Some real estate investment trusts (REITs) are very clear about their dividend goals. For example, Realty Income specifically states that it is "committed to providing our shareholders with dependable monthly dividends."

AGNC Investment (AGNC +0.47%) is a bit more circumspect, stating that it is trying to provide "favorable long-term returns for our stockholders through substantial monthly dividend income." There is an important difference between these two statements.

The approach matters for REITs

Realty Income is a traditional property-owning REIT. It buys physical properties and then charges tenants rent, as you would if you owned a rental property. The difference is that Realty Income operates on a much larger scale, with more than 15,500 properties in the U.S. and Europe.

Image source: Getty Images.

Realty Income prides itself on its reliable dividends, even trademarking the nickname "The Monthly Dividend Company." It has increased its dividend annually for 30 consecutive years. If you are looking to create a reliable income stream, it's the type of stock you will want to examine, with its attractive 5.3% yield right now.

AGNC's yield is 12.2%, more than twice as high as Realty Income's. That might entice some investors to consider AGNC over the other, especially since they are both REITs.

Except that AGNC isn't a property-owning REIT; it is a mortgage REIT (mREIT). And that changes the investment equation in a big way.

AGNC Investment is focused on total return

AGNC manages a portfolio of mortgage securities. These are bond-like assets that have been created by pooling together mortgages. Its business is very similar to that of a mutual fund. The company even reports tangible book value per share, which is roughly akin to the net asset value (NAV) provided by mutual funds.

The mREIT is basically always managing its mortgage security portfolio as it tries to maximize total returns for shareholders. You can argue that property-owning REITs are doing something similar. But properties aren't as easy to buy and sell, so they tend to be held for much longer periods of time.

And property portfolios need to be operated on a day-to-day basis, while mortgage securities aren't that way at all. They are just passing mortgage payments through to their owners, so there's nothing for the bondholders to "operate."

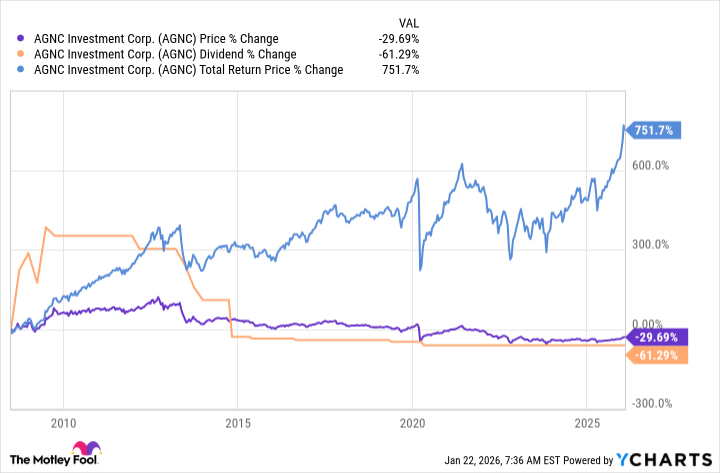

And, perhaps more importantly, AGNC's focus on total returns requires the reinvestment of dividends. That's a problem for shareholders looking for a consistent or growing income stream.

As the chart above highlights, AGNC has achieved its total-return goal. In fact, since its initial public offering, it has actually outperformed the S&P 500 index on a total return basis. What the graph also shows, however, is that it has not provided a consistent and growing dividend. The payout has been highly volatile, and during the past decade, it has been trending lower. The stock price has headed lower with the dividend.

Make sure you know what you are buying

AGNC is a well-run mREIT that has been rewarding for those who have reinvested their dividends in search of a high total return. If, however, you had spent the dividends on living expenses, you would have ended up with less income and less capital. That would likely be seen as a bad outcome for most dividend investors.

If you are looking for total return, AGNC Investment is worth a deep dive. If, however, you are looking for reliable, growing dividends for income, go with a property-owning REIT like Realty Income. You will have to give up some yield, but you will likely be much happier with your outcome.