Tesla pioneered the electric vehicle (EV) industry. The EV leader has proven a tough act to follow. Upstart EV maker Rivian Automotive (RIVN 2.70%) has found success with its initial vehicle, the electric truck R1T. But after going public with a ton of hype, the stock has declined more than 90% from its all-time high. There is reason for hope, though.

The company has made some business decisions that have worked out well, and its upcoming R2 vehicle could be a game changer when it arrives this year. Should investors buy the stock for what's to come in 2026?

Image source: Rivian.

Rivian's financials are making progress

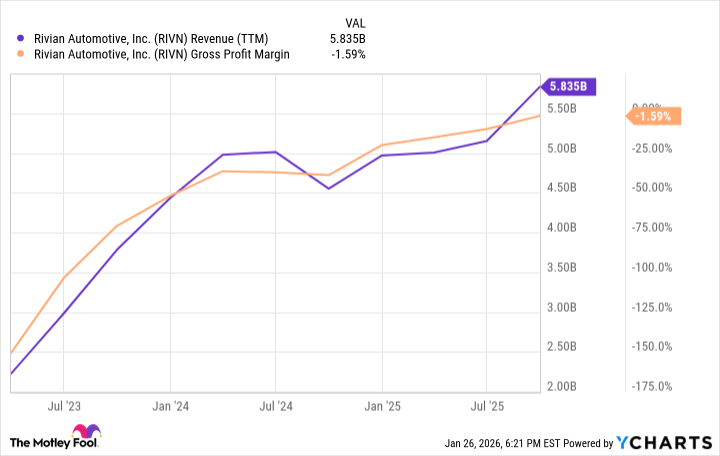

The biggest challenge for a new automotive company is making the business financially sustainable before running out of money. Rivian's gross margin has improved alongside sales growth, and you can see that margins have made significant strides since 2024, even as revenue has increased modestly.

RIVN Revenue (TTM) data by YCharts.

What happened? Rivian reengineered the design and supply chain of its R1T and R1S models to reduce manufacturing costs. Additionally, Rivian has generated higher-margin revenue from EV regulatory credit sales and software services.

As a result, Rivian's free cash flow losses have shrunk to less than $500 million over the past four quarters. That's very promising, considering Rivian still has $7 billion in cash. It's a nice financial cushion for the company as it prepares to launch the R2, a mid-size SUV model, this year.

Can the stock break through in 2026? Yes, but tread carefully

A lot is riding on the R2 launch (no pun intended). It will start at $45,000, much less than the R1S's starting point of roughly $78,000. Rivian hopes that the R2 will help it become a mainstream automotive brand and deliver the volume its factories need to operate profitably, much like the Model 3 did for Tesla.

NASDAQ: RIVN

Key Data Points

Analysts currently estimate that Rivian will finish the year at about $6.8 billion in revenue, then jump up to $11.2 billion in fiscal 2026 on the tailwind of the R2 launch. The stock trades at a price-to-sales (P/S) ratio of 3. That looks like a bargain compared to Tesla's P/S ratio of 3, but not so much compared to traditional automotive companies, which trade at less than 1 times sales.

It might be worth buying Rivian before the R2 launch as a small, speculative investment. A strong launch would likely bolster the market's confidence in Rivian's trajectory and raise its valuation -- just as long as investors understand the downside risk if Rivian swings and misses on its opportunity to entrench itself in the broader vehicle market with the R2.