After announcing earnings on the morning of Nov. 5, shares of Hertz Global Holdings (HTZ +0.00%) fell a whopping 10.50% to close at $21.30, 23.2% off their 52-week high of $27.75. The reason? Not earnings, surprisingly. Rather, the company's decline came about because of fallout with one of its strategic partners and management's estimates that this will result in a $50-$70 million hit.

Earnings beat forecasts

For the third fiscal quarter, Mr. Market expected Hertz to post earnings per share of $0.71 on revenue of $3.06 billion. Revenue, at $3.07 billion, beat expectations by 0.3% as the company saw a 22% increase in third quarter revenue from the $2.52 billion it reported in the same quarter a year ago.

According to Hertz, the significant sales increase can be attributed to a 32.6% increase in revenue for its U.S. car rental segment. For the quarter, revenue increased to an all-time high of $1.77 billion due to a 33.9% increase in Hertz's car count, which hit a high of 493,400 units. This, in turn, has been chalked up to the company's acquisition of Dollar Thrifty, a provider of low-cost car rentals.

In regard to earnings per share, Hertz also saw a rather large rise of 32.7% to $0.73. This beat analyst expectations by $0.02 and far outpaced the $0.55 in diluted earnings the company reported in the same period a year ago. This rise has been largely chalked up to the company's increased revenue. If it were this simple, we could just call it a day and say that Hertz is a fantastic investment. Unfortunately, this isn't the case because the number being reported as an earnings beat is actually the company's adjusted earnings per share, which factors out a number of expenses under purchase accounting practices.

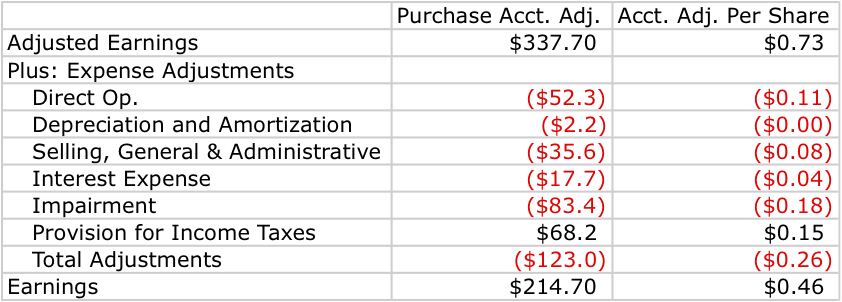

These adjustments, as shown above, take the $0.73 in adjusted earnings per share that the company reported for the quarter and add back the various expenses that management believes are uncalled for under generally accepted accounting principles, or GAAP. The bulk of these changes relate to the company's purchase accounting adjustments, essentially a byproduct of the company bringing the assets it acquired to fair-market value relative to what their book values were.

As an example, if the company acquired 25 cars for $1 million (or $40,000 apiece) and the cars were previously stated at a value of $30,000 each, then the company would increase the stated value of the cars up to what it believes to be fair value. So, if management believed that the cars were worth $35,000 each, then the cars would be stated at $35,000 each on the books, which would equal $875,000 in aggregate. The remaining $5,000 apiece (or $125,000) would be allocated to goodwill.

As a result of the company increasing the book value of each car on its books to bring those vehicles up to fair market value, the company will have higher depreciation expenses as well as other expenses across the board that relate to the cars. To adjust for this, management elected to remove these expenses using the non-GAAP measure of adjusted diluted earnings per share. This effectively illustrates how Hertz's metrics would look if it wasn't required to bring the assets' values up to fair market value. In doing so, Hertz was able to show that its earnings rose to $0.73 after adding these costs back to its earnings per share under GAAP.

Although this is good for the company, I don't like the idea of deviating from GAAP requirements as it becomes easier to make unfavorable things look more appealing. To account for this, I added the expenses back onto the company's adjusted diluted earnings per share to come up with earnings per share of $0.46. This is one penny lower than what the company's earnings release stated for the quarter. I decided to try and find the missing penny, eventually concluding that management must have erred in their earnings release because the $0.26 per share in adjustments they reported would actually round up to $0.27, while its $0.47 per share in regular earnings should be stated as $0.46.

Hit hard by a deal gone South

Despite the company's positive earnings results, its shares ultimately declined because a subleasing deal between Hertz and Simply Wheelz, a subsidiary of Franchise Services of North America, was canceled by Hertz after the latter failed to pay two months of sublease installments following Hertz's divestiture of its Advantage Rent-A-Car business.

Despite negotiations between the two entities, Hertz concluded that no deal could be struck that it determined to be adequate. As a result of this, Advantage will not have any cars with which to operate, effectively leading to an orderly liquidation through a Chapter 11 bankruptcy filing that the company announced.

Hertz, which currently has significant exposure to the Advantage business, expects to be on the line for somewhere in the range of $50 million to $70 million. As a pre-emptive measure, management took an impairment charge this past quarter in the amount of $40 million, on top of factoring another $4 million into a reserve account for the losses of Advantage's two most recent payments that were missed.

Foolish takeaway

Based on the analysis above Hertz has exceeded analyst expectations, but only when factoring in non-GAAP adjustments. Without these adjustments, the company's results were a disappointment that should cause investors some concern. Furthermore, the charge the company took as a result of its hit through Franchise Services has placed a modicum of strain on the company's earnings.

However, since most of the expected loss is already accounted for it is unlikely that this will be a significant concern moving forward. For the Foolish investor, I would be more concentrated on the company's ability to generate future earnings that are superior to what it just reported, rather than the one-time charge. If you believe that the company's decline was primarily due to news of the charge and nothing more, then it is likely that this could present a buying opportunity for investors who find the company appealing moving forward.