Artificial intelligence (AI) investing has started to become a bit concerning for some investors. Some believe that the market is in an AI bubble and that it could burst any day and send some of the largest stocks tumbling. While this is a possibility, I think investors need to take a more refined view.

I see both the absence and the emergence of a bubble in the AI sector at the same time. How can that be? It all depends on which companies you look at.

Some stocks, like hardware providers, are actually trading at fairly cheap valuations compared to other big tech stocks. On the flip side, certain AI application companies have extreme valuations, such as OpenAI. However, OpenAI isn't public yet, so you can't bet for or against it.

However, there's one AI stock trading on public markets that is becoming common to bet against: Palantir (PLTR +2.23%). Palantir is an AI software company, and analysts have issued many warnings about the stock. So, should you bet against it?

Image source: Getty Images.

Palantir's business is excelling

Palantir makes artificial intelligence-powered data analytics software. The primary idea is to take information from multiple data streams and give its users real-time insights to help them determine what to do next. The company also has features to automate the decision-making process with generative AI tools. Palantir's software originally catered to government businesses, but it found adoption in the commercial sector as well.

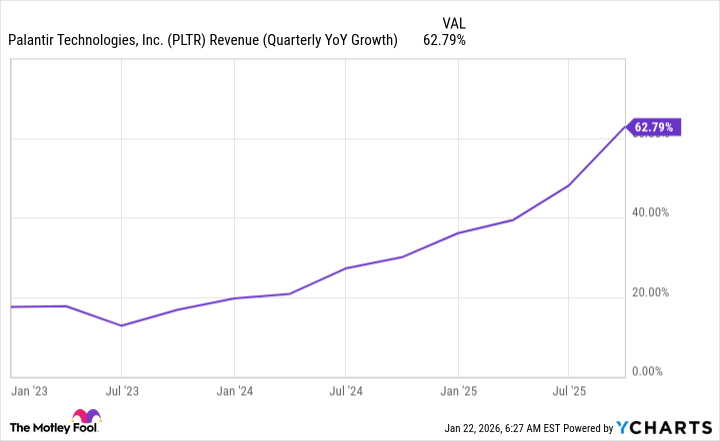

Both government and commercial clients have rapidly adopted Palantir's software, and its revenue growth has been nothing short of astounding.

PLTR Revenue (Quarterly YoY Growth) data by YCharts. YoY = year over year.

Palantir's revenue growth continues to accelerate, showcasing how popular an AI offering it is becoming.

With just that information, you'd be a fool to bet against Palantir's stock. But there's more to the picture.

What you pay for a stock matters

Palantir's impressive performance comes at a cost. While many software companies trade for 10 to 20 times sales, with some getting as expensive as 30 times sales, Palantir has completely blown by this level.

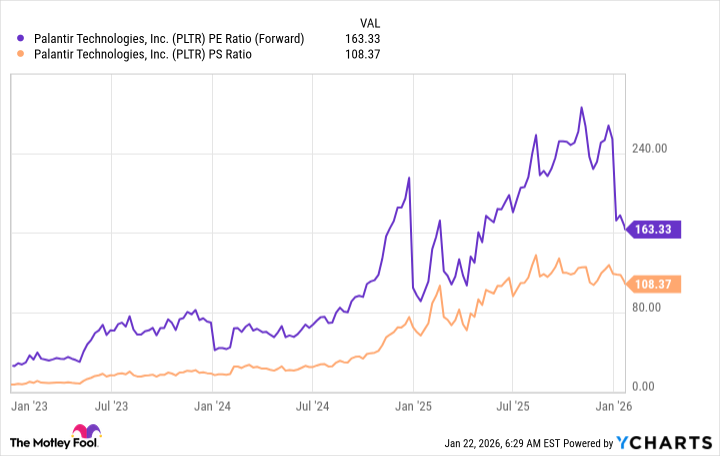

PLTR PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio. PS Ratio = price-to-sales ratio.

It trades for nearly 110 times sales. It is also fully profitable, so using the forward price-to-earnings (P/E) ratio is also valid. At more than 160 times forward earnings, it's among the most expensive stocks in the market.

As a result of its high valuation, Palantir stock may struggle if the company sees its growth decelerate throughout the year. That's exactly what Wall Street analysts are predicting, with 2025's revenue growth expected to be about 54% and 2026's expected to be about 43%.

NASDAQ: PLTR

Key Data Points

That could set the stock up for disaster, making it a candidate to bet against. However, I wouldn't suggest shorting the stock. Palantir's stock has long exceeded normal valuation ranges. It may continue to do so, making it a good stock not to short. Instead, investors can avoid it and invest in one of the many popular AI options on the market.