Rigetti Computing (RGTI 8.62%), along with quantum computing pure-play peers like IonQ and D-Wave, captured the imagination of investors last year who were looking for the next truly revolutionary technology. And quantum computing could be just that.

The technology, which leverages the strange rules of subatomic physics, could help quantum computer users work through incredibly complex problems with mind-bending efficiency, or even solve problems once thought unsolvable. But, while the promise is real, there is a long way to go before commercially viable quantum computers are a reality.

That hasn't stopped investors from piling into Rigetti, however. The company's stock has seen incredible growth in the last few years.

NASDAQ: RGTI

Key Data Points

One year ago, Rigetti stock was already on a massive run

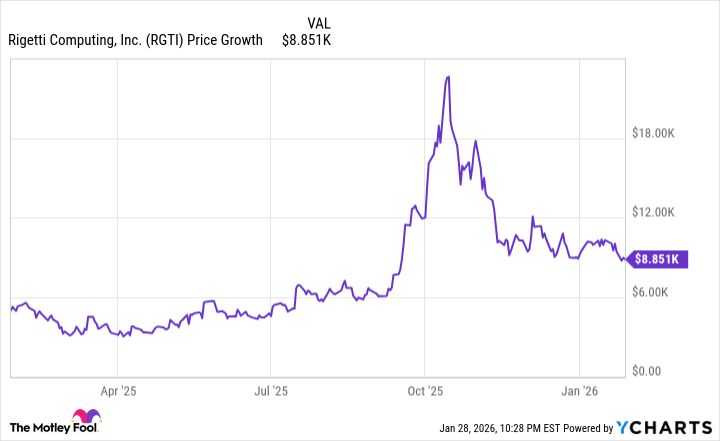

Although you would have still made a roughly 77% return if you had invested in January of 2025, you would have just missed out on a more than 2,640% return had you invested just a few months earlier. Still, a 77% return in a year is an incredible return by any measure.

So, how much would you have if you'd invested $5,000 in Rigetti stock a year ago? You would have $8,851. You can see the solid gain in the chart below.

Data by YCharts.

Rigetti is too risky for most investors

I think investors have really gotten ahead of themselves with Rigetti and the rest of the pure-play stocks. There is a massive disconnect between what these companies bring in the door and their current valuations. Rigetti's total revenue over the last 12 months is just $7.5 million, yet the company has a market capitalization of more than $7 billion. That is an enormous amount of growth already baked into the stock.

Image source: Getty Images.

If you have a particularly high risk tolerance, Rigetti can have its place as a small, speculative stake in your portfolio. For most investors, however, I would look elsewhere. Alphabet is a great pick for investors who want exposure to quantum without the enormous risk Rigetti and its peers present.