walmart.com

Wal-Mart Stores (WMT +1.47%) constantly finds itself in the news. This should come as no surprise given the fact that Wal-Mart is the largest retailer in the world. However, as the largest retailer in the world, it has a target on its back. While Target (TGT +2.56%) and Amazon.com (AMZN 1.02%) are consistently trying to steal share from Wal-Mart, only Amazon is seeing progress.

For Wal-Mart to keep Amazon off its back, it must constantly innovate. Wal-Mart must focus on innovations that are likely to improve the consumer shopping experience. One recently announced initiative should help in this regard while also aiding the top and bottom lines.

Empty shelves

Currently, you can find many online articles related to Wal-Mart intending aiming to improve its in-store merchandising, which Wal-Mart sees as a $3 billion opportunity. This is both good news and bad news.

It's bad news because this proves that customers have been disappointed with what Wal-Mart has had to offer. Its means those customers are likely to try another retailer to find what they need. It's good news because there is room for improvement. In essence, Wal-Mart has discovered an area where it's failing, but that area presents tremendous revenue potential. It should be an easy fix, right? Not necessarily.

The solution is a potential problem

As you might have already heard, Wal-Mart is seeing slower foot traffic. This is due to the headwinds that low-income consumers now face, including the end of the payroll tax holiday and a reduction in food stamp benefits. These are also some reasons why many low-income consumers are frequenting dollar stores. Wal-Mart is fighting back against the dollar stores with its small-box stores, opening between 270 and 300 Neighborhood Market and Walmart Express stores this year. However, that's a story for another time.

The point here is that Wal-Mart is struggling on the top line. Therefore, it must deliver on the bottom line in order to please investors. In order to do this, it must cut costs, or at least prevent costs from increasing. Wal-Mart has focused on headcount to cut costs. For instance, in 2008 there were 1.6 million Americans working at Wal-Mart and Sam's Club. Today, there are 1.4 million Americans working at Wal-Mart and Sam's Club. The catch? Wal-Mart has added 650 locations over that time frame.

That being the case, those who work at Wal-Mart are now being stretched thin, which isn't likely to lead to happy employees and quality customer service. On the other hand, it's possible that this is overstated and that Wal-Mart really did have too many workers several years ago.

If Wal-Mart has an opportunity to potentially add $3 billion to the top line (by filling shelves quicker with high-demand merchandise), then all would seem well, right?

Efficient or not?

Wal-Mart has always been efficient. For example, over the past five years, its top line outpaced its selling, general, and administrative expenses: 18% growth versus 17.4%. However, take a look at the past year:

Wal-Mart revenue (trailing-12 months) data by YCharts

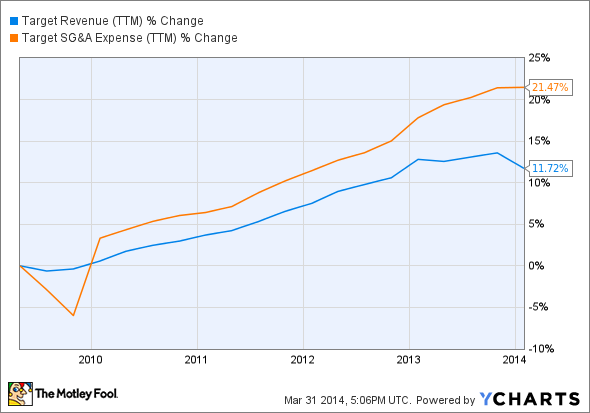

Moving forward, if Wal-Mart can significantly reduce its inventory, then costs should decline at a rapid rate, which would put smiles on the faces of investors. You might think that Target was also highly efficient prior to the data breach, but the five-year chart below tells a different story:

Target revenue (trailing-12 months) data by YCharts

The data breach only worsened an already challenging situation. Target is now facing severe headwinds with data breach costs still in play. But what about Amazon?

Amazon revenue (trailing-12 months) data by YCharts

This might be surprising to some people given Amazon's enormous popularity with consumers and investors. But while Amazon's top-line growth is phenomenal, it lags Wal-Mart in the efficiency department. That being the case, while investors looking for high-growth potential will favor Amazon, those looking for safety and efficiency, which often leads to increased capital returns to shareholders, will still favor Wal-Mart.

The Foolish bottom line

Wal-Mart is no longer a growth company, but it still finds innovative ways to grow. The opening of more small-box stores is one example. Another is to improve in-store merchandising.

If Wal-Mart is correct, then adding $3 billion in a fiscal year would equal approximately a 0.6% contribution to the top line. That might not sound like much, but Wal-Mart's revenue has only increased 1.4% over the trailing-12 month period. Also consider cost reductions due to less inventory over the long haul, assuming Wal-Mart sticks with this plan.

Overall, this sounds like a positive plan with more upside potential than downside risk. Please do your own research prior to making any investment decisions. And if you're looking for much greater growth potential than Wal-Mart, then you need to read about The Motley Fool's Top Stock for 2014.