Source: Wikimedia Commons.

After reporting earnings for the fourth quarter of 2013, J.C. Penney (NYSE: JCP) saw its shares rise a whopping 25% to close the week of Feb. 23 up more than 32%. While the primary driver behind the company's share-price appreciation was its blowout earnings, one thing investors might be overlooking is its balance sheet.

Now that we have an updated picture of J.C. Penney's state of affairs, does it look like the business is positioned for a brighter future, or is its balance sheet signaling further distress ahead?

Things are looking up

For the quarter, J.C. Penney reported cash and cash equivalents on hand of $1.5 billion. This represents a substantial rise compared to the $930 million the retailer reported in the year-ago quarter and is slightly higher than the $1.2 billion it reported last quarter.

In its release, management stressed that the major contributor to its increased cash position was an $812 million inventory reduction, as the company did all it could to sell off old merchandise. This liquidation pushed inventory down 22% from $3.7 billion in the third quarter to $2.9 billion in the most recent quarter, but it's still higher than the $2.3 billion the business saw in the year-ago period.

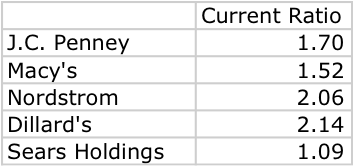

How liquid is J.C. Penney compared to its peers?

To make things look even better for J.C. Penney, its earnings release showed that its change in asset composition resulted in a higher current ratio, which currently stands at 1.7. What this means is that for every dollar in liabilities due within the next 12 months, the company has $1.70 in assets that, in theory, can be liquidated within that same time frame. This is far higher than the 1.4 ratio reported by the company during the fourth quarter of 2012 and is slightly higher than the 1.6 reported last quarter.

In order to fully understand how good this is for the company, we should compare it to competitors like Macy's (M +3.18%), Nordstrom (JWN +0.00%), Dillard's (DDS +2.30%), and Sears Holdings (SHLD +0.00%).

As we can see in the table above, J.C. Penney's current ratio stands in the middle of its peers. Based on each company's most recent quarterly results, Dillard's has the greatest level of liquidity, with an impressive $2.14 in current assets for every dollar in current liabilities. This suggests that, out of its peer group, Dillard's has the least chance of falling behind on payments in the near term.

Then, on the other hand, we have Sears. Out of all five retailers, Sears reported a current ratio that was, by far, the lowest. According to the company's earnings release for the fourth quarter of its 2013 fiscal year, it only holds $1.09 in current assets for every dollar in current liabilities. In the event that a large amount of long-term liabilities drift on the company's balance sheet or the business' cash flow generation eases, it could suddenly find itself struggling to pay its bills.

Solvency is a huge factor too!

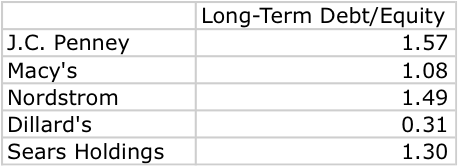

Based on these observations, it may look as though J.C. Penney's financial situation is as solid as can be. However, this would be a dangerous assumption to make. Don't believe me? Take a look at the table below:

Source: Recent company earnings releases.

As we can see, J.C. Penney's relatively strong liquidity has come at the cost of solvency. For the quarter, the business reported its long-term debt/equity ratio at about 1.6. What this means is that for every dollar in assets after factoring in all liabilities, the company has long-term debt of $1.57. This represents a sizable increase compared to the $0.90 reported a year earlier but came down from the 1.9 reported in the prior quarter.

While this isn't a super-dangerous level, it's far from great and is worse than any of its peers. For instance, the only company here whose long-term debt/equity ratio comes near J.C. Penney's is Nordstrom, with a ratio of 1.5. Even Sears, which has been performing poorly in recent years, has managed to maintain a ratio of 1.3. The only one with a strong ratio is Dillard's, which stands at an impressive 0.3.

Foolish takeaway

Based on the balance sheets of J.C. Penney and its peers, it looks as though J.C. Penney is showing some improvements in the short term. However, this does come with the downside of making the retailer less solvent. In the event that management can turn the business around, this idea of assuming higher debts for the sake of liquidity could pay off handsomely; but if performance falters, J.C. Penney's shareholders could be in for a world of hurt.