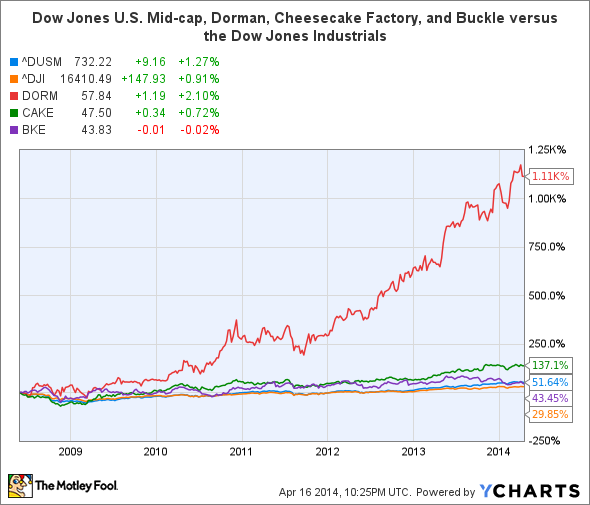

Mid-Cap Companies, broadly defined as as companies with market capitalization between $2 billion and $10 billion , represent ideal investment ideas. These companies are typically big enough to weather catastrophic events and small enough to have growth potential. The Dow Jones U. S. Mid Cap index outpaced the Dow Jones Industrials by 22% over the past 10 years. Apparel retailer Buckle (BKE +4.75%), restaurant chain The Cheesecake Factory (CAKE +0.92%), and auto parts supplier Dorman Products (DORM +0.11%) all represent examples of companies in this category (chart below). Do these companies sit on solid financial footing?

Mid-Cap data by YCharts

Online sales provides a small boost

Buckle's brick-and mortar business includes 450 stores in the United States in addition to its e-commerce business, as of the most recent quarter. Like most retailers it struggled somewhat on the brick and mortar side with same store sales remaining basically even in 2013. By contrast, Buckle's online sales, which comprised 8% of Buckle's sales, increased 5.3% during that same time. This made a small contribution toward boosting Buckle's overall sales which only increased 0.36% last year.

Buckle's net income and free cash flow decreased 1% and 24% respectively. Increases in expenses such as shrinkage (theft), increased payroll, and health care costs all contributed to the decrease in net income. Inventory made the biggest impact on free cash flow. Buckle's balance sheet remains in excellent shape. . Cash and short-term investments make up a whopping 51% of stockholder's equity. Buckle possesses no long-term on its balance sheet.

Buckle prefers returning cash to its shareholders in the form of dividends. The company has made no share repurchases since 2012. Last year it paid out 67% of its free cash flow in dividends which resides a little in the steep range. The company does exercise prudence in its dividend policy. It typically pays a regular dividend and a yearly special dividend that can vary based on circumstances such as profitability. Currently the company pays its shareholders a regular dividend of $0.88 per share per year translating into a yield of 2% not factoring in any special dividend it may pay this year.

More than cheesecake

Source: Motley Fool Flickr by pon5555

Full-service dining restaurant chain The Cheesecake Factory operates under three brands : The Cheesecake Factory with 169 restaurants, Grand Lux Café with 11 locations, and a single RockSugar Pan Asian Kitchen location according to the company to the company's latest 10-K. The Cheesecake Factory provides superior quality lunch, dinner, and desserts in the moderate price range. The Grand Lux Café provides an upscale experience with "globally inspired, artisan cuisine with an ambiance of modern sophistication." The Cheesecake Factory's one RockSugar Pan Asian Kitchen location provides an upscale Southeast Asian experience.

The Cheesecake Factory saw its overall sales and net income increase 4% and 16% respectively last year. Its free cash flow declined 10% during the same time frame. Comparable sales increased 1% in 2013. Price increases helped the company overcome a decrease in guest traffic sending both revenue and comparable sales into the positive range. A hefty increase in capital expenditures stemming from store expansion contributed to the decline in free cash flow. The Cheesecake factory also possesses cash amounting to 11% of stockholder's equity and no long-term debt . Last year, The Cheesecake Factory paid out 28% of its free cash flow in dividends. Currently the company pays its shareholders $0.56 per share per year and yields 1.2%.

Product innovation rules

Dorman Products distributes replacement automotive parts to the "automotive aftermarket" like your local auto parts retailer and/or car dealer according to its SEC filings . Last year proved kind to Dorman Products. Revenue, net income, and free cash flow all increased an impressive 17%, 15%, and 20% respectively. Revenue and profitability growth came from a strong demand for new products introduced by the company in the 24 months leading up to the end of 2013. The increase in net income, timing of payments toward customers, and accounting accruals contributed to the free cash flow increase. Dorman Products' cash balance comprised 15% of stockholder's equity and the company possessed no long-term debt at the end of 2013. The company currently pays no regular dividend.

Looking ahead

Buckle investors should look for its online sales to trend favorably upward as consumers increasingly shop online. However, it represents such a small part of the overall business that weaknesses in its brick and mortar sales may overwhelm its entire business. The Cheesecake Factory needs to increase guest traffic; it can only increase prices so much before guest traffic declines overtake any benefit from price increases. Innovation will serve as key to the future of Dorman Products which represents the company with the greatest potential as people increasingly want to get a longer life span out of their vehicles.