Gold is a precious metal, and it has been considered a store of value for ages because of its scarcity. Even to this day, investors buy it hand over fist during times of heightened political and economic uncertainty.

Then there is Bitcoin (BTC 1.64%), a fully decentralized cryptocurrency that was launched in 2009. Even though it's entirely digital, it's also a scarce asset because it has a fixed total supply that can never be changed. As a result, a growing number of investors characterize it as a digital version of gold.

But that thesis fell apart last year when gold and Bitcoin went in entirely different directions, and it's crystal clear that one of these assets is a much better buy in the face of elevated inflation, soaring government spending, and erratic economic policies. Read on.

Image source: Getty Images.

Bitcoin's status as digital gold is in doubt

Assets like stocks and real estate produce income, which means they can generate internal growth to create value for investors. Assets like gold and Bitcoin, on the other hand, produce nothing, so they draw their value from two primary sources: speculation, and the gradual devaluation of paper currencies.

Up until 1971, the U.S. was on the gold standard, which prevented the government from printing paper money unless it had an equivalent amount of physical gold to match. After abandoning that mechanism, money supply exploded, so the purchasing power of the U.S. dollar has collapsed by about 90% since then.

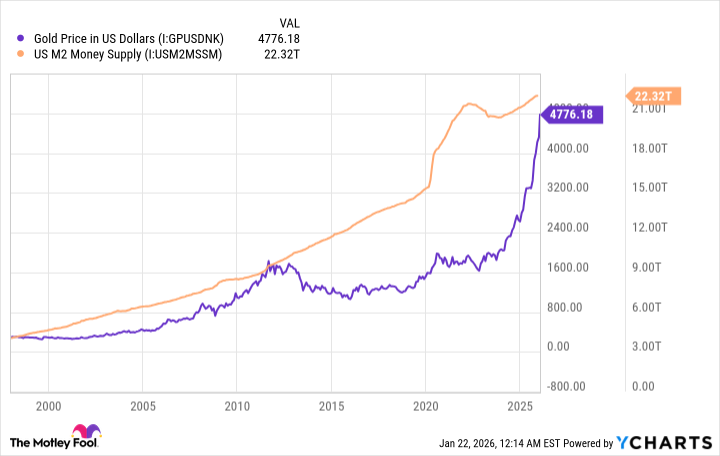

Per the chart, the price of gold in dollar terms has trended higher almost in lockstep with the increase in money supply.

Gold Price in US Dollars data by YCharts

As a result, any time investors fear a sharp increase in money supply is on the horizon, they pile into gold. The U.S. government ran a budget deficit of $1.8 trillion in fiscal 2025 (ended Sept. 30), which sent the national debt to a record high of $38.5 trillion. Throughout history, governments have opted to increase money supply to devalue their domestic currencies in order to make challenging fiscal deficits easier to manage. This time probably won't be any different, which is why gold soared by a whopping 64% last year.

Bitcoin, however, fell by 5% on the year, which puts into serious doubt the idea that it's a digital equivalent to the shiny yellow metal. This is concerning in my opinion, because the cryptocurrency isn't very useful in any other capacity.

CRYPTO: BTC

Key Data Points

Real gold looks like the better buy in 2026

Bitcoin is fully decentralized, which means no person, company, or government can control it. It is also built on a secure and transparent system of record called a blockchain, which gives investors confidence to hold it for the long term. Combined with its capped supply of 21 million coins, these factors have contributed to the cryptocurrency's meteoric rise in value.

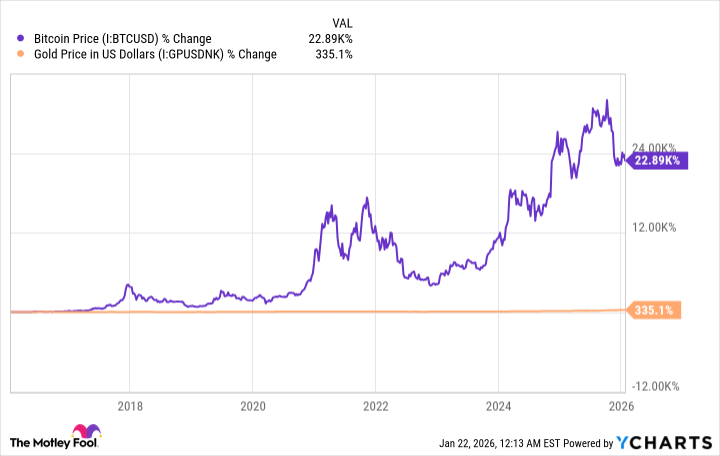

During the past 10 years, Bitcoin has obliterated gold in terms of performance. Their returns aren't even in the same stratosphere, with the cryptocurrency surging by 22,890%, and the shiny yellow metal climbing by just 335%.

Bitcoin Price data by YCharts

However, this is one of those cases where past performance is absolutely not a reliable indicator of future results, and 2025 was proof of that. But here's the burning question: What could be in store for 2026?

The U.S. government is on track for another trillion-dollar deficit during fiscal 2026, which will propel the national debt to even greater heights and stoke further fears about the growing money supply and weakening dollar.

Moreover, the Federal Reserve has cut interest rates six times since September 2024. Plus, the central bank recently ended its quantitative tightening program and is now actively buying government-backed securities once again, which increases the size of its balance sheet. An increasing money supply is a typical consequence of both of these policy stances.

Therefore, this year is likely to serve up very similar political and economic conditions to last year, meaning gold will probably be a much better buy than Bitcoin once again.