Many of America's largest companies reported operating results beginning this month for the fourth quarter of 2025, giving investors a valuable update on the state of their businesses. Netflix (NFLX +3.09%) released its results on Jan. 20, noting a record amount of subscribers for its industry-leading streaming service and impressive growth in its still-developing advertising business.

Despite Netflix's reported success, the stock price is down 36% from its mid-2025 peak. Investors are weighing the value of its maturing business and are considering the potential impacts of the recently announced plans to spend $82 billion to acquire Warner Bros. Discovery.

The stock is still up 78,000% since going public in 2002, and the current business appears to be doing well, so the recent dip might be a mere speed bump ahead of further gains in the future. Opportunities for long-term investors to buy this stock at such a steep discount don't come around often, so should investors make a move?

Image source: Netflix.

Netflix isn't resting on its success

The streamer ended 2025 with over 325 million paying subscribers, so it continues to tower over its main competitors, Amazon Prime and Disney's Disney+, which have 200 million and 131.6 million members, respectively. But staying ahead of the pack requires constant innovation, which involves testing new pricing structures that appeal to people of all income levels.

In 2022, Netflix launched a low-cost subscription tier supplemented by advertising. It is priced at $7.99 per month, which is much cheaper than the Standard ($17.99 per month) and Premium ($24.99 per month) tiers.

But each ad-tier member becomes more valuable over time, because Netflix can charge businesses more money for advertising slots as the subscriber base grows. The company can also charge more for ad slots when showing premium content, which is why it's leaning heavily into live sports, from boxing to the National Football League.

Netflix's advertising business has incredible momentum right now. Its revenue doubled year over year in 2024, and then more than doubled again to $1.5 billion in 2025. It represented a mere fraction of the company's total revenue of $45.2 billion, but it won't take long for the ad business to become far more significant if it continues growing at this pace.

NASDAQ: NFLX

Key Data Points

In December, Netflix announced plans to acquire Warner Bros. Discovery, which owns the rights to blockbuster movie franchises like Harry Potter and The Lord of the Rings, in addition to smash-hit TV shows like The Sopranos, Friends, The Big Bang Theory, and Game of Thrones. Warner also owns the DC Entertainment universe, which includes the rights to Batman and Superman movies, and more. These assets could give Netflix's ad business another major boost.

Although it would be a fantastic deal, regulators will have real concerns about its impact on the competitive landscape. Warner is the world's fourth-largest provider of streaming services, so there will be questions about whether the deal will make Netflix far too dominant. It's possible no other streaming service will ever be able to match its scale if this acquisition is approved, so there is no guarantee it actually goes ahead.

Netflix stock is trading at an attractive level

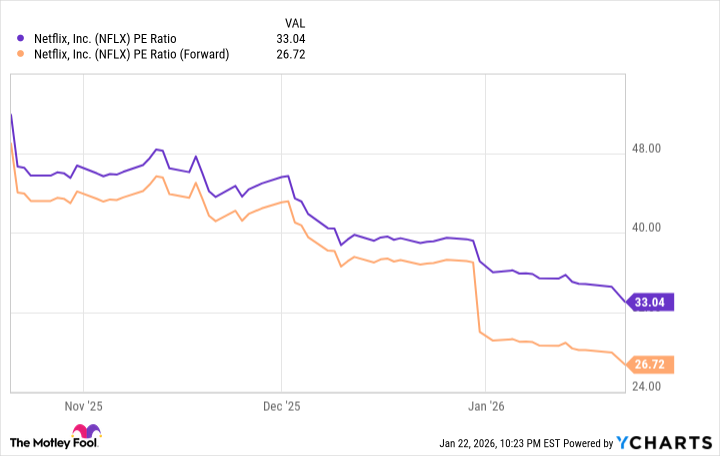

The company generated earnings of $2.53 per share in 2025, placing its stock at a price-to-earnings ratio (P/E) of 33. That is roughly in line with the P/E of the Nasdaq-100, which is currently 32.6, so you could argue Netflix is fairly valued relative to its peers in the technology space.

But looking ahead, Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Netflix's earnings could grow to $3.12 per share in 2026, placing its stock at a forward P/E of just 26.6.

Data by YCharts.

That means Netflix stock would have to climb by 24% by the end of this year just to maintain its current P/E of 33, so there is a strong potential return on the table for investors. There will be some volatility along the way as Wall Street learns whether or not the Warner Bros. deal is allowed to proceed, but even if it gets struck down, Netflix still has a very bright future.

Management expects the advertising business to roughly double in size yet again this year, and the company continues to outspend its peers to create and license content, ensuring its platform remains the most attractive destination for new potential subscribers. As a result, I think the recent 36% decline in Netflix stock could be a great buying opportunity.