Shares of Intel (INTC 5.72%) sank on Monday, finishing down 5.7%. The drop came as the S&P 500 gained 0.5% and the Nasdaq Composite rose 0.4%.

The struggling chipmaker's stock is still sliding after its most recent earnings disappointed investors. While the company technically beat fourth-quarter estimates, management warned that "acute internal supply constraints" will lead to depressed sales and earnings figures in the coming months and set forward targets well short of analyst expectations. The stock dropped nearly 20% on Friday following the company's Q4 release.

NASDAQ: INTC

Key Data Points

Intel has a production issue

The core issue for Intel right now isn't a lack of demand; instead, the company is struggling to deliver enough product. CFO David Zinsner admitted that the company does not have the capacity to meet current demand.

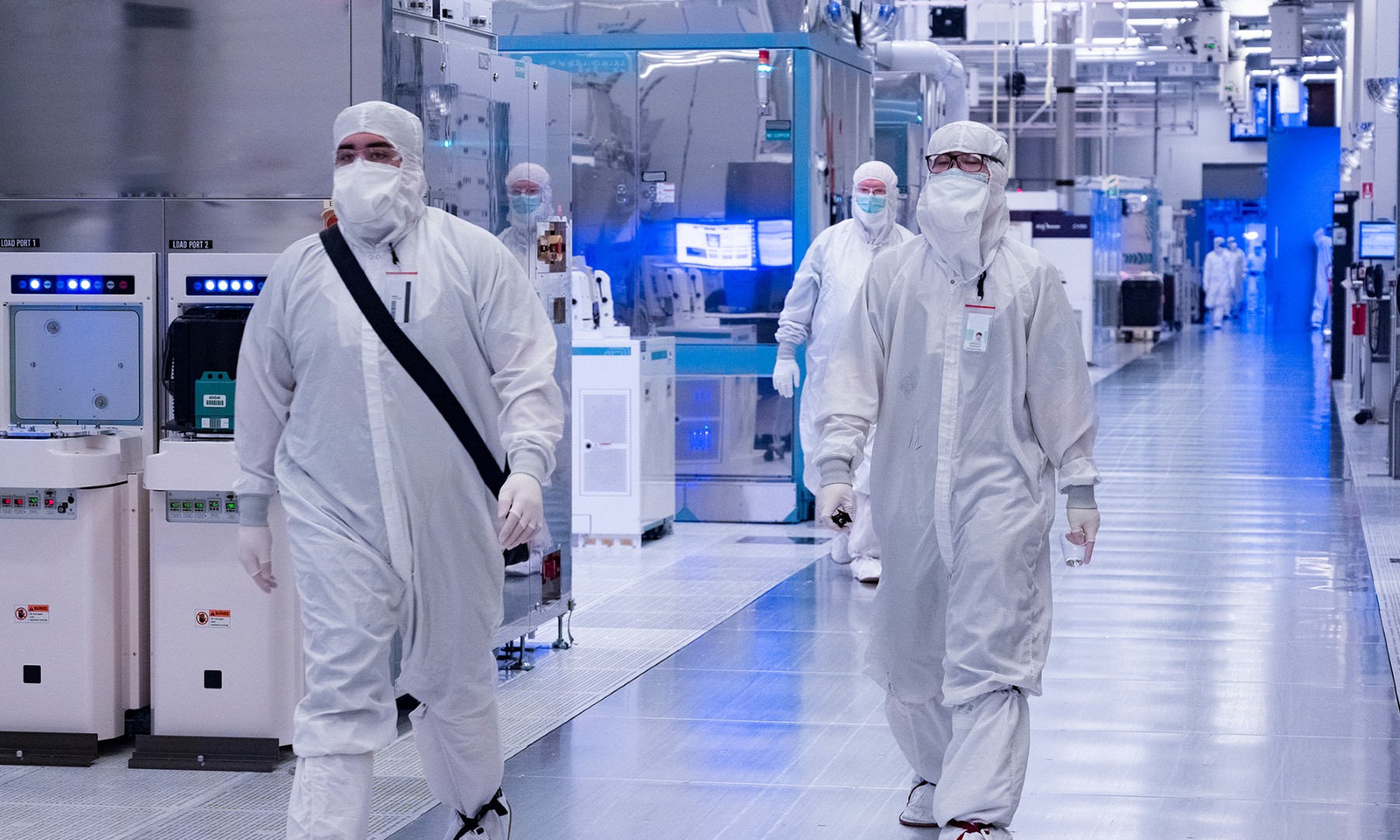

Image source: Getty Images.

This is a frustrating setback for CEO Lip-Bu Tan's vision, as it suggests that even as Intel's technology improves, its manufacturing efficiency remains a major hurdle. The company is currently operating at near-full capacity but is struggling with yields as it ramps up its most advanced fabrication.

While these are serious issues and challenges remain significant for the struggling chipmaker, I think Intel is still a solid pick for long-term investors.