Nine American companies have amassed valuations of $1 trillion or more, but only four of them have entered the ultra-exclusive $3 trillion club:

- Nvidia: $4.6 trillion

- Alphabet: $4.1 trillion

- Apple: $3.8 trillion

- Microsoft: $3.2 trillion

I think Meta Platforms (META 3.21%) could join them in the coming years, as artificial intelligence (AI) increases engagement on its social media apps like Facebook and Instagram, which is fueling rapid growth in its operating results.

The company has a market capitalization of $1.8 trillion as I write this, so investors who buy Meta stock today could earn a 67% return if it does join the $3 trillion club.

Image source: Getty Images.

AI might soon control the entire social media experience

Almost 3.6 billion people use at least one of Meta's social networks every single day. Since that already represents nearly half the planet, it's becoming harder for the company to grow its user base. This poses a risk to its advertising business, where it generates most of its revenue.

That's why Meta is now focusing more on increasing engagement instead. It's using tools like AI to learn what type of content each user likes to see on Facebook and Instagram, so it can feed them more of it to keep them online for longer periods of time. This means they see more ads, which ultimately leads to more revenue.

During the third quarter of 2025 (ended Sept. 30), AI-powered recommendations drove a 30% increase in the amount of time users spent watching Reels on Instagram (year over year), so this strategy has been a massive success.

But Meta CEO Mark Zuckerberg wants to take the AI strategy a step further. He believes every single user will soon have a personalized AI agent that understands their interests, so every time they open Facebook or Instagram, they will be met with an even more specific set of content. He even thinks these agents will be capable of generating new content for each user, which I think will accelerate social networks' transition from places to connect with friends to pure entertainment platforms.

Meta delivered stellar financial results last year

Meta generated $200.9 billion in total revenue during 2025, which was a 22% increase from the previous year. The company's earnings, however, shrank by 2% to $23.49 per share, but that was primarily because of a massive one-off tax provision, caused by the Trump administration's "big beautiful bill."

If that provision came in at the same level as it did in 2024, Meta's 2025 earnings would have actually grown by 26% to $30.16 per share.

NASDAQ: META

Key Data Points

Moving on, one of the most important factors investors were watching in Meta's latest earnings report was its capital expenditures (capex), which reflect the amount of money the company is spending on data center infrastructure, chips, and components for its AI projects. It came in at a record $72.2 billion for the year, which was a whopping 84% increase compared to 2024.

Meta wouldn't be spending that sort of money if it didn't anticipate a payoff at some point in the future, so capex growth could be interpreted as a confidence meter on the potential success of AI. On that note, the company intends to spend even more during 2026, with management forecasting somewhere between $115 billion and $135 billion in capex.

Meta's (mathematical) path to the $3 trillion club

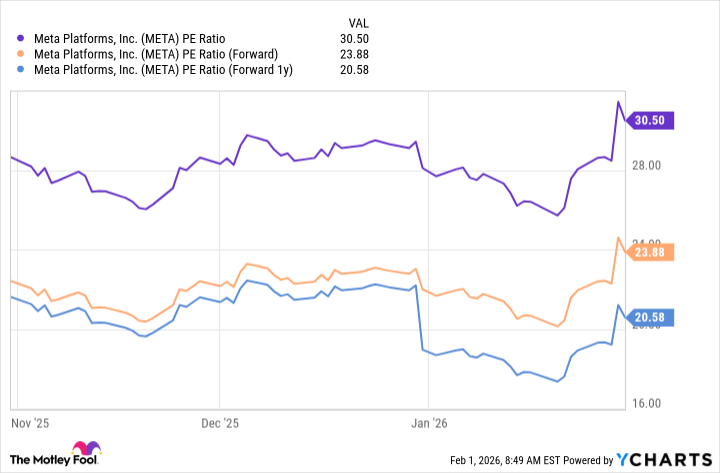

Based on Meta's 2025 earnings of $23.49 per share, its stock is trading at a price-to-earnings (P/E) ratio of 30.5. That is a slight discount to the Nasdaq-100 index which currently has a P/E ratio of 32.9, so you could argue Meta is cheap relative to its big-tech peers.

Based on Wall Street's consensus estimate (provided by Yahoo! Finance), Meta's earnings could grow to $29.56 per share in 2026, followed by $34.30 in 2027, placing its stock at forward P/E ratios of 23.9 and 20.6, respectively.

META PE Ratio data by YCharts

That means Meta stock would have to rise by 48% before the end of 2027 just to maintain its current P/E ratio of 30.5, which would propel its market cap to $2.66 trillion. If Meta's P/E ratio were to match the P/E ratio of the Nasdaq-100 instead, its stock would have to climb by 60% over the same period. That would take its market cap to $2.88 trillion -- a stone's throw away from the coveted $3 trillion milestone.

Therefore, as long as Meta generates at least 4.2% earnings growth in 2028, it could enter the $3 trillion club that year. However, if Wall Street's forecasts for 2028 look strong, it's possible investors will start pricing in some of the upside during 2027, which could allow the company to achieve the valuation milestone even sooner.

In summary, I think it's only a matter of time before Meta earns its membership into the exclusive $3 trillion club.