The Permian Basin that stretches from Texas to New Mexico has produced prolifically since the 1920s. Its history makes it particularly interesting to mature, development focused operators, tainting the basin with a boring aura. "Mature" is after all, a euphemism for in-decline. However, the development of new unconventional production strategies now puts the basin squarely back in the crosshairs of growth-oriented operators.

While production has waned from the 1960s, the long, steady decline has reversed. Production is up the last few years, and some believe it's the tip of the iceberg. The oil shale successes in the Bakken and Eagle Ford are leading producers to rethink the potential of other basins and the venerable Permian now sits center stage.

Two basins in one

While often viewed as a single basin, the Permian's so large that its different regions are actually quite geophysically distinct. The Midland Basin on the eastern side of the Permian is grabbing most of the press right now. There are many productive intervals, but most current interest revolves around the Wolfcamp and Spraberry intervals.

For years, operators have vertically drilled the Lower Spraberry and completed it in combination with the Upper Wolfcamp. With the recent adoption of unconventional horizontal technologies, prospects for this so-called 'Wolfberry' trend are looking even more attractive. Drillers with large exposure to these unconventional plays are hot and prices are being bid up. Pioneer Natural Resources (PXD +0.00%) estimates recoverable Wolfberry reserves at 50 billion barrels, placing it second globally behind the Ghawar field of Saudi Arabia.

While interesting in its own right, less chatter surrounds the Delaware Basin on the western flank of the Permian. It's more geologically complex and gassier than the Midland Basin. Yet, Concho Resources (CXO +0.00%) touts the Delaware as the more productive horizontal basin, with more big wells in 2012-13 than its high-profile sister basin. Productive intervals out west are principally the Bone Springs and Avalon shale. The Delaware's thinner, gassier Wolfcamp section is likely the primary reason that it remains under-the-radar.

The Big, Bad Wolf

Pioneer's CEO Scott Sheffield points to the Wolfberry's 4,000 feet of prospective shale as reason for excitement. It dwarfs even the homeruns that we're all familiar with. The Eagle Ford is 300 feet thick, the Barnett 400 feet, and the prolific Bakken comprises only three relatively thin zones. It's easy to see why the Permian's unconventional resource potential is the talk on the Street. The resource potential is staggering.

Pioneer is gradually shifting its Wolfberry drilling from vertical to horizontals wells in both the Lower Spraberry and Wolfcamp, carefully evaluating different intervals. While excited about the prospects, the company actually remains relatively cautious compared to some peers. With its Eagle Ford operations, Pioneer simply has too many irons in the fire to go whole hog yet.

A rattler in the weeds

That's not the case with Diamondback Energy (FANG +1.45%). It's aggressively proving out every horizon within the Wolfberry. This is a pure Permian play that's growing by leaps and bounds. Little Diamondback is running four rigs, just one shy of giant Pioneer, and another will be added by year end.

While the company is new on the scene, management is stocked with veterans from other large Permian operators. Execution has been impressive. Second quarter year-over-year production growth was an astonishing 160%. As a result, anyone shopping for Diamondback shares will pay up. Shares price with a lofty P/E north of 100.

Slow shifting to horizontals

Despite all the potential, most Permian operators have been slow to adopt unconventional technologies. Both Pioneer's Sheffield and Apache Corp's (APA +1.08%) Steve Farris point to the large number of small independents in the Permian as a contributing cause. Directional drilling and fracturing are expensive, and horizontal Wolfberry holes cost upwards of $7 million. Cheaper, safer opportunities are abundant and smaller operators cling to these projects out of necessity.

Times are changing. While only 10% of Permian wells drilled industrywide this year were horizontal, Apache anticipates that statistic to flip in the near future. Apache is so encouraged by growth prospects in the U.S. that it's divesting producing assets overseas and settling back home in the Permian and Anadarko basins. It threw off partial interest in its Egyptian production to Sinopec and divested its Gulf of Mexico production assets to raise capital.

These moves are part of a concerted effort to get back to growth by realizing its unconventional potential in both basins. Apache is actually the most aggressive driller in the Permian, with a rig count that leads all Permian drillers, and its combined Permian and Midland resource potential is 9.9 billion BOE. That's three times its current proved reserves.

Rising to the west

The Delaware Basin deserves more love than it gets. Concho Resources is the largest pure Permian play and one of the few that is leveraged to both basins. Its big driver, though, is the Delaware.

Concho is pulling back rigs in some of its other strategic regions to concentrate on Bone Spring and Avalon horizons in the northern Delaware Basin. Its horizontal Delaware Basin production grew an astounding 37% in a single quarter. Unfortunately, that was blunted by a drop in its New Mexico shelf Yeso production, where midstream issues caused shut-ins. Overall production gains were 7.3% linked quarter. Year-over-year growth was still a robust 30%.

It's also proving out the southern reaches of the Delaware with interesting results. The Delaware's Wolfcamp is gassy up north. Down south, oil cuts near 80% have been a pleasant surprise. Going forward, Concho plans to cut back on Yeso development until midstream issues are resolved, reduce vertical rigs, and accelerate horizontal development, focusing its spend on Delaware development where growth potential is strong.

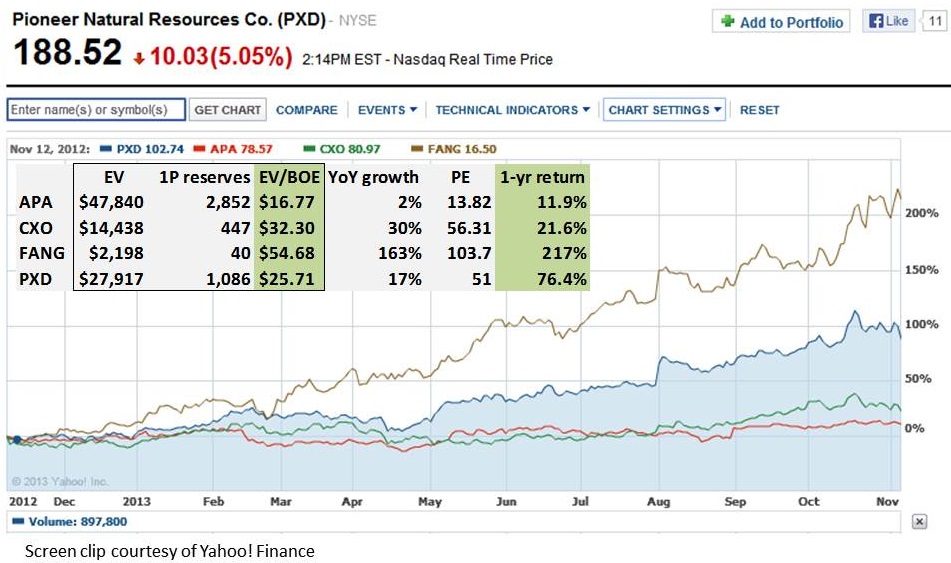

Lots of promise, but some really high price tags

These four aren't all created equal. Share growth is being driven by production growth. Those with high growth have stratospheric valuations, while Apache sits at true value levels with its limited growth. Tiny Diamondback tripled this year on the back of its excellent production gains. Pioneer almost doubled. Concho pops out as one of interest given its rapid Delaware basin gains and still moderate valuation due to Yeso headwinds.

Investors should keep in mind that these are among the most expensive oil shale wells to complete, so high oil prices are a necessity. It's also critical to factor in the reality that we're chasing a rising market when buying stocks like Pioneer and Diamondback. As the market settles back and oil prices dip, the high fliers could face significant losses. Pioneer is 17% off its recent highs in just three weeks. There's a lot of potential, but a lot of risk in this frothy market. Let the buyer beware.