Shares of international coffeehouse giant Starbucks (SBUX 0.93%) are up 13.7% in 2026 so far, as Wall Street reacted favorably to the company's Q4 2025 earnings report. From growing same-store sales to a 5% bump in global revenue and the opening of 128 net new coffeehouses around the world, it was the most triumphant earnings report since former Chipotle Mexican Grill CEO Brian Niccol took the helm of Starbucks in September 2024.

I own shares in Starbucks, but despite the recent positive news, I won't be adding to my position. For all of the hopeful statistics, one number in the company's fundamentals is a dealbreaker. A successful turnaround could change things, but for now, there's still work to be done.

Here's what I'm watching to see if Starbucks can return to its glory days.

Image source: Getty Images.

The challenge for Starbucks

While the share price is up this year, it's down about 24% from its all-time high of $126 per share in July 2021. Back then, Starbucks had just reported Q3 2021 earnings. Looking back, it's striking how much ground it's lost in the 4.5 years since.

At the time, Starbucks had just reported two-year U.S. revenue growth of 16% since Q3 2019, a figure which wouldn't have been skewed by the pandemic. Two-year same-store sales growth in the U.S. was 10%, while the company added over a million active Starbucks Rewards members that quarter, bringing its total to 24 million active members. In China, two-year revenue growth had surged 45%. Net earnings came in at $1.15 billion.

But last quarter, the company reported just $293.3 in net income for the most recent quarter, a 75% decrease from quarterly net income at the stock's all-time high. Granted, much of this collapse is explained by Starbucks' recent deal to turn its China locations into a joint venture with Boyu Capital, in which the latter is taking an up to 60% interest in its retail operations.

But this doesn't strike me as much of a silver lining. One of the biggest reasons to be bullish on Starbucks used to be that it was poised to tap into the Chinese market, where up to 400 million people could soon be joining the middle-income population. Instead, in selling the 60% position for $4 billion, Niccol apparently thought that Starbucks' 8,000-store China presence was worth just $6.7 billion, plus whatever he hopes to collect from long-term license fees.

NASDAQ: SBUX

Key Data Points

Under the deal, Starbucks is ceding all store operating expenses to Boyu Capital. It will save Starbucks $39 million a month not to have to concern itself with these stores' upkeep, but will they be in good hands? It's one of China's biggest private equity firms, but it doesn't have much experience in global brand consumer and retail investments.

The deal might work out well for Starbucks -- after all, over 90% of McDonald's stores are owned and operated by local business owners. But it's a big question mark hanging over the stock.

Here's what instantly disqualifies Starbucks stock for me

Since I compared its position now to that of 2021, I should note some bullish developments. Last quarter, Starbucks had 35.5 million active Starbucks Rewards members, compared to 24 million at the stock's all-time high. Its U.S. store count hit 16,911 last quarter, a 10% rise from the 15,348 U.S. stores in Q3 2021.

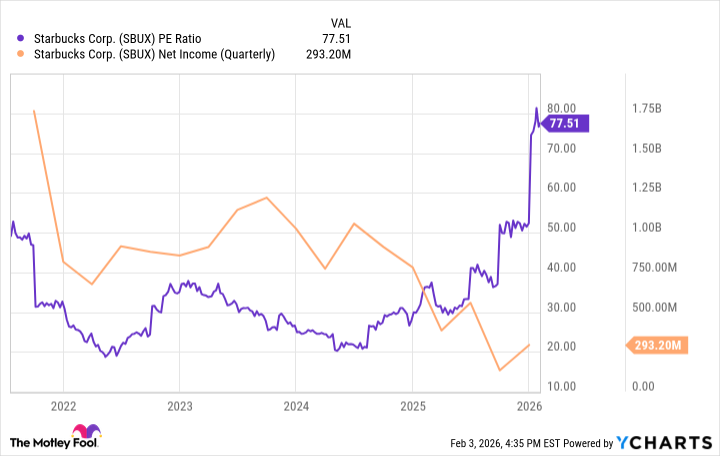

But while net income plummeted, look what's happened to Starbucks' price-to-earnings (P/E) ratio.

Data by YCharts.

For shareholders, this is a grim chart. Starbucks' P/E ratio is now just below 78, much higher than at the share price peak, because while the share price has fallen 24%, net income has fallen far more.

This is an extremely rich valuation compared to the S&P 500 average P/E ratio of 29.5. Starbucks is already priced as if its successful turnaround were a done deal, when it's far from assured. This valuation tilts the odds against investors. Because I don't like being at a disadvantage, I'm considering selling.