In voice recognition for commerce applications, SoundHound AI (SOUN 6.09%) has attracted considerable interest from high-profile companies and investors alike. It has built on its following among automakers to serve other industries such as retail, finance, and communications.

Nonetheless, its market cap is a relatively modest $4.1 billion, a tiny fraction of its "Magnificent Seven" competitors. That could spark interest in larger peers, and given Alphabet's (GOOGL +0.71%) (GOOG +0.75%) resources, investors may want to consider that stock instead.

Image source: Getty Images.

Alphabet's voice-recognition footprint

A market lead in digital advertising drives most of the Google parent's current revenue, and consequently, its future appears to lie in offerings driven by artificial intelligence (AI) like Google Cloud and Waymo.

However, technology like Google Assistant and voice commands on Android have helped make Alphabet a major player in voice-powered commerce. Also, the company just introduced Gemini Enterprise for Customer Experience, which can direct customers to specific products through natural language.

This also includes its Universal Commerce Protocol (UCP), an open standard designed for agentic commerce, enabling AI agents to search, compare, and complete transactions on behalf of customers.

Such products should help a company like Alphabet capitalize on this rapidly growing market. According to Grand View Research, voice-powered commerce will have a 25% compound annual growth rate (CAGR) through 2030, enough to become a significant growth driver for the company.

NASDAQ: GOOGL

Key Data Points

But why Alphabet instead of a pure play like SoundHound AI?

Moreover, financial conditions may help favor Alphabet over SoundHound AI. The latter reported a negative free cash flow of about $109 million over the trailing 12 months. Hence, even though it has around $269 million in liquidity, it may need to raise cash again soon.

Alphabet has no such issue. Its free cash flow over the previous year was $74 billion, and that is in addition to its $98 billion in liquidity. That gives the company the resources to outdo a smaller company like SoundHound.

Alphabet has innovated in AI since 2001, presumably giving it a competitive advantage over most other companies of all sizes. Under such conditions, investors may prioritize that measure of safety over holding a voice-recognition pure play like SoundHound.

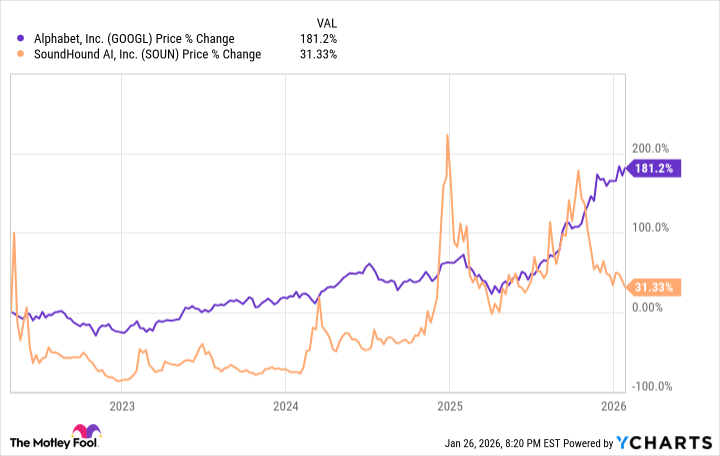

Amid a recent stock surge, Alphabet has delivered higher returns since SoundHound AI's debut in 2022. When also considering its aforementioned financial stability and optionality, that history may give investors even more reason to choose it over SoundHound.

Data by YCharts.

Alphabet as a voice recognition stock

Although SoundHound AI has made technical and business breakthroughs in voice-recognition for commerce, investors may be better off choosing Alphabet.

To be sure, this technology is unlikely to ever become a primary revenue source for Alphabet. Nonetheless, it is a longtime leader in AI that has already released competing products.

Moreover, with its vast financial resources, it can deliver returns with minimal financial risk. Thus, if investors want safety and a higher likelihood of success, they are more likely to find that in Alphabet stock.