Breakfast News: Powell Under Pressure

January 12, 2026

| Friday's Markets |

|---|

| S&P 500 6,966 (+0.65%) |

| Nasdaq 23,671 (+0.81%) |

| Dow 49,504 (+0.48%) |

| Bitcoin $90,452 (-0.61%) |

Source: Image created by Jester AI.

1. Powell Faces Legal Threat

Stock futures fell after Federal Reserve chair Jerome Powell revealed the Department of Justice has opened an investigation into him and has subpoenaed the central bank. S&P 500 futures dipped over 0.5% with the Nasdaq's down 1% at one point this morning, after a week in which the two indexes gained 1.6% and 1.9% respectively.

- It is "a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public": Powell also spoke of the threat that "monetary policy will be directed by political pressure or intimidation," while President Trump told NBC News "I don't know anything about it."

- Gold tops record $4,612: A flight to safety following news of the DoJ's actions also pushed silver to a record $84.69 per ounce, with both metals falling back slightly this morning.

2. Google and Walmart's AI Tie-up

Alphabet's (GOOG 0.02%) announced its Universal Commerce Protocol at the National Retail Federation annual show Sunday, aiming to set the standard for AI agents used in retail applications. It comes as Google vies with OpenAI and Amazon (AMZN 1.02%) for AI footholds in e-commerce.

- "The transition from traditional web or app search to agent-led commerce represents the next great evolution in retail": Walmart (WMT +1.47%) CEO John Furner joined Alphabet CEO Sundar Pichai to reveal a plan to use Google's Gemini AI assistant for shopping. Walmart already has a similar deal with OpenAI to use ChatGPT.

- 270 drone-enabled locations by 2027: Walmart is also expanding its partnership with Google's Wing to bring drone deliveries to 150 more stores over the next year.

3. Key Earnings to Watch This Week

Taiwan Semi (TSM 2.65%) is due to officially report fourth-quarter earnings Thursday, after AI chip demand reportedly led to record annual sales in 2025 as the chip maker posted record quarterly revenue of $33.1 billion in the previous quarter.

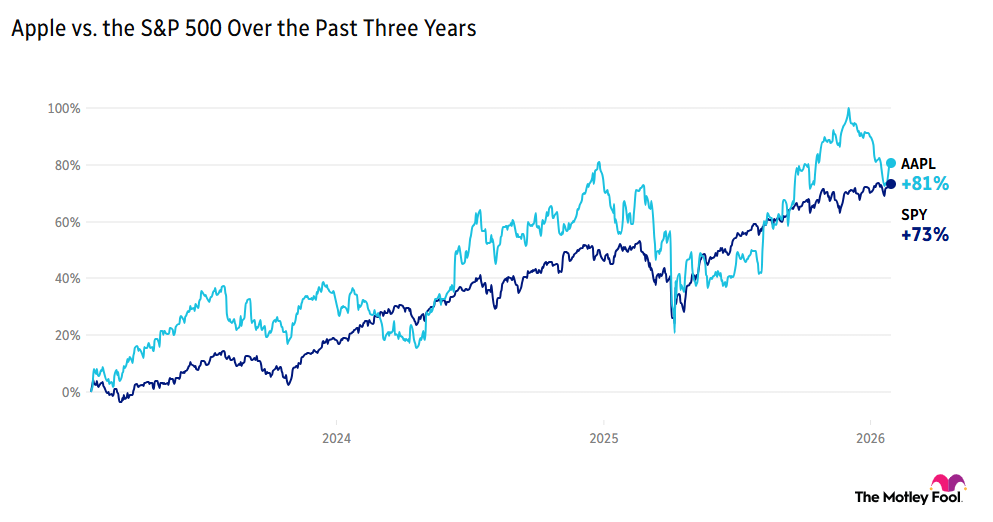

- 12% rise in Q3 net income: JPMorgan Chase (JPM 0.17%) kicks off bank reporting season Tuesday morning with full-year results, with the biggest U.S. bank set to take over from Goldman Sachs (GS 0.50%) as the new issuer of Apple's (AAPL +0.62%) credit card.

- Superscore of 74 on the Hidden Gems Primary Database: Karooooo (KARO +1.34%) is projected to report Q3 results this week, following a 21% revenue jump in Q2. In an interview last summer with CEO Zak Calisto, Fool analyst Emily Flippen noted one of the most impressive things about the business was its "ability to drive profits and build up this incredible financial profile while also growing rapidly."

4. Inflation Data Set to Shape Fed's Path

The December consumer price index (CPI) print is due Tuesday, expected to remain steady at 0.3% on the month and 2.7% year over year (YoY). Economists see core CPI edging up to 2.7% YoY, from November's 2.6%.

- RBC analysts see monthly PPI rising to 0.4%: Producer price index (PPI) reports have yet to catch up from the government shutdown, as delayed November figures are due Wednesday – with core PPI previously at 2.9% YoY. The same day brings November's delayed retail sales update.

- Next interest rate decision due January 28: Though inflation looks set to remain stubborn, the CME FedWatch tool still shows a 95% probability of no interest rate change at the Fed's next meeting – unswayed by political pressure.

5. Your Take

Which, if any, positions have you sold all or some of from your portfolio in the last month, and why? Share with friends and family, or become a member to hear what your fellow Fools are saying.