Artificial intelligence (AI) stocks have offered investors major gains in recent years. Many have climbed in the double or triple digits, thanks to promising platforms -- and in some cases, revenue that already is soaring. For example, chip designers and cloud service providers are delivering massive growth as companies flock to their AI products and services. Why is AI stirring up a lot of excitement? Because it could boost efficiency and innovation at companies and therefore lead to earnings growth over time.

Though valuations of many AI players have surged, certain stocks still trade at reasonable levels. And the great news is that one of these players is a top-quality company that has demonstrated its ability to win in AI. Wall Street expects this stock to advance 46% in the coming 12 months. And right now, it's dirt cheap.

Image source: Getty Images.

An early AI winner

This AI giant is an early winner in the AI space, and it's likely to continue generating growth here too. I'm talking about Microsoft (MSFT 4.95%), a well-established technology powerhouse that brings in revenue through a range of businesses, from cloud services and software to gaming and advertising.

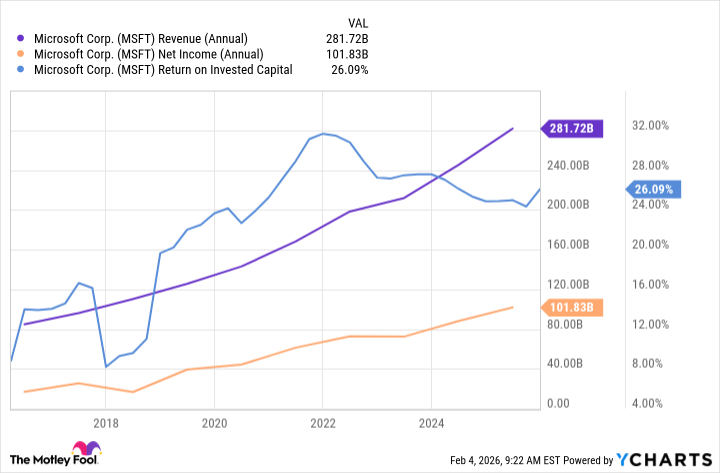

Over time, this has resulted in growth in revenue, net income, and return on invested capital (ROIC). The trend in ROIC is important as it shows Microsoft, after spending, has always gone on to benefit from those investments.

MSFT Revenue (Annual) data by YCharts

Though Microsoft stock has delivered gains for investors over the long term, it's faltered in recent times -- and it even plunged about 10% in one trading session last week following its latest quarterly earnings report. Microsoft beat analysts' expectations for revenue and net income, but certain points in the report disappointed investors.

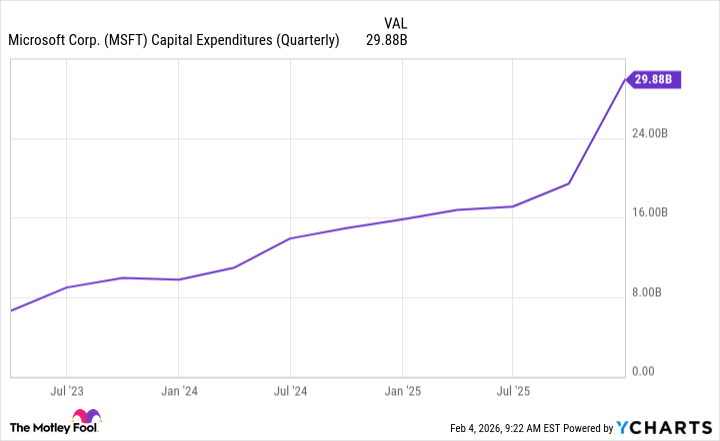

And one that stands out is Microsoft's spending on capacity expansion versus the cloud revenue growth resulting from those investments. Capital expenditures have been on the rise as Microsoft builds out its AI infrastructure to meet current and future demand. Customers turn to Microsoft's cloud business for a variety of AI products and services, including the powerful graphics processing units (GPUs) that power key AI tasks.

MSFT Capital Expenditures (Quarterly) data by YCharts

Spending vs growth

But, considering this pace of spending, some investors expected more than the announced 39% growth from the cloud business. Chief financial officer Amy Hood put the growth number into perspective, saying that if Microsoft had used all of its AI chips for cloud rather than deploying them across its other businesses, cloud growth would have been stronger. It was important for Microsoft to balance out the needs of all of its businesses rather than focusing more heavily on cloud.

NASDAQ: MSFT

Key Data Points

Microsoft's decisions as it builds out its AI presence are meant to support long-term growth -- and sometimes that happens at the expense of short-term performance. This is actually good news for long-term investors because it offers us an opportunity to get in on a top-quality stock for a reasonable price. In the case of Microsoft in recent days, the price has become dirt cheap. The stock trades for 24x forward earnings estimates, its cheapest in at least three years.

A company that's proven itself

This offers investors a chance to get in on this company that's proven itself over time -- and, as I highlighted above in my comments about ROIC, we can see that Microsoft has a track record of making investment decisions that have always gone on to deliver growth. Considering the company's strong position in the cloud space and demand we're seeing in the AI market, I would expect Microsoft's AI buildout investments to follow this path and generate significant growth in the years to come. The company is very likely to benefit as the AI market gathers momentum -- analysts predict this market will reach into the trillions of dollars by the end of the decade.

All of this means it doesn't matter whether Wall Street is right or wrong about its Microsoft stock prediction for the coming 12 months. This top tech stock still has what it takes to soar over the long term.