Anytime a broad index like the S&P 500 grows 18% in just over a year, it's considered a good stretch. That has been the case with the S&P 500 since the start of 2025, rebounding after a volatile year.

While the S&P 500's performance has been a good sign for American stocks, there has been a Vanguard ETF brewing abroad that far outperformed the market. The Vanguard International High Dividend Yield ETF (VYMI +0.44%) is up 41% since the start of 2025 (through Jan. 30).

Image source: Getty Images.

One ETF with a wide reach

As the name hints, VYMI focuses on international companies that pay above-average dividends. To be included, a company must meet yield criteria and show it can maintain its dividend. VYMI currently contains over 1,500 stocks, with the regions divided as follows:

- Europe: 44%

- Pacific: 25.9%

- Emerging markets: 20.9%

- North America: 8.2%

- Middle East: 0.8%

- Other: 0.2%

Including companies from both developed and emerging markets gives investors the best of both worlds. You get the (relative) stability of companies in developed markets and the high growth opportunities that often come with investing in companies from emerging markets.

And since these companies pay dividends, they're much more likely to be financially stable and firm in their industries. For perspective, its top five holdings are Roche, HSBC, Novartis, Nestle, and Royal Bank of Canada. These are well-established companies with a history of being shareholder-friendly.

NASDAQ: VYMI

Key Data Points

An attractive dividend

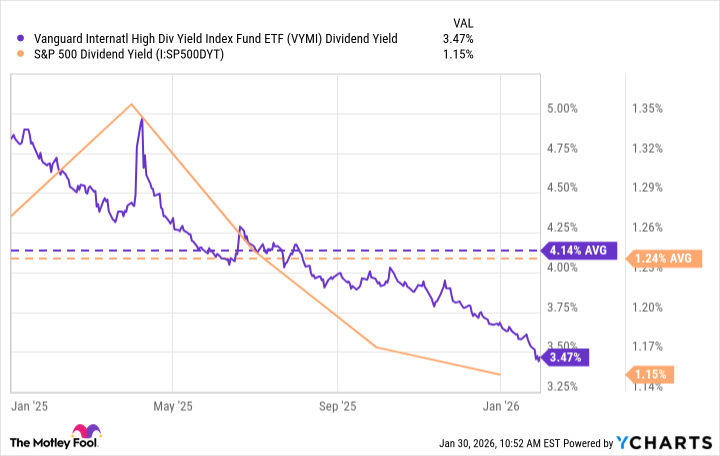

VYMI's current dividend yield is around 3.4%, but it has averaged a yield of around 4.1% since the start of 2025. Both are more than three times the S&P 500. The yield will fluctuate with VYMI's stock price, but if we assume it maintains a 4% yield (below its five-year average), every $1,000 invested would pay out $40 annually.

VYMI Dividend Yield data by YCharts

VYMI can be a good complementary piece

Investing in an international ETF is a good way to develop a truly diversified portfolio. Investing in companies across sectors and sizes is important, but so is investing in companies from different geographical locations. I would keep the bulk of my investments in American stocks (around 90%) because of the long-term track record, but it's good to have international companies that can help cushion the blow if U.S. stocks hit a speed bump.

In VYMI's case, even if (or, rather, when) VYMI loses momentum, it can still be a good income source for your portfolio.