Wall Street's obsession with artificial intelligence (AI) stocks has helped fuel a historic bull market over the last few years. Megacap technology stocks in particular have witnessed pronounced valuation expansion throughout the AI revolution, which has contributed to some frothiness in the major indices.

As growth stocks roar higher, it's becoming more challenging to find a good deal in the market. I've found one AI stock that stands out from the pack in this regard, though.

Last year, shares of Micron Technology (MU 2.64%) nearly tripled. This performance only adds to the company's illustrious shareholder returns. Since its initial public offering (IPO) in 1984, Micron stock has gained about 28,700%.

While it may appear that Micron is turning into the market's next momentum stock, I think its rally has only just begun. Let's dig into what makes Micron such an integral piece of the AI ecosystem and analyze why the stock could be about to go parabolic.

Image source: Micron Technology.

What does Micron do and why is it important for AI development?

When it comes to semiconductor stocks, smart investors understand that not all chips serve the same purpose.

Nvidia and Advanced Micro Devices design graphics processing units (GPUs) -- the hardware on which generative AI models like ChatGPT are trained. By contrast, Broadcom helps the hyperscalers build custom silicon for specific workloads.

Micron operates in a completely different pocket of the chip landscape. The company specializes in high-bandwidth memory (HBM) and storage solutions. For much of its history, Micron played an integral role in the consumer electronics market -- often benefiting from upgrade cycles in PCs and smartphones.

While Micron's value proposition to the tech landscape was clear, the cyclical dynamics of consumer hardware was a blemish on the company's growth potential. That narrative is swiftly changing thanks to the AI boom.

Micron's business is growing like a weed

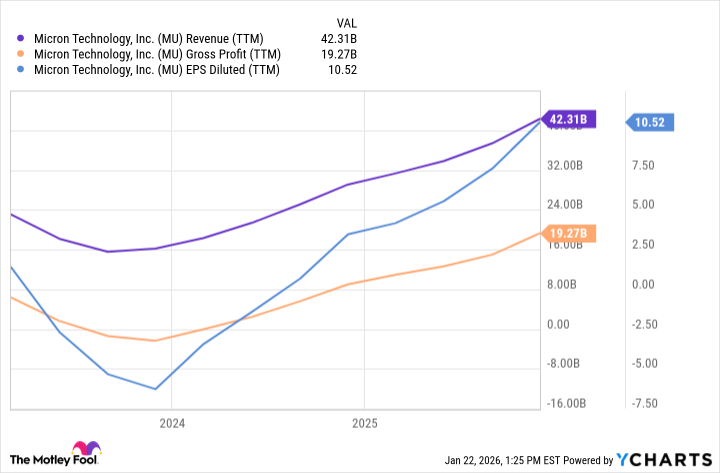

Over the last year, Micron's revenue has kicked into a new gear. This acceleration underscores that AI developers are beginning to allocate larger portions of their capital expenditure (capex) budgets to memory and storage as opposed to just GPU procurement.

MU Revenue (TTM) data by YCharts.

What's even more impressive is the company's ability to complement its revenue profile with improving profit margins. Considering the total addressable market (TAM) for HBM chips is expected to grow at a 40% compound annual growth rate (CAGR) and reach $100 billion by 2028, I suspect Micron will continue to witness surging sales and maintain healthy profits.

Micron stock is dirt cheap

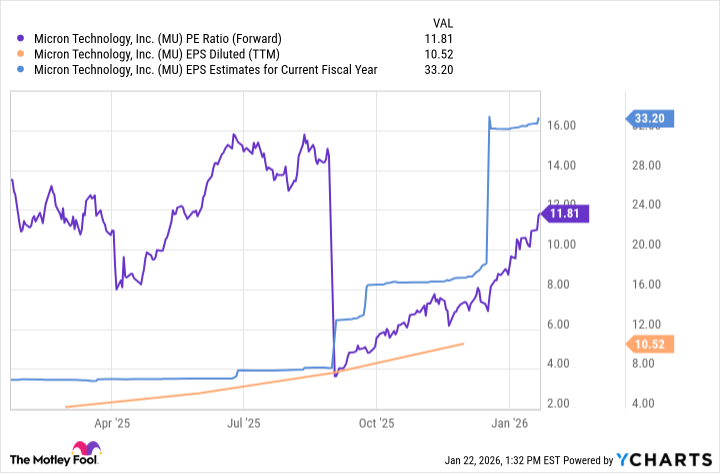

Over the last year, Micron generated about $10 in earnings per share (EPS). However, Wall Street's consensus estimate for this year is $33.20. Nevertheless, Micron currently trades at a rather pedestrian forward price-to-earnings (P/E) multiple of 12.

MU PE Ratio (Forward) data by YCharts.

Nvidia and Broadcom have commanded forward earnings multiples that are double or even triple compared to Micron. While those companies may not be direct competitors, the bigger takeaway here is that the market has rewarded leaders in the broader chip value chain with premium valuations.

If Micron's forward P/E were to double, which I think is reasonable considering the pace of its compounding earnings profile, the stock could reach $780 per share by year-end -- essentially implying a 100% increase to current prices.

In my eyes, Micron stock is the biggest bargain of the AI infrastructure trade right now. I see the company as a no-brainer for investors with a long-term horizon.