If you've got $500 sitting around, there are shares of a few companies that you can scoop up. If you don't have access to fractional shares at your brokerage, this task may be a bit more difficult. However, all of the stocks on this list can be purchased with just $500.

I think these are well worth the price, and investors will be happy about their decision at the end of 2026.

Image source: Getty Images.

Nvidia

Nvidia (NVDA 0.72%) trades for about $190 per share, and it's a must-own for nearly every investor. Nvidia is at the middle of the artificial intelligence buildout, and its graphics processing units (GPUs) are the most popular computing option available. It has become the world's largest company by market cap thanks to huge AI demand, and that doesn't look to be slowing anytime soon.

NASDAQ: NVDA

Key Data Points

For the fourth quarter, Wall Street analysts expect 67% growth, and 52% growth in fiscal year 2027 (ending January 2027). This indicates that the AI buildout still has a lot of room to run, and if it does, Nvidia is a top option to invest in.

PayPal

While Nvidia is at the fast-growing, high-execution end of the spectrum, PayPal (PYPL 0.79%) is on the other end.

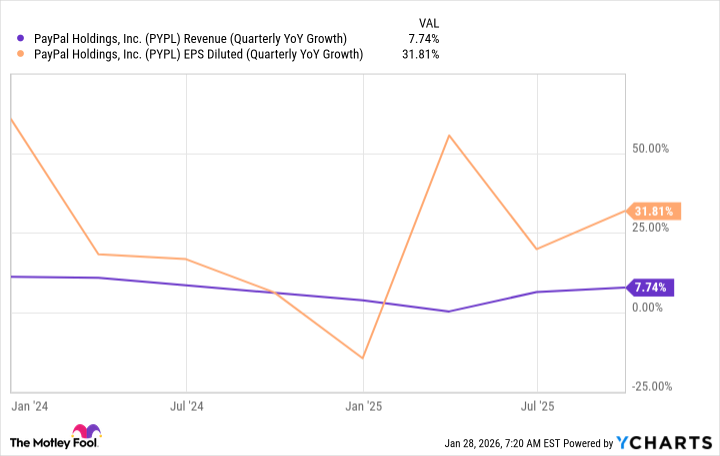

PayPal is lucky to generate high single-digit revenue growth, so it may seem like a poor stock to invest in as a result. However, management is using all available free cash flow to repurchase shares and drive the earnings per share (EPS) figure higher. This leads to market-beating growth when analyzed from an EPS perspective.

PYPL Revenue (Quarterly YOY Growth) data by YCharts

Despite that solid track record, PayPal's stock trades for less than 10 times forward earnings. That's an absolute steal and will allow for share repurchase to be far more effective. The stock could easily rise 50% based on valuation alone, and I think it's an incredible value play in the market right now.

At $55 per share, that leaves a little over $250 to spend on my last pick.

Amazon

Last is Amazon (AMZN 1.02%), which trades for about $245 per share. Amazon was a poor performer in 2025, as it lost to the market despite delivering a positive return overall. However, I think 2026 could be the year it soars, because its cloud computing business is starting to accelerate alongside high execution in its commerce segments.

NASDAQ: AMZN

Key Data Points

Amazon is one of the world's most powerful companies, and it is primed to deliver solid, market-beating returns in 2026 as long as the rest of the year looks similar to the results in Q3. We'll find out what 2026 holds for Amazon during its earnings report on Feb. 5, but I think it will be a great year for the stock.