The level of hype around quantum computing seems to cycle up and down. For example, excitement about it surged to peaks during December 2024 and October 2025, but lately, it has significantly declined. While the nascent technology and the companies attempting to bring it to market are still on some investors' radar, they have fallen entirely off of most people's. That could make now a prime opportunity to buy some quantum computing stocks at lower prices, and that's exactly what I did.

After missing some of IonQ's (IONQ 3.55%) major rises in 2025, I recently bought its shares, which are now down by more than 50% from their high. I think it's a great option in the quantum computing space, but is it the top buy overall?

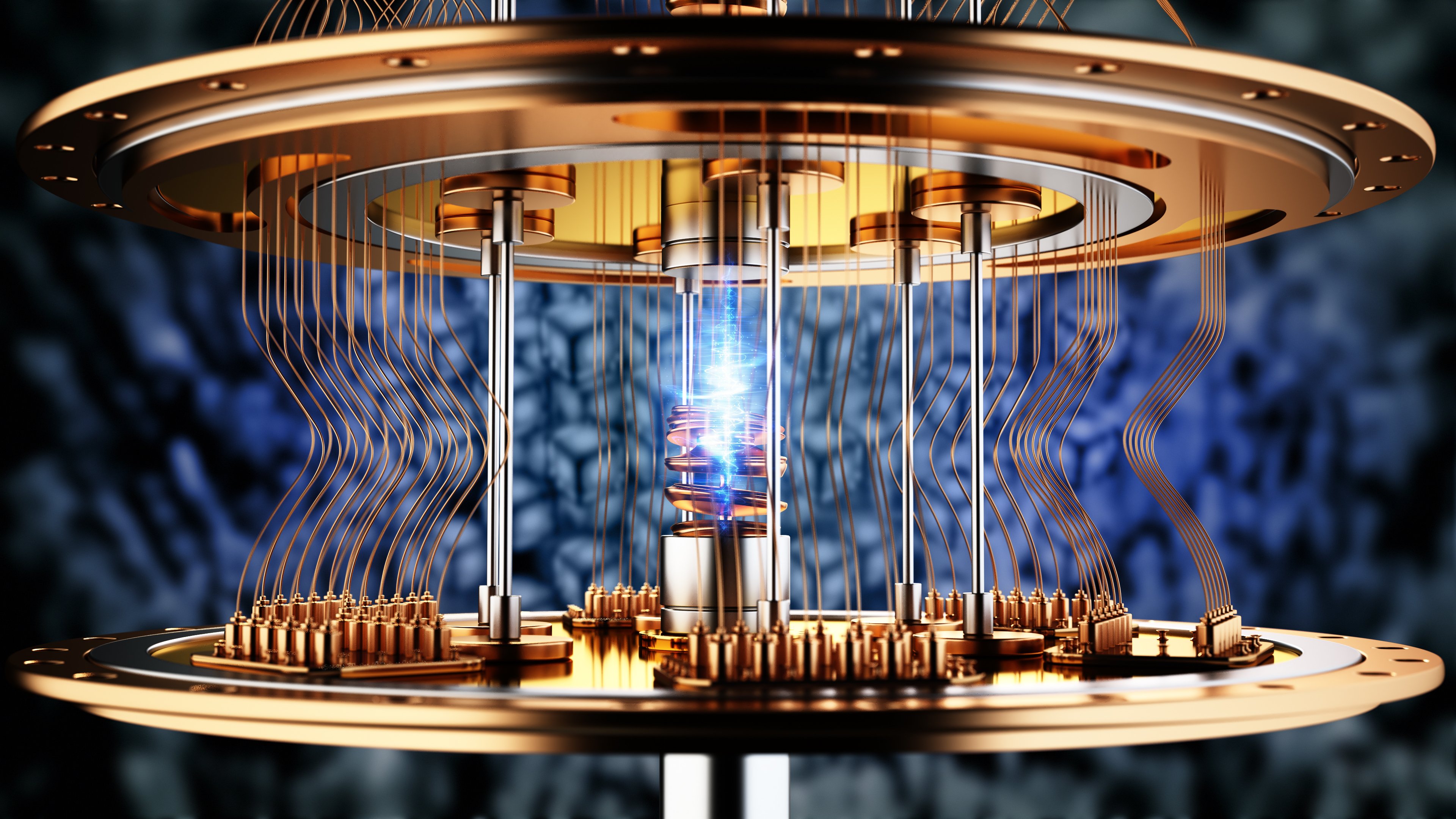

Image source: Getty Images.

IonQ's fidelity advantage

The quantum computing field is filled with competitors, large and small. IonQ is among the smaller pure-play upstarts with relatively few resources that are looking to become major players. But many giant tech companies with nearly unlimited resources to devote to R&D are also competing in the quantum computing realm, as this new technology could bolster their already formidable capabilities. There are viable competitors across the size spectrum, but the reality is, we're a long way off from knowing which ones will eventually be the winners.

NYSE: IONQ

Key Data Points

Most companies in the quantum computing space are forecasting that 2030 will be the year when the technology becomes commercially viable. The biggest hurdles in front of them right now are error prevention and error correction.

Quantum computers today are trillions of times more likely to have errors in their computation results than classical computers. Imagine running a workload that involves vast numbers of calculations on your traditional computer, and having to assume that at least one out of every 1,000 calculations' results will be wrong.

Given that thousands of processes must occur for each action, these errors can stack up and become problematic quickly. That's about where most quantum computing companies are at with the technology. However, IonQ is in the lead when it comes to addressing this problem. Its trapped ion quantum computers have an advantage over rival machines, with a two-qubit gate accuracy rate of 99.99%, or one error in every 10,000 calculations.

Others in the space have achieved better than 99.9% two-gate fidelity, but only IonQ can claim 99.99% so far. If it can keep advancing its error correction and prevention gains and maintain its lead, it may be the best quantum computing stock to buy right now. However, we're still so far away from this being a commercially viable technology that there will be plenty of time for other companies to rise and dethrone IonQ.

I believe that IonQ is likely the best quantum computing pure play to buy right now, but in the end, it could still lose out to a major tech company like Alphabet or Microsoft. That's why the position I recently opened only accounts for about 1% of the value of my total portfolio. If IonQ turns out to be a failure, it will only marginally affect my overall returns. If it's a major winner and increases tenfold from here, then that tiny position will become a much larger stake.