Artificial intelligence (AI) infrastructure stocks are likely to deliver another year of solid growth in 2026. Market research firm Gartner estimates that AI infrastructure spending could jump to almost $1.4 trillion this year, up by 41% from last year's levels.

While investing in the usual suspects -- such as Nvidia, Broadcom, TSMC, or Micron Technology -- can help investors capitalize on this terrific growth, there is another AI infrastructure company that hasn't received much love on the market: Marvell Technology (MRVL 2.96%).

Let's look at the reasons why this overlooked AI name could be a big winner this year.

Image source: Getty Images

Marvell Technology's growing share of custom AI processors should ensure outstanding growth

Marvell Technology makes application-specific integrated circuits (ASICs), which are in terrific demand right now as they are being used in AI data centers. The cost and performance advantages that ASICs enjoy over graphics processing units (GPUs) are why they are expected to corner a significant share of the AI accelerator market in the long run.

NASDAQ: MRVL

Key Data Points

Bloomberg estimates that the market for custom ASICs deployed in AI data centers could grow at a compound annual growth rate (CAGR) of 27% through 2033, generating $118 billion in revenue. Marvell is expected to control 20% to 25% of this market by the end of the forecast period. That would translate into annual revenue of $23.6 billion to $29.5 billion for the company, according to Bloomberg's estimates, more than triple the revenue Marvell generated in the past year.

Bloomberg points out that Marvell's relationships with Amazon and Microsoft for its custom AI processors would enable it to capture a nice chunk of this lucrative opportunity. And Marvell could do better than that. That's because Marvell doesn't just make custom AI processors; it also makes networking and storage components that go into data centers.

The company estimates that its addressable market could increase at a 35% CAGR through 2028, reaching $94 billion after three years. Even better, Marvell seems firmly on track to capitalize on this massive opportunity. Its custom AI processors are used by four of the top hyperscalers in the U.S., along with emerging hyperscalers. It supplies 18 custom processor designs to these customers and estimates that it could expand those design wins to more than 50.

So, it won't be surprising to see Marvell sustaining its remarkable growth.

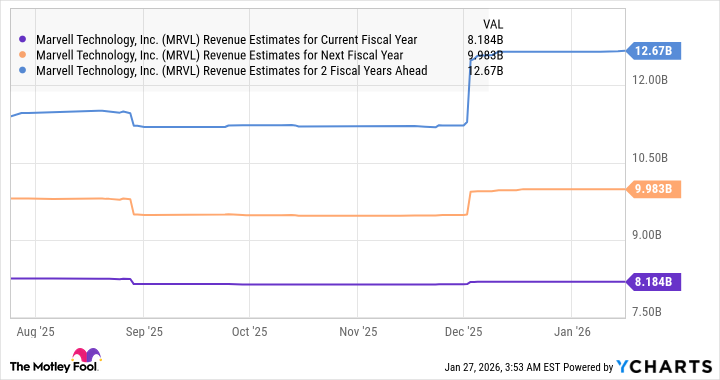

MRVL Revenue Estimates for Current Fiscal Year data by YCharts

The stock is primed for impressive gains in 2026

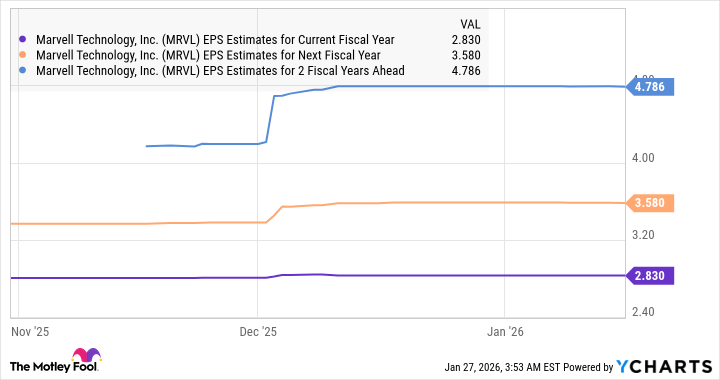

Marvell trades at an attractive 22 times forward earnings estimates. That's a slight discount to 26 multiple of the tech-laden Nasdaq-100 index. Considering that Marvell's earnings are anticipated to increase by 80% in the current fiscal year, followed by healthy growth in the next couple of years as well, buying this stock is a no-brainer right now.