It's been a tough past five years for online pet supply store Chewy's (CHWY +1.55%) shareholders. While the stock soared during and because of the onset of the COVID-19 pandemic, it peaked in early 2021. The stock now trades down more than 80% from that high, in fact, after peeling back from a failed recovery effort in 2024. Investors are understandably losing hope.

This may be the exact right time to take a fresh look at this scrappy small cap, though. Its growth rate still isn't heroic, but its long-term strategy is undeniably working now, and the company's fiscal results may be on the verge of reaching critical mass.

Image source: Getty Images.

A slow-growing but increasingly solidified business

If you're not familiar with it, Chewy is an online seller of pet food, toys, treats, and even medicine. It's unique within the business, however, in that it's only an e-commerce company ... no brick-and-mortar retail presence.

But it works. Although it also obviously competes with Amazon on this front, data from Bloomberg Intelligence indicates Chewy enjoys about the same one-third share of the online pet supply market that Amazon does.

It's growing too, even if only modestly. Its fiscal third-quarter revenue of $3.1 billion was up 8.3% year over year, extending a trend and pace that's been in place for some time now.

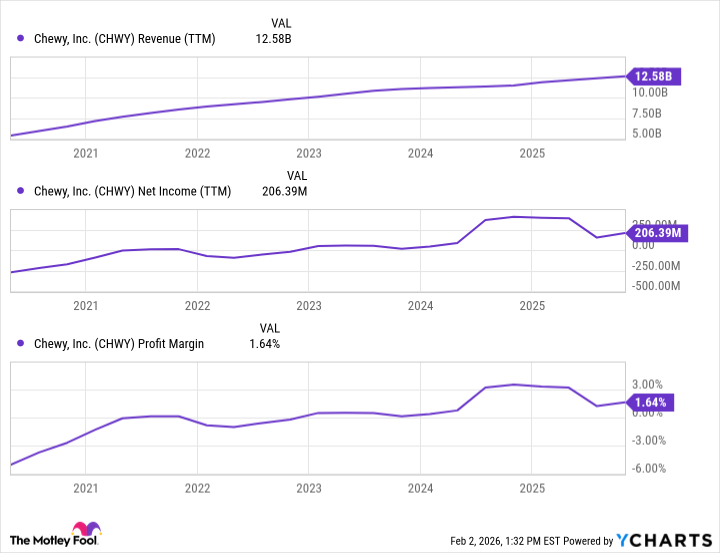

That's not the chief reason Chewy has become such a compelling prospect again, however. The much better bullish argument is that the company has recently worked its way out of the red and into the black, and seemingly to stay. And, it's done so at a much faster pace than its top line has grown.

Data by YCharts.

Analysts expect more of the same going forward, too.

It's the underlying key to this growth, however, that really firms up the argument that this swing to profitability is permanent.

See, of Q3's top line of $3.1 billion, 83.9% of that revenue came from customers who have signed up for subscription-based recurring shipments of pet food, treats, and medicine. That's up from 80% in the same quarter a year earlier, which was up from 2023's comparison of 76.4%, which was higher than the prior year's figure of 73.3%.

You're reading that right. There are now several million customers willingly handing over nearly $600 per year to Chewy without even thinking about it. That's the power of offering consumers extreme convenience. Given that it's much cheaper to keep a customer than it is to win a new one, look for Chewy's bottom-line growth to continue outpacing its top-line growth now that it's readily covering its mostly fixed overhead costs.

Time to hold your nose and dive in

The rest of the market doesn't share the same sentiment right now. Chewy shares are not only still down from June's peak, but recently reached a new 52-week low. The bears are clearly in charge for now.

NYSE: CHWY

Key Data Points

Just take a step back and look at the bigger long-term picture. This stock's forward-looking price/earnings ratio is a relatively modest 22, and that's based on a price that's 60% below analysts' consensus 12-month target of $46.19. The tide could easily shift back in a bullish direction sooner rather than later, and with little to no warning.