As the parent company to Applebee's and IHOP, DineEquity (DIN 2.10%) is one of the bigger players in the casual-dining sector. Earnings for competitors have been coming in for a few weeks now, and overall things haven't looked good. What should investors be watching for when DineEquity reports earnings on Oct. 29?

Watch IHOP closely

IHOP has been struggling with declining comp sales and restaurant traffic. This finally improved last quarter when both metrics were up for the first time in nine quarters.

IHOP is not alone in the struggle. Competitor Denny's (DENN 1.83%) has also been struggling with comp sales, but managed to post a 0.6% increase last quarter. The difference is that Denny's did not grow restaurant traffic. The company is trying to turn this around by remodeling its restaurants, and reported that guest traffic has picked up at the remodeled locations. By the end of the year, more than half of its company-owned locations should be remodeled.

DineEquity's management attributes the increase in guest traffic at IHOP primarily to an updated menu. Customer reviews say the menu is easier to navigate. The menu update is a three-stage strategy with the first two stages already in effect, leaving one stage for later this year. If management is correct that the new menu is increasing traffic, then restaurant traffic should continue to improve as the menu roll-out continues.

Is this just a temporary blip for IHOP or the start of a longer trend? We'll know more next week.

Restaurant openings

DineEquity has respectable unit growth plans in place when compared to several casual-dining competitors. The company expects to open between 40-50 Applebee's and 50-60 IHOP restaurants, which will be operated by franchisees.

Six new Applebee's and 22 new IHOPs were opened in the first half of the year, leaving a significant amount of locations to be opened in the second half of the year. Look to see how much progress is made toward reaching this year's goal.

This is especially relevant right now for DineEquity after two franchises went bankrupt several months ago. These two apparently unrelated bankruptcies forced closures at 18 Applebee's and a still-pending number of IHOPs. So far this year, 28 Applebee's and 10 IHOP locations have been closed. Getting new locations opened to replace lost revenue is important.

What wasn't said last time...

DineEquity was quick to highlight several things last quarter, such as increased franchise profits and a decrease in administrative expenses. These improvements were the result of the company's refranchising efforts. The company reduced company-owned Applebee's from 160 to just 23, and IHOP restaurants from 14 to 12. This also reduced the company's revenue 31%.

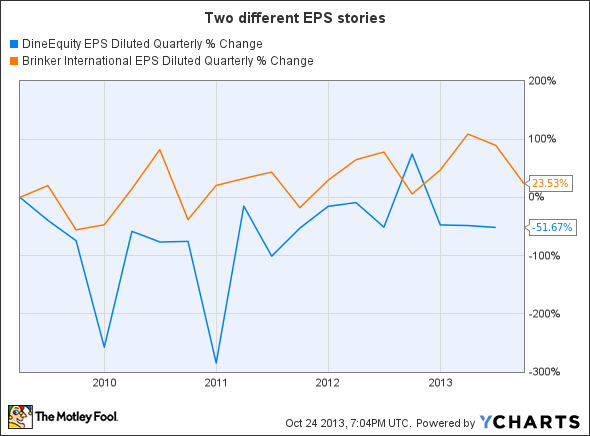

Typically when restaurants refranchise there is an quick positive impact on the bottom line. Not mentioned in the earnings call was that DineEquity's earnings per share were also down. For the first half of the year, diluted earnings per share were down to $1.80/share -- a 29% year-over-year drop. Compare that with Brinker International (EAT 3.87%), which grew its EPS 16% in the most recent quarter despite a 5% decline in revenue.

DineEquity EPS diluted quarterly data by YCharts

Brinker has been increasing efficiency with kitchen upgrades and higher-margin menu items. These initiatives have helped pad the bottom line even during a slow casual-restaurant environment.

Given the long-term downward trend, I want to see which way DineEquity's EPS will move this coming quarter.

A positive for DineEquity is its commitment to returning money to stockholders. The company returned 83% of its free cash flow to stockholders last quarter with a $0.75 dividend and by repurchasing more than 200,000 shares. At $0.75, the dividend is more than 4% -- one of the top payouts in the restaurant sector. If this can continue, EPS should grow long term.

Keep it in perspective

Quarterly earnings reports are important, but as long-term investors we need to be careful not to be too effected with what happens in a three-month span. We're looking for patterns and trends. Correctly identifying which way a company is moving will help us better identify winning investments.