A leadership change has finally occurred at Berkshire Hathaway (BRK.B 1.29%). At the end of 2025, Warren Buffett stepped down as the chief executive officer of the trillion-dollar conglomerate after a 60-year run transforming the tiny business into one of the largest holding companies in the world. Berkshire's new CEO is Greg Abel, who previously led the company's operating businesses.

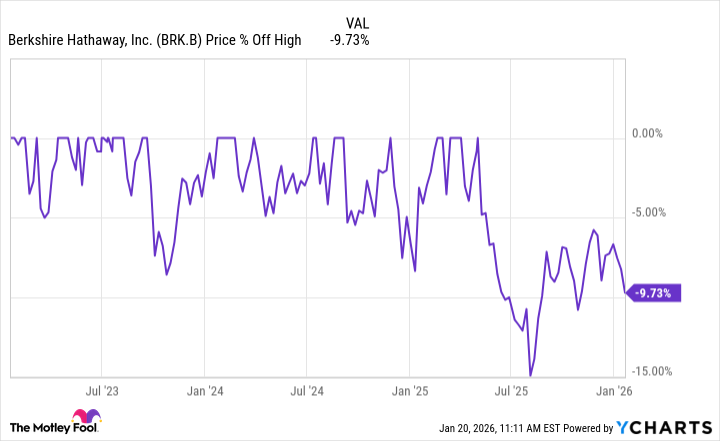

Berkshire Hathaway stock is now down about 10% from highs set around the time of Buffett's retirement announcement last year. Does that make the stock a buy?

NYSE: BRK.B

Key Data Points

Abel's operating businesses

Who is Greg Abel? He is a Canadian who joined Berkshire Hathaway after the acquisition of MidAmerican Energy, which was renamed Berkshire Hathaway Energy in 2014. Since 2008, he has led the energy division, with expanded duties in 2018 to all of Berkshire Hathaway's non-insurance businesses.

These include Berkshire Hathaway Energy, the BNSF railroad, Lubrizol specialty chemicals, and retailers such as See's Candies. Combined, these businesses generate about $25 billion in operating earnings a year, making them one of, if not the largest, drivers of value creation for Berkshire Hathaway in the 21st century as it transitioned from an investment vehicle to a wider conglomerate.

Abel has performed admirably running these business units, which is likely why he was given the executive role after Buffett. Now, he is leading the entire Berkshire Hathaway organization and has the final say on capital allocation.

Image source: Getty Images.

A $380 billion problem

Buffett made his mark as an investor. Berkshire Hathaway's large investment portfolio reflects that to this day, with a portfolio totaling more than $300 billion at the end of last quarter. Stock holdings include Apple, American Express, and Occidental Petroleum.

Where problems may arise is managing this investment portfolio, which Buffett was mainly in charge of for the last decade. He had two vice presidents running investments for Berkshire, but one of them, Todd Combs, just left for JPMorgan. That leaves Ted Weschler behind to manage hundreds of billions in assets, while the other leaders at the company -- Ajit Jain and Greg Abel -- have backgrounds in different fields (insurance and energy, respectively).

Last quarter, Berkshire Hathaway had $380 billion in cash on its balance sheet, earning relatively little interest income. With tens of billions in profits coming in from the operating businesses and insurance every year, this cash pile is only set to rise unless the leadership team can find a way to deploy that capital.

An idea that may come to mind is sending out a large special dividend to shareholders. This would be a tax-free way to return capital to Berkshire Hathaway's shareholders while also solving the problem of having a dead weight cash position that is growing by the day. If new management cannot find a way to deploy hundreds of billions in capital to new ideas, this is probably the best option for shareholder returns at some point in the coming years.

Is Berkshire Hathaway stock a buy now?

With a market cap of about $1.05 trillion, Berkshire Hathaway looks cheap relative to the profitability of its operating businesses. Its equity portfolio is about $300 billion, while its cash position is now probably around $400 billion. Subtract these two figures from the current market cap and add $82 billion in debt on the balance sheet, and you have an enterprise value of $432 billion for the operating businesses.

In 2024, Berkshire's operating earnings, excluding insurance investment income, were $34 billion. That is about 13 times its current enterprise value.

Berkshire Hathaway is not going to be a hypergrowth stock for your portfolio. However, at the current multiple of operating earnings, the stock looks like a steady blue chip to buy and hold right now, with a huge cushion from its large and growing cash pile. If you are confident in this new management team, you might want to consider buying the dip on Berkshire Hathaway stock today.