It seems Qualcomm (QCOM 1.20%) has done it again. A Strategy Analytics report that came out last week said the company dominates the baseband space with 63% of revenue share -- a new record for the company.

But what's even more impressive is that Qualcomm's lead is not likely to be overtaken -- not even by Intel (INTC 0.19%).

Riding the cellular waves

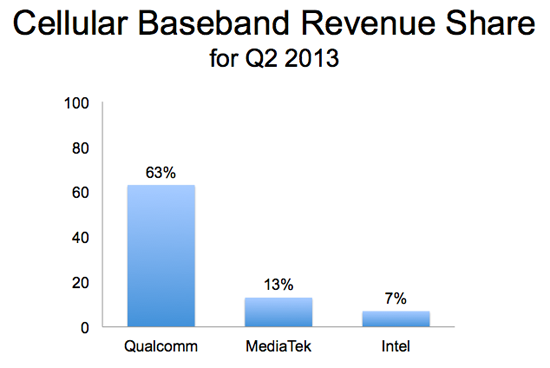

The cellular baseband processor market grew just 5.4% year over year in Q2 2013 to become a $4.4 billion market. But even with that modest growth, Qualcomm continued to hold a strong lead over the competition. It's easy to see Qualcomm's dominance from the graph below:

Data source: Strategy Analytics.

Part of Qualcomm's success comes from its early progress in LTE baseband chips. In the second quarter of this year, 40% of the company's baseband shipments were for LTE. But Intel started shipping the XMM 7160, its first multimode LTE baseband chip back in August, and is looking to make a big push in LTE over the next few years.

One of the ways Intel may be able to make more inroads into LTE is through its integrated chips. The vast majority of smartphone makers utilize integrated baseband and application processors, and Intel may be able to gain some design wins in these types of phones starting next year. Intel's XMM 7160 can work on 15 different LTE bands, along with 2G and 3G networks. The opportunity for Intel comes from the fact that the LTE chipset market is expected to grow to 850 million shipments in 2018. With that LTE growth, ABI Research said earlier this year that they expect Intel to be a "significant challenger" to Qualcomm over the next few years.

But even if Intel makes big gains in the baseband market, it's highly unlikely the company will unseat Qualcomm anytime soon. While Intel may have baseband chip that works on 15 LTE bands, there about 40 LTE bands worldwide -- and Qualcomm has the world's only global LTE band chip able to roam on almost any global network. That dominance in LTE is why Qualcomm currently holds about 97% of all LTE revenue share. On top of that, the company is the only chipset maker that is shipping commercially integrated support for almost all bands and wireless standards.

Qualcomm's growing competition won't mean much if the company continues to get design wins from device makers. That's why investors should continue to watch how many original equipment manufacturers sign up for Intel or Qualcomm designs. In July, it came out that Qualcomm is expected to have its LTE technology in about 500 upcoming devices. That will give Qualcomm a huge advantage over Intel and other competitors, but with the LTE market expected to have compound growth of 44% over the next two years, you can expect whoever becomes the second-biggest player to benefit from the growth as well.