Bank of America (BAC 0.57%) has seen its stock rise almost 75% over the last year. Have investors missed the boat? I don't think so, and here's why.

1. Strong business performance

At first glance, the performance of Bank of America likely leaves something to be desired. Through the first nine months of the year, its return on average assets and return on equity when compared to peers pales in comparison, as shown in the chart below:

|

Bank |

Return on Average Assets |

Return on Average Equity |

|---|---|---|

|

Bank of America |

0.49% |

4.2% |

|

Citigroup (C 0.37%) |

0.80% |

7.8% |

|

Wells Fargo (WFC +0.41%) |

1.52% |

13.9% |

|

JPMorgan Chase |

0.71% |

8% |

Source: Company Earnings Reports.

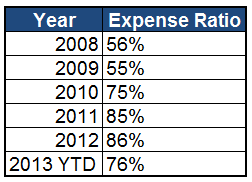

While Bank of America wasn't the only bank hit by the crumbling of the housing market, it has seemingly been the one most affected by it. However, if you look at the actual performance of its other business lines, the picture looks much better.

Source: Company Earnings Reports.

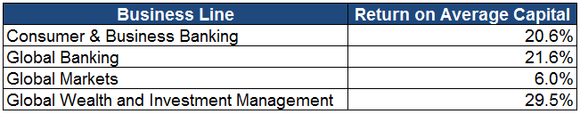

In fact, apart from the slight decline in its Global Banking business (which saw a $400 million gain from its provision for credit losses in 2012, versus a $600 million expense in 2013), each line of business has watched its net income grow in dramatic fashion relative to last year:

Source: Company Earnings Reports.

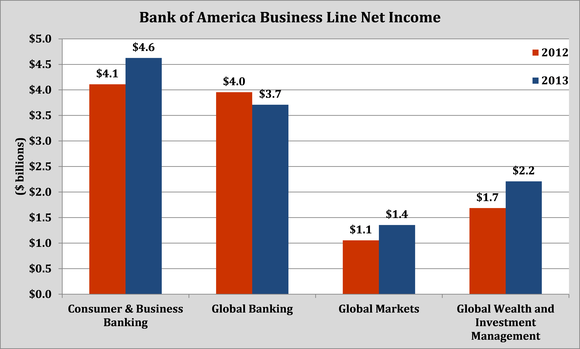

It is notable that Bank of America has watched its business line net income rise by 10% over the past year, from $10.8 billion to $11.9 billion. And you can see in the comparison against its peers that things look much better than at first glance:

Source: Company Earnings Reports.

Certainly the legal costs and losses on its mortgage portfolio are not to be discounted, as those are tangible dollars that Bank of America cannot give to its to shareholders, but the performance of its actual underlying business units is in fact quite strong. At some point, those payouts will cease, and Bank of America will be a radically different bank than the one it is seen as today.

2. It's reducing its expenses while growing its businesses

While Bank of America has been dubbed too big to fail, one of the biggest problems with it previously was that it had simply become too big too fast.

Through its distressing acquisition of Countrywide and messy acquisition of Merrill Lynch during the depths of the financial crisis, the company seemingly overextended itself under the guidance of former CEO Ken Lewis. It has taken years to slowly shed assets (and liabilities) that simply weren't part of its core operations, and it probably still isn't finished in these efforts.

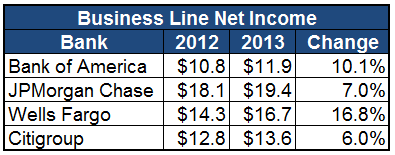

But the reality remains it has seen marked improvement on the expense front, as evidenced by its efficiency ratio (which measures the cost it takes to get each dollar of revenue) finally moving in the right direction:

Source: Company Earnings Reports.

Where have these improvements come from? Well, the bank is finally beginning to unwind and slow down many of the costs associated with its mortgage unit, and its litigation expenses are also beginning to taper off. But just slashing expenses isn't enough -- a company has to grow its business, too, and Bank of America has executed in this regard as well.

Consider that in the third quarter, Bank of America issued over a 1 million new credit cards, grew the assets in its brokerage business by 18% over the prior year, and added 33% more small business loans. And all of that was simply in its consumer bank.

In fact, it did all of that while decreasing its branch count by 5% to 5,243. On the other side of the spectrum, its Global Banking business had the No. 1 position in the Americas with 11%, and was ranked No. 2 in the world with 7.7% market share.

Bank of America's Wealth and Investment Management business saw its assets under management increase by more than 7% versus the third quarter of last year, and it delivered record asset management fees of $1.7 billion. This all came while the number of financial and wealth advisors fell by 7%.

Bank of America is now proving that it can operate efficiently all while maintaining a strong business presence and continually delivering results.

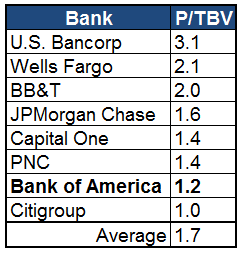

3. It's cheap

Despite its recent run, the bank's stock is still incredibly cheap. As it stands, its price to tangible book value, which measures the premium investors are willing to pay for actual equity at a bank, is among the lowest in the industry:

Source: Company Earnings Reports.

As you can see, Bank of America is trading at a significant discount relative to its peers. And when you consider that it is has delivered strong performance this year, it's poised to continue its growth, and it is cheap, it makes a rather compelling reason to consider investing in this bank.