If you're looking to make a small speculative investment, say around $1,000, and tuck it away for the long haul, you're going to want to try to find a stock with some potential game-changing technology. As such, the quantum computing space may be one of the best places to look.

The sector is not for the faint of heart, as it is likely many years away from commercialization, and which technological approach and company will come out on top is far from determined. However, there is one clear-cut choice in the space that I think has the most potential: IonQ (IONQ 8.14%).

NYSE: IONQ

Key Data Points

An accuracy leader

One of the biggest roadblocks currently facing quantum computing is that the technology is error-prone. The reason for this is that instead of using classical computing bits, which can be a 0 or a 1, quantum computing uses qubits, which are in a state of superposition and have the potential to be either a 0 or a 1 until acted upon. Superposition is a big part of the reason why quantum computers can perform certain calculations exponentially faster than traditional computers, but it also puts them in a more fragile state that is prone to being impacted by outside forces such as vibrations or temperature changes.

Unlike most competitors that use man-made qubits, IonQ employs a trapped-ion approach that uses actual atoms, which are identical by nature and thus more stable. The technology has helped the company achieve some of the highest accuracy in the industry, with the company attaining a 99.99% two-qubit gate fidelity rate. While it still has a way to go to develop a fault-tolerant quantum computer, it is one of the furthest ahead and can now focus on software and other solutions to help reduce error rates even further.

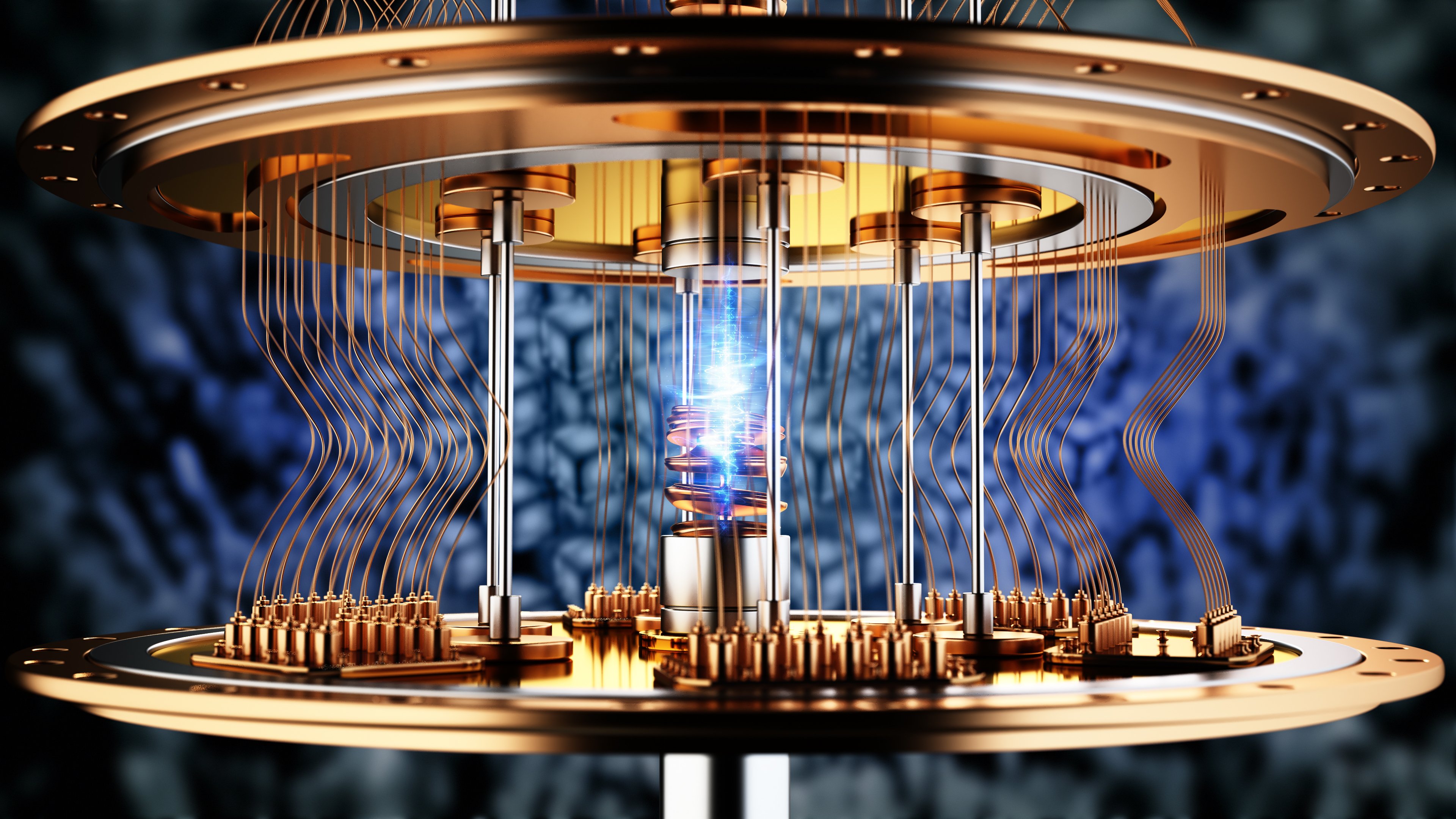

Image source: Getty Images.

In addition to its strong accuracy performance, the other reason I like IonQ over competitors is that the company is not afraid to make acquisitions, and it is looking to control the entire quantum ecosystem. For example, one of the big reasons IonQ was able to reach 99.99% fidelity was because the acquisition of Oxford Ionics allowed it to move away from using huge lasers to stabilize its chips and to instead integrate microwave electronics into its chips to make them more stable. This will also help them shrink the size of their machines.

More recently, the company announced it will acquire SkyWater Technology, a semiconductor foundry specializing in quantum computing. The deal will give it priority access to the most advanced die and fabrication technology for quantum chips, and also give it complete control over its supply chain. This could be like if Nvidia owned Taiwan Semiconductor Manufacturing.

As a leader in quantum computing accuracy, IonQ is a stock to consider making a small, speculative bet in for the long haul.