While Shakespeare's rose by any other name might smell as sweet, 1-800-Flowers.com (FLWS +2.35%) by any other name would likely not have bloomed into as large a flower-delivery company. The company's name -- together with its distribution system -- was once part of its solid moat. However, the Internet changed the playing field, and 1-800-Flowers needs to beef up its moat because Amazon.com (AMZN +0.64%) is a comin.'

The company's stock withered about 10% on Oct. 29 after it released disappointing fiscal first-quarter 2014 results for the period ending Sept. 30, and it has not recovered. Here are the highlights:

- Revenue increased 2.9% to $123 million, slightly missing estimates of $124.3 million.

- Earnings-per-share were essentially unchanged at negative $0.07, in line with estimates.

- Sales in the floral segment (58% of revenue) decreased 1.7%, while sales in the gourmet food and gift-baskets segment (25% of revenue) grew 15.1%, and sales in BloomNet (17% of revenue) increased 2.9%.

- Full-year guidance was maintained at revenue growth in the mid-single digits, and EPS growth greater than revenue growth.

The quarterly results were far from a Shakespearean tragedy, especially since the fiscal first quarter is the industry's slowest period. And there was some good news, such as the growth in the gourmet food and gift-basket segment. However, I think investors need to step back from the quarterly results and focus on the bigger picture: The company's moat has not been the same since the Internet made its 1-800 telephone number considerably less of a competitive advantage.

Great products and services alone are often not enough

I've used 1-800-Flowers many times. It offers a wonderful diversity of products and good customer service. However, great products and services alone are often not enough for a company to thrive over the long term. A company needs a strong enough moat -- or competitive advantage -- to keep competitors at bay.

It helps this discussion to know a bit about 1-800-Flowers' growth story. Founder and CEO Jim McCann started with one retail florist in New York in the 1970s. He expanded to 14 locations by 1986, when he changed the company's strategy to take advantage of the emergence of toll-free telephone calling. He acquired the toll-free number 1-800-Flowers, adopted it as the company's name, and began aggressively building a national brand.

The company developed what was -- and still is -- considered a technically advanced infrastructure for order fulfillment and transaction processing. It created BloomNet, a network of independent florists throughout the U.S., to enable it to deliver products on a same-day or next-day basis. Reportedly, the company was one of the first businesses to embrace the then-new toll-free-calling way of doing business.

Surely, many independent florists offering great products and services eventually found they could not compete with 1-800-Flowers' new way of doing business.

Does this story strike a familiar chord? It certainly reminds me of Amazon founder and CEO Jeff Bezos recognizing the potential of the Internet early on, and developing a technically advanced infrastructure to support the sale of books and eventually a gazillion other things.

And that leads us to...

An Amazonian moat needed to keep Amazon at bay

1-800-Flowers is one of the largest, if not the largest, flower-delivery companies. It's only had to fend off many smaller companies in this highly fragmented business. However, that has recently changed, as Amazon -- a name that should strike fear in any industry in its Amazonian-sized path -- entered the flower-delivery business in August.

Amazon now sells its own flowers, the "Amazon Curated Flower Collection." Amazon has long sold fresh flowers, of course, but previously customers could only buy flowers offered through third-party sellers. At this point, Amazon's floral offerings are limited and it doesn't provide delivery on a specified date -- which is huge in the flower business.

However, Amazon Prime members don't have to pay shipping costs, a competitive advantage. Additionally, as AllThingsD reported, Amazon's frequently asked question section contains: "We are not able to offer scheduled delivery yet, but are working to bring you this feature as soon as possible."

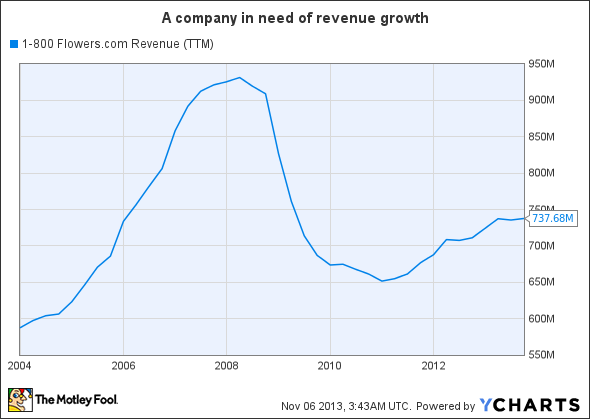

1-800-Flowers has been struggling to grow revenue since the recession, as you can see in the first chart. The company doesn't have much breathing space on the margin side, as the second chart shows. (The chart shows operating margin, as the quarterly profit margin chart is too choppy, due to the seasonality of the business, to be helpful here. Keep in mind the profit margin is even smaller; the current trailing-twelve-month profit margin is 1.7%.) So it's not in the position to grow revenue by sacrificing margin. Growing revenue without sacrificing margin will be considerably more difficult if Amazon decides to go whole-hog into the flower-delivery business.

FLWS Revenue (TTM) data by YCharts

FLWS Operating Margin (TTM) data by YCharts

Takeaway

1-800-Flowers offers a wonderful diversity of floral arrangements and other gift products, provides excellent customer service, and has a highly advanced distribution system.

However, investors need to keep abreast of Amazon's progress in its flower business. Amazon certainly has the capability to expand its product offerings and develop a more advanced distribution system. If and when this happens, 1-800-Flowers needs to have an even more fortified moat in place.