The FCC board, Chairman Tom Wheeler is center. Photo: Bloomberg

The Federal Communications Commission, or FCC, voted last week on new regulations to limit "joint sales agreements," or JSAs. These agreements give two stations the ability to team up and negotiate ad sales as one unit. This action will effectively target a broadcaster that owns a particular station, but sells advertising for another station in the same city. The supporters of these new regulations hope to eliminate the possibility of one corporation dominating the local market by becoming the only company that exchanges advertising space for all stations.

This new rule has come as a blow to broadcasting companies such as Sinclair Broadcast Group (SBGI 1.20%), which has used JSAs for years to circumvent rules which govern how much of a market one single broadcaster can own. Sinclair's stock took a hit on the news, as the FCC has given the company a two-year time limit to dismantle its current agreements in this area. However, the decision could be a more long-term boost to cable TV providers such as Comcast (NASDAQ:CMSCA) and Time Warner Cable (NYSE: TWC) that could benefit by having lower costs since the broadcasters will have less negotiation power.

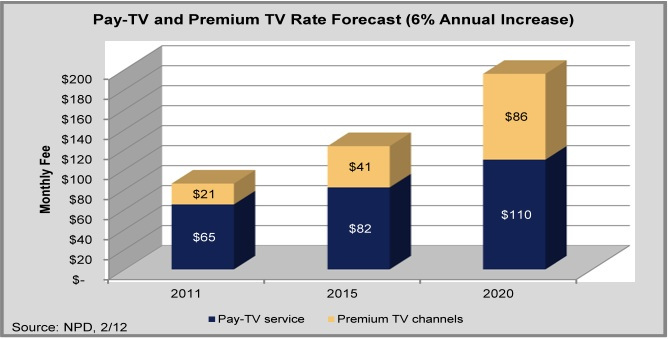

Cable rates have skyrocketed recently

JSAs have become commonplace in the last few years as smaller stations team up with bigger stations to jointly sell their advertising space. Supporters of the practice say that without the help from the bigger stations, these smaller local stations would have a hard time getting adequate compensation for their advertising space and they could go out of business.

Graphic source: Gigiam

By some estimates, the joint agreements have caused fees to skyrocket from $28 million in 2005 to $2.4 billion in 2012, according to reports from the FCC. These cable rate hikes have not gone unnoticed by consumers, and cable TV providers don't want to take the blame for these rate increases.

Time Warner Cable and Comcast, as well as other big cable companies, would be happy to see lower advertising expenses. For cable companies, when local TV broadcasting stations join together to have more clout in negotiating advertisement fees, the result is larger cable companies pay more to show the TV programming, and thus have to charge customers more in monthly fees to compensate.If the smaller stations have less clout in negotiating ad sales, the cable companies could have an easier time with lowering their own expenses leading to more profits and/or lower rates for consumers. This is good, as cable companies have struggled to prove to consumers that their services are worth the steep price increases.

Thomas "Tom" Wheeler, chairman of the Federal Communications Commission. Photo: Bloomberg

Will this regulation finally mean lower cable prices?

"Chairman Wheeler is taking steps to protect consumers and preserve local broadcasting by preventing the erosion of competition in local broadcast markets," the FCC said. "These steps will curtail practices that have put upward pressure on cable prices." Supporters suggest that lower prices paid by pay-TV providers will mean lower cable and pay-TV rates for consumers.

However, not everyone agrees that the individual consumer will benefit from these changes. "The real loser will be local TV viewers, because this proposal will kill jobs, chill investment in broadcasting and reduce meaningful minority programming and ownership opportunities," said Gordon Smith, president of the National Association of Broadcasters, or NAB, insisting that instead the changes would benefit "big cable companies who want less competition for advertising in local markets."

Investors' Foolish takeaway: Where are the long-term profits?

Less flexibility in advertising negotiations will hurt broadcasters such as Sinclair Broadcasting Group. However, lower costs for pay-TV could mean better profits for the big cable providers such as Comcast and Time Warner. As a consumer, whether or not this will trickle down to lower cable rates is yet to be seen. As an investor, this could be a boost for big cable.

Editor's note: A previous version of this article misstated the American Cable Association's view on JSA's. The Fool regrets the error.