Intel (INTC +11.93%) stock suffered for years as peers like AMD, Nvidia, and Taiwan Semiconductor (TSMC) surpassed it on technical fronts, designing better chips and building better fabrication infrastructure. Previous management teams tried and failed to return the company to its former leadership position in the chip industry.

However, under the new leadership of CEO Lip-Bu Tan, technical improvements and a coherent artificial intelligence (AI) strategy have begun to change investors' perceptions of the chip giant.

The question now is whether these changes are going to make Intel stock a smart long-term bet.

Image source: Intel.

Intel's improvements

Tan rose to prominence in the chip industry as CEO of Cadence Design. In his 13 years at the helm, its stock rose by around 2,650%. He also spent around two years previously as a member of Intel's board from 2022 to 2024 before resigning from that role, allegedly over disagreements with leadership about how to reinvigorate the company.

But since March 2025, he has been the leader at Intel. It's still too early to see if he will be just as successful there as he was at Cadence. Nonetheless, even though Tan has held the CEO job at Intel for less than a year, a visible AI strategy seems to have already come together.

Last fall, Intel announced a partnership with Nvidia to develop custom data center and PC-related products. The deal tied the fortunes of Intel to the leader in AI accelerators.

Moreover, Intel released a new data center GPU called Crescent Island that is designed to handle AI inference workloads, with a high memory capacity and competitive energy efficiency.

Additionally, during the annual CES trade show that took place in Las Vegas earlier this month, it debuted its first AI PC platform built on its 18A process technology. These chips' backside power delivery design gives them a slight performance edge over those manufactured by foundry leader TSMC.

Effects on Intel stock

So far, investors appear impressed. The market has bid Intel stock up by almost 110% over the last year.

NASDAQ: INTC

Key Data Points

Admittedly, its financials do not yet reflect the anticipated improvements. In 2025, revenue fell by about 0.5% to $53 billion. Also, a surge in interest income compensated for most of its operating loss, though Intel still lost $267 million in 2025.

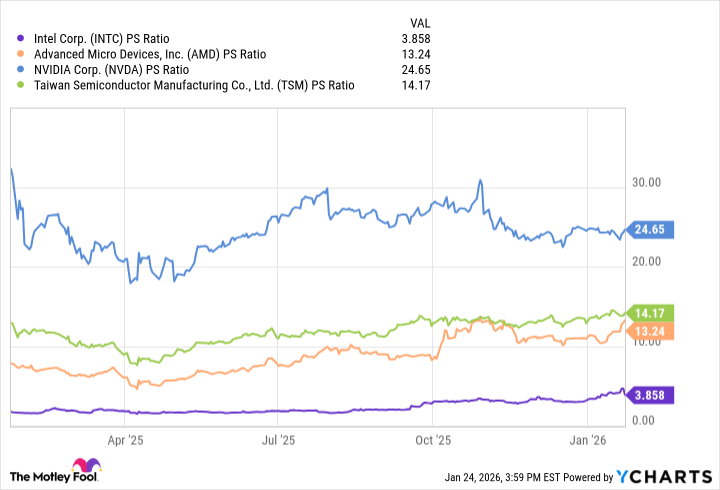

The loss left it without a meaningful P/E ratio. Still, even with its price-to-sales (P/S) ratio on the rise, its sales multiple of just under 4 is far below that of its most prominent peers. Hence, assuming much of the optimism eventually proves justified by rising sales, it is likely not too late to consider buying Intel stock.

INTC PS Ratio data by YCharts.

Is Intel a smart long-term bet as AI scales?

While the company lost its way under previous management teams, Tan was highly successful at Cadence, and early indications suggest he's taking Intel in a promising direction.

With the company delivering new AI products and technical breakthroughs, Intel stock has surged. Obviously, there are still a lot of unknowns and variables here, but based on Tan's track record and the stock's still-low valuation, it could pay for investors to buy Intel stock at current levels.