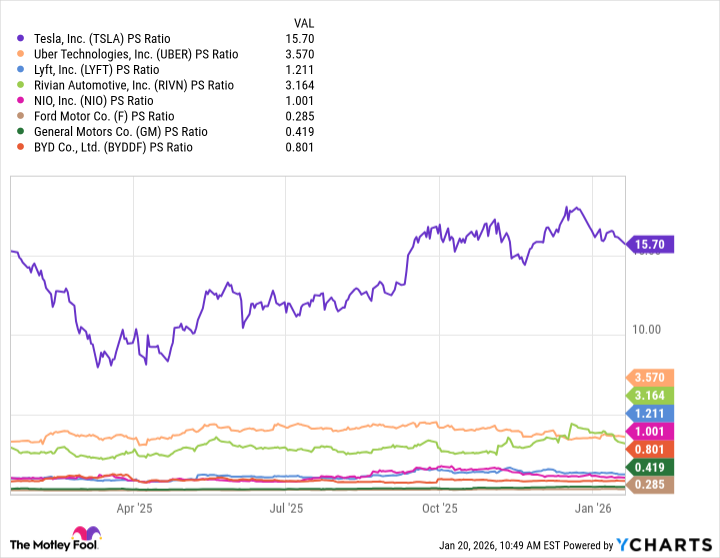

The chart below illustrates the price-to-sales (P/S) ratios for a number of traditional automakers and tech-enabled driving services platforms.

TSLA PS Ratio data by YCharts

Tesla is the clear outlier in this cohort. The company's P/S multiple of 15.7 reflects extreme optimism over the company's next-generation AI products. In other words, the market is already pricing Tesla less like a car business and more like a hypergrowth technology platform.

While the company's ambitions in robotaxis are inspiring, Tesla remains in the testing phases of this new business. For now, Tesla still needs to win over the regulatory landscape before it can launch its autonomous ride-hailing platform at scale.

To be fair, Nvidia is not immune to the regulatory environment either. However, DRIVE represents just one of the company's many different businesses.

While Nvidia hasn't put Tesla in checkmate, the company has smartly positioned itself to benefit no matter which automakers emerge as industry leaders should autonomous driving become widely adopted. Tesla, by contrast, is not in such a neutral position.

I think Tesla stock is priced to perfection and risks a harsh correction should FSD's potential underwhelm. Against this backdrop, I do not see Tesla as a smart stock to buy right now.