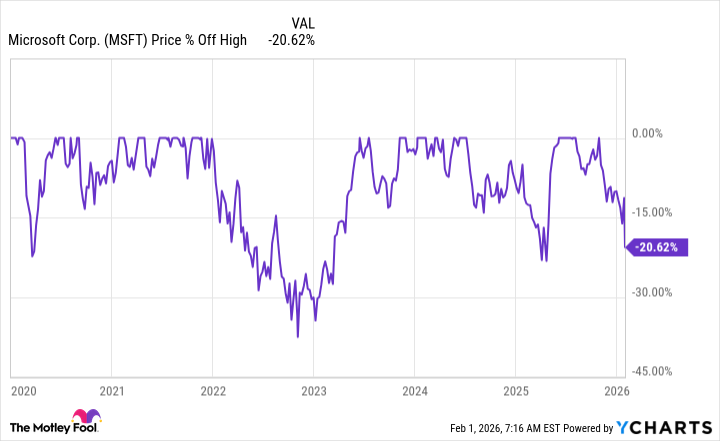

Microsoft (MSFT +0.56%) stock has now reached levels that it has rarely been to in recent years. The 10% sell-off following its earnings was harsh, and now the stock is about 20% off its all-time high. While some may view this as a warning sign for things to come, I think this could be a buying opportunity.

History tells us that right now could be an excellent time to load up on Microsoft stock. I have personally done just that, purchasing Microsoft shares following its sell-off because I think it is one of the best buying opportunities for Microsoft stock that investors have seen in years.

Image source: Getty Images.

Microsoft doesn't trade at a discount that often

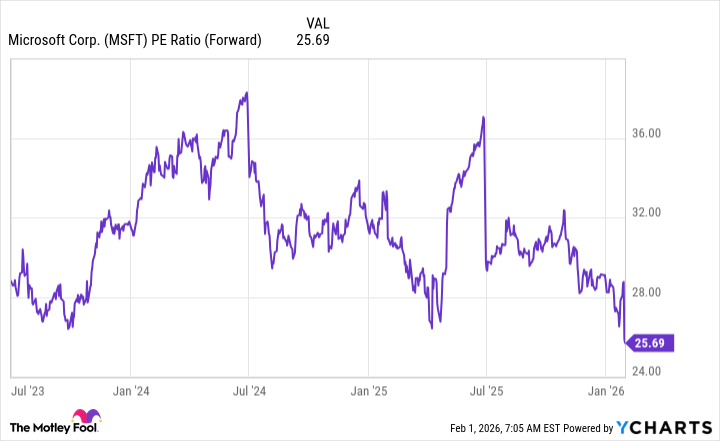

There are several ways to value a stock. When you have a company that's growing at a decent pace and is expected to do so in the future, the trailing price-to-earnings (P/E) ratio isn't as useful. Instead, I prefer to assess the stock using forward earnings. While this isn't a perfect measure because there is some uncertainty involved, I think it's one of the best to use for Microsoft. From this standpoint, Microsoft is the cheapest it has been over the past three years.

MSFT PE Ratio (Forward) data by YCharts

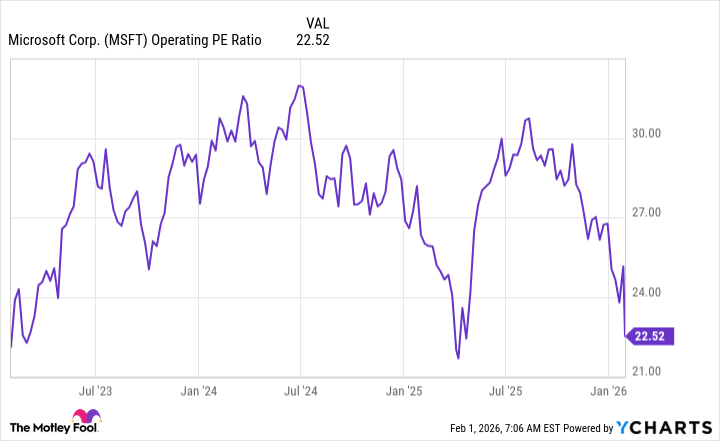

The last few times Microsoft traded this cheaply, the stock ripped higher in a relatively short time frame, making it seem like right now is a prime buying opportunity. If you're stuck on using past results, I think the price-to-operating profits ratio is a better measure for Microsoft, as its earnings per share (EPS) is heavily skewed by its large investment in OpenAI. If we use this measure, it's still among the cheapest levels it has been in three years.

MSFT Operating PE Ratio data by YCharts

At its peak, Microsoft traded at around 35 times forward earnings or 30 times operating profits. That indicates the stock could have nearly 50% upside if the valuation eventually returns to that level and Microsoft maintains its profits. But is that a realistic expectation?

Microsoft's sell-off was unwarranted

Another aspect we must assess is why Microsoft sold off in the first place. There could be an entirely valid reason for a 10% drop, which would justify a lower stock price. However, I cannot find any.

Companywide revenue was up 17% year over year to $81.3 billion in the second quarter of Microsoft's fiscal 2026, which ended Dec. 31. For reference, management gave investors a revenue guidance range of $79.5 billion to $80.6 billion during its Q1 earnings call.

NASDAQ: MSFT

Key Data Points

Digging in a bit deeper, two of three segments outperformed Microsoft's guidance. The two outperforming segments were productivity and business processes and intelligent cloud. The one that didn't outperform was more personal computing, which is a tricky division to forecast. Still, it's also the smallest and frankly not a segment that most Microsoft investors worry about.

Microsoft's most important segment, Azure, once again delivered incredible results. This all-important cloud computing platform is a key indicator of how AI spending is going, and as long as Microsoft continues to do well in this field, it shows that the AI build-out is still going strong. Azure's revenue rose 39% year over year, and management noted that this growth rate could have been higher if it hadn't devoted some of the computing capacity that came online during Q1 and Q2 to internal capabilities.

There are really no red flags for Microsoft's business that I can see, so I'm confident in buying the dip that the market is presenting to investors. Since 2020, Microsoft's stock has sold off more than 20% four times.

Each of those has proven to an excellent time to invest, so I think investors should make a move now and scoop up Microsoft shares while they're still cheap.