Gold's allure is strong, but historically it hasn't been the investment you might think. Source: Wikipedia.

Over the past month, I've written two articles about Market Vectors Gold Miners ETF (GDX +0.49%) discussing both reasons it could be a good investment and reasons it could lose value. The yellow metal is a divisive topic in the investing world. Some people tout gold investing -- whether in gold itself through a vehicle like the SPDR Gold Trust (GLD 0.07%) or in gold miners as a proxy for gold -- as a safe and market-beating way to invest. Others are stoutly against gold as an investment vehicle.

What I haven't discussed, however, is whether the Market Vectors Gold Miners ETF is worth buying today. And my answer, in short, is no.

Let me explain.

Gold's recent performance is alluring, but this gold miners ETF may not be a good proxy

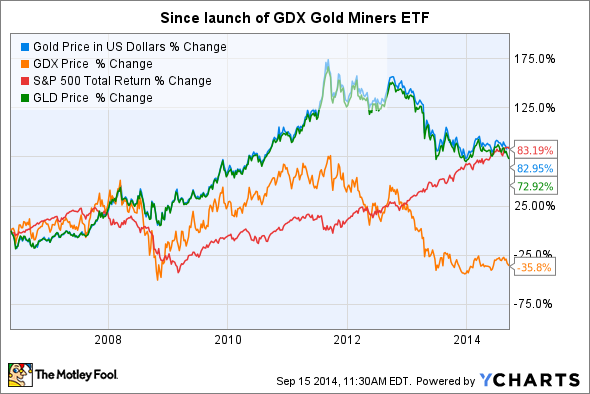

From early 2001 to 2011, gold had its best bull run in more than a century as an investment asset before losing about 30% of its value from 2011 until now. Market Vectors Gold Miners ETF was launched in May of 2006, and since then the strong rebound in the stock market has matched the performance of gold. Unfortunately, Market Vectors Gold Miners ETF hasn't kept up with this strong performance in stocks and gold:

Gold Price in US Dollars data by YCharts.

The reason? Gold mining is difficult and expensive, and as a result, gold miners can be "boom or bust" in nature. While there are a handful of exceptional performers, the majority of gold miners tend to underperform, and this has made the Market Vectors Gold Miners ETF, which is made up of some 40 different companies, a disappointing investment.

Rising input costs and the scarcity of gold compounding the risk

More than 50% of the Market Vectors Gold Miners ETF is allocated to six companies: Goldcorp (GG +0.00%), Barrick Gold (ABX 0.36%), Newmont Mining (NEM 0.25%), Silver Wheaton (SLW +2.52%), Franco-Nevada Corp. (FNV +0.12%), and Newcrest Mining, Ltd. (NCMGY +0.00%).

GG Total Return Price data by YCharts

Since the launch of the ETF, only two of the six have seen their stocks show a positive return -- Silver Wheaton and Newcrest Mining -- while the rest have lost value.

A big factor in this is the drop in gold prices, but that's not all there is to the story. Gold mines are typically in extremely remote places, with limited or no access to industrial power or fuel. Every bit of diesel used to run the machines and power the generators has to be trucked in at enormous cost. Furthermore, every ounce of gold produced requires the removal of tons of rock.

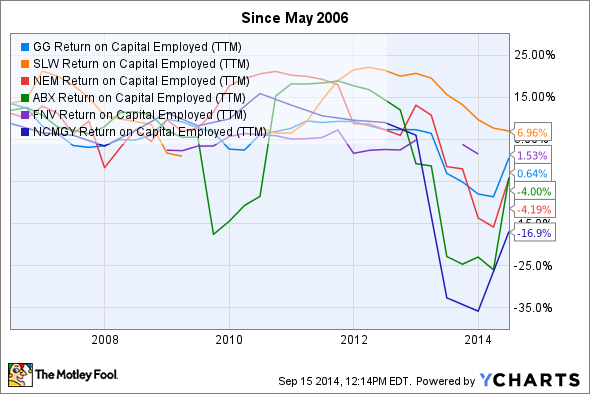

And while "difficult and expensive" doesn't necessarily mean "unprofitable," the gold mining business can be tough and unforgiving. Here's a look at how these six companies have performed, as measured by return on capital employed:

GG Return on Capital Employed (TTM) data by YCharts

While even ROCE isn't a straight-line measure, the data is worth examining. Only Silver Wheaton managed to get a decent return on its capital over the past few years.

These numbers are partly skewed by the asset writedowns that gold miners have had to take due to the falling price of gold -- which are paper losses and not "real" losses -- but this lost value may or may not return. In short, the miners that tend to be good investments are the ones that perform best when the industry is down. If there's one clear takeaway from the table above, it's just how wildly ROCE can swing for gold miners. Silver Wheaton is the only one of the six to maintain positive ROCE since 2006.

Let's look into one last metric: free cash flow.

GG Free Cash Flow (TTM) data by YCharts.

As you can see, gold miners can generate massive amounts of cash, and each of Market Vectors Gold Miners ETF's six top holdings generated positive cash from operations. However, free cash flow -- which measures operating cash flow minus capital expenditures -- shows how quickly a gold miner can spend huge amounts of money, often just to replace depleted assets. Much like oil and gas exploration companies, gold miners must constantly look for new reserves and spend significant amounts of cash to acquire the rights.

In short, it's a rough and demanding business, and only a few companies -- like Silver Wheaton -- have shown the ability to consistently turn assets into profits and grow shareholder value at the same time.

Even as a hedge, this ETF is not a great investment

In the "reasons to buy" article, I talked about the potential value of gold as a hedge in small quantities, but the reality is that I can't completely get behind that idea, especially using Market Vectors Gold Miners ETF as a proxy. In short, even if the price of gold rebounds, the long-term data doesn't give me much faith in the gold mining industry -- as represented in this ETF -- to be a value-creating investment over the long term.