The recent market pullback has been harder on some stocks than others. Cyclicals, for example, have taken a beating as concerns over Europe and China have caused some investors to flee the high-beta stocks. But the recent downturn presents some excellent buying opportunities in this sector, among them engine-maker Cummins

Let's take a look at some other reasons the company looks like a buy.

History

Cummins may not have the brand premium that consumer-facing giants like Coca-Cola or Johnson & Johnson do, but founded in 1919 as one of the world's first diesel engine manufacturers, the company is just about as reliable. Revenues have grown consistently over the last 10 years, and shares have appreciated by about 1,000% in that time. Its balance sheet looks solid with twice as much cash as long-term debt, and it operates in over 190 countries and territories.

As an industry leader, Cummins sits on a number of valuable patents, and its experience in meeting strict EPA regulations gives it an advantage in competing in other countries where environmental regulations are expected to become tougher.

Growth

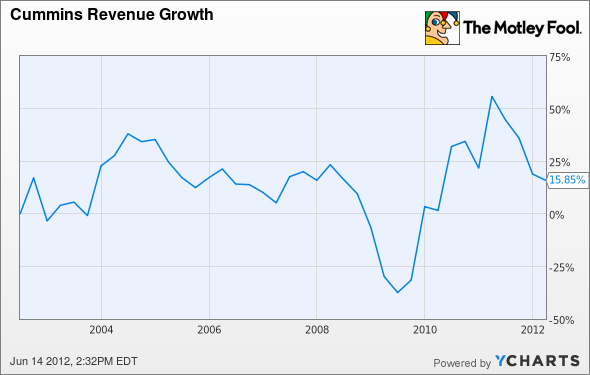

While Cummins is certainly a mature company, sales continue to forge ahead as the company finds new opportunities abroad.

CMI Revenue Growth data by YCharts

Sales climbed 36% last year, and analysts expect revenue to continue to grow around 10% this year and next with EPS jumping even more. Emerging markets have become a huge opportunity for the company as trucking is the lifeblood of the modern economy. In 2010, sales in China and Brazil grew by 70%, and sales in India increased 37%. While international growth appears to be slowing down with the global economy, it still remains an excellent long-term opportunity.

Natural gas opportunities

Westport Innovations

Cummins isn't stopping with the JV. In March, it said it would be developing a natural gas engine of its own: a 15-liter, heavy-duty, spark-injected version meant for on-highway applications. Production will start in 2014. Given its expertise and experience in diesel-engine building and its early inroads into natural gas engines, Cummins figures to be a major player if natural gas fueling takes off as some hope it will.

Other plays in the area

Cummins isn't the only machinery maker getting beaten down by the market pullback. Shares of earth-moving-equipment maker Caterpillar

Finally, Deere

All three of these machinery companies are industry leaders with brand value and staying power. They make necessary products that, while cyclical, need to be replaced and upgraded often. Despite an economic slowdown, their core business is not going away. Mr. Market looks foolish for discounting them so deeply.

To make matters more enticing, this group of stocks all pay solid dividends. If you're looking for more dividend picks, we've got a brand-new special free report on the best dividend payers in the Dow. It highlights three stocks that are all dividend aristocrats, consistently raising their payments, and that operate in stable businesses that will allow them to keep returning cash to shareholders for years to come. Get the names of these great companies in our free report: "The 3 Dow Stocks Dividend Investors Need." You can get your copy now by clicking right here.