If I could only hold one stock over the next five years, it would be Broadcom (AVGO +7.26%). The company is riding two of the biggest trends in the market today, making it a top artificial intelligence (AI) stock to buy and hold.

A huge growth opportunity ahead

By all accounts, the AI infrastructure market is expected to continue to see rapid growth over the next several years. Foundry leader Taiwan Semiconductor Manufacturing has talked about seeing AI chip demand increasing at a more than 50% annual rate, while famed investor Cathie Wood recently predicted that AI infrastructure spending would increase nearly threefold from around $500 billion today to $1.4 trillion by 2030. Nvidia, meanwhile, has projected that the total installed base of the global data center market could climb to $3 trillion to $4 trillion by 2030.

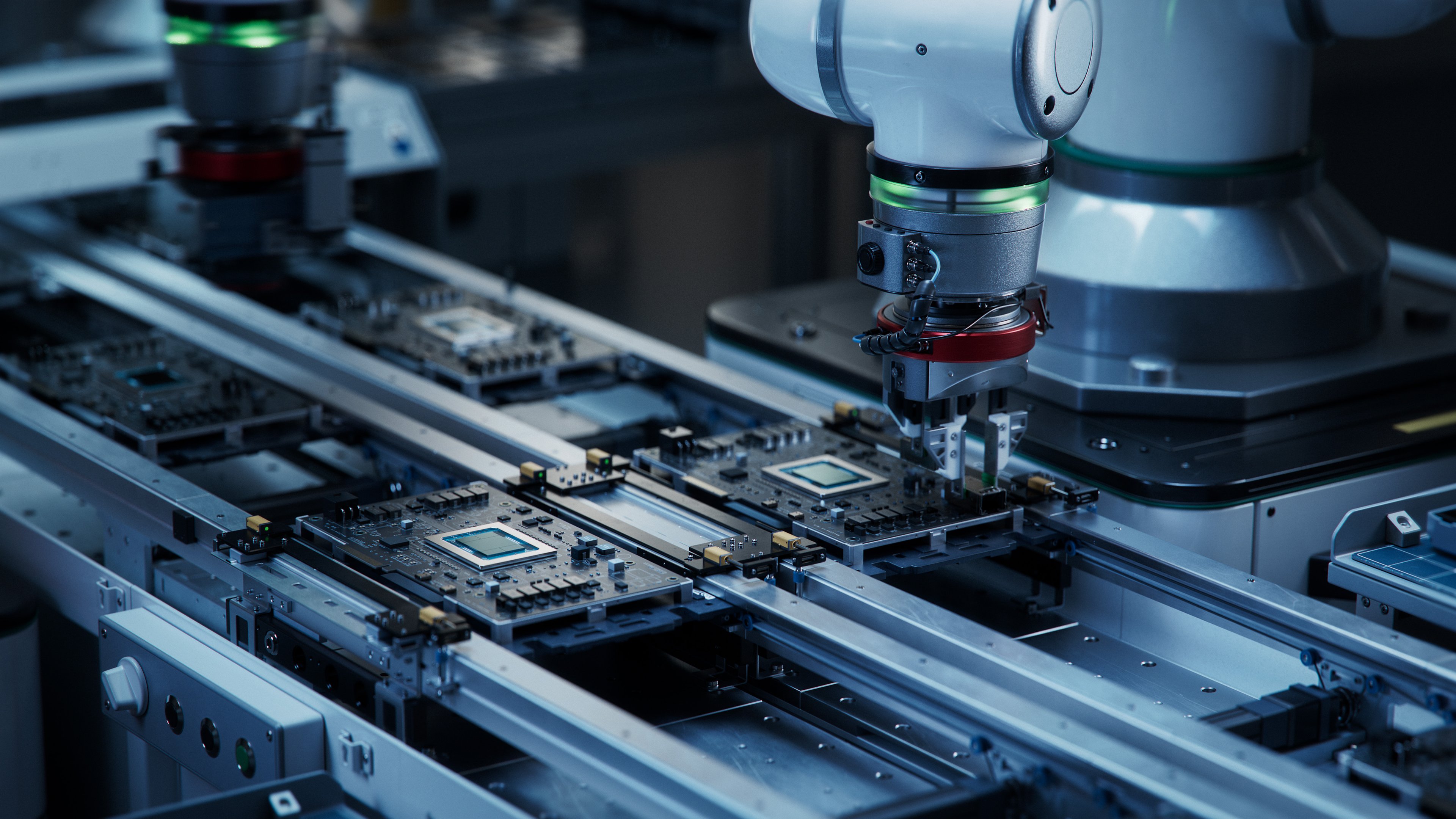

Image source: Getty Images

One of the companies best positioned to benefit from this spending is Broadcom. Wood sees networking growing at a faster pace than compute, which plays into Broadcom's networking strength. The company is a leader in Ethernet and other networking components that help manage data flow and distribute AI workloads across servers. As AI chip clusters grow in size, networking becomes even more important as latency reduction is paramount. In other words, having millions of AI chips sitting idle waiting for data to be moved loses the effectiveness of having millions of AI chips in the first place and costs companies money.

While networking should be a big growth driver for Broadcom, it's not even its largest opportunity. That will come from helping customers create their own custom AI chips. Nvidia is currently the clear leader in powering AI workloads with its graphics processing units (GPUs). However, hyperscalers (owners of large data centers) are increasingly starting to develop their own custom AI ASICs (application-specific integrated circuits) to help save costs and boost performance. ASICs are hardwired chips designed to handle specific tasks, and as such, tend to perform these tasks very well while being more energy efficient.

NASDAQ: AVGO

Key Data Points

Broadcom is a leader in ASIC technology, and after helping Alphabet create its highly regarded Tensor Processing Units (TPUs), other companies are turning to it to help them design their own custom AI chips. This includes Meta Platforms and OpenAI, among others, while Anthropic has placed a large order with Broadcom for Alphabet's TPUs to be deployed through Google Cloud. This is an enormous opportunity, with analysts projecting huge AI growth for the company in the coming years. This includes Wolfe Research forecasting Broadcom to reach nearly $80 billion in AI revenue by fiscal 2027, up nearly 4 times versus fiscal 2025 levels, while Citigroup is expecting its AI revenue to climb fivefold to $100 billion.

With that type of growth, Broadcom is the stock I most want to own over the next several years.