The number of smokers in developed nations is declining, which is a big problem for the likes of Altria Group (MO 2.07%), Philip Morris International (PM 2.03%), and Reynolds American (RAI +0.00%). As a result, all three companies have reported sliding cigarettes sales for many years now. However, consumption of cigarettes and tobacco around the world is actually on the rise, and this is great news for Universal Corp. (UVV 0.85%).

Why Universal?

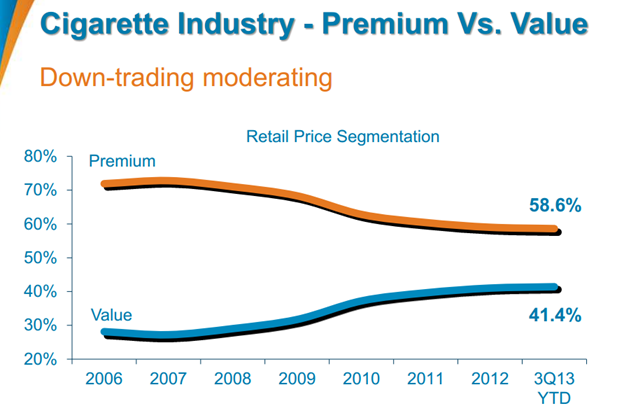

Before I get into why this is good news for Universal, let me go over some tobacco industry trends. Take a look at these two charts:

Source: Reynolds American investor presentation.

As we can see from the charts, over the past 10 years, consumers, especially within developed nations, have been 'down-trading,' favoring cheaper products over premium brands and smoking more roll-your-own tobacco rather than cigarettes.

This trend is extremely prevalent within the results of both Philip Morris and Altria. Specifically, Altria reported that in the nine months ended Sept. 30, the volume of Marlboro cigarettes shipped by the company declined 3.8%. Meanwhile, the volume of value-branded cigarettes shipped by Altria in the nine months to Sept. 30 rose by 5%.

Unfortunately, it would appear that Reynolds is not interpreting its own research correctly, as even the company's value offering is not reporting higher sales. Specifically, for the first nine months of 2013, sales of Reynolds' premium cigarettes fell 6.2%, and sales of value cigarettes fell 6.3%.

Another rising trend

In addition, another part of the tobacco market that has done well over the last few years is the cigar industry. According to the Centers for Disease Control, the consumption of cigars expanded by a staggering 123.1% during the period 2000 to 2011. The industry has continued to expand since, with sales jumping 9% during 2011 and then 4% during 2012.

That being said, although these are global trends, the situation is once again different within the domestic US cigar market. Indeed, data once again supplied by Reynolds American shows that around 8 billion units (cigars) total are expected to be sold in within the US during 2013. This figure is down from around 11 billion units sold during 2010. In comparison, the global consumption of cigars is expected to hit 22.7 billion units by 2018.

Unfortunately, while Altria does sell cigars within the US, its cigar sales are only declining. However, Reynolds' sales of its Natural American Spirit cigars jumped slightly more than 17% for the first nine months of 2013.

So where does Universal fit in?

Where does Universal fit in? As previously mentioned, according to the World Health Organization the consumption of tobacco products is actually increasing globally, and the data above seems to support this conclusion.

Unlike other tobacco companies, Universal does not manufacture cigarettes--the company actually grows the tobacco used by cigarette producers. As a result, far from being worried about falling tobacco sales, Universal is gearing up for growth. Specifically, the company recently embarked on a program to increase the company's tobacco leaf and production capacity within Mozambique. Similarly, other smaller-scale projects are currently in development in several other countries to enhance local processing and leaf services. All in all, the company plans to spend $50 million increasing its processing capacity this year.

That said, investors did raise concerns during the first half of this year when Universal reported a year-over-year decline in operating income of 55%. Nonetheless, investors need not be worried, as this lower income was a result of shipment timings and had nothing to do with demand. Universal's management has stated that it expects shipment volumes to return to normal levels during the second half of the fiscal year.

Foolish summary

So the tobacco industry is changing, and cigarettes are falling out of favor with smokers worldwide. On the other hand, consumption of tobacco is rising through other mediums, and Universal will be able to benefit from this.

In an industry that's well known for its defensive qualities, Universal looks as if it is now a defensive stock with plenty of potential for growth--possibly the best type of investment that you can get.