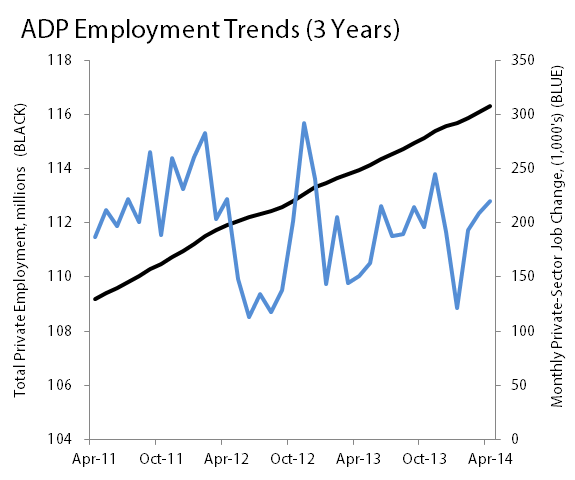

Most months, ADP's (ADP +0.56%) private-payroll jobs data is the most important piece of economic news on the day it's released. Today that wasn't the case, as the monthly GDP update, which reported 2014's first-quarter data for the first time, overshadowed everything else. Most market-watchers and economic analysts have focused on the fact that America's economy barely budged in the first quarter, while a deeper dive revealed that Obamacare has all but singlehandedly kept the economy afloat. However, ADP's jobs data, which has been updated to include April's results, shows a somewhat more positive picture:

Source: ADP.

Last month, ADP reported a new all-time high in American private nonfarm payroll jobs, and the trend of slow-but-steady jobs growth has continued in April, with another 220,000 new jobs on record. April's job additions are the second most of the past year behind last November and are slightly ahead of the median monthly job gain of 202,000 of the past three years. This figure also pushes the average growth in private-payroll jobs seen over the past year up from 190,000 per month, which is where it had been after March's update, to 196,000 per month. This show of modest strength might help to explain why the Dow Jones Industrial Average (^DJI 0.09%) closed out the day in positive territory despite a lousy GDP report -- as long as the American economy keeps adding jobs, it's not likely to plunge into recession.

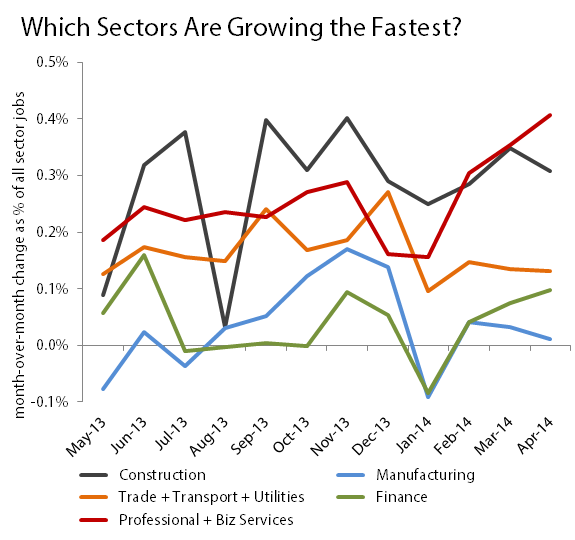

And, contrary to the construction-related weakness seen in the first-quarter GDP report, ADP's sector-by-sector jobs breakdown shows that construction continues to be one of the country's best places to find a job -- 19,000 new construction workers joined America's private employment rosters in April, for a gain of 0.31%. The only sector with a larger month-over-month gain, percentage-wise, was the consistently strong (and far larger) professional-services sector. Over the past year, however, this is more an exception than a rule, as construction jobs have been added at a greater rate than those of any sector for nine of the past 12 months:

Source: ADP.

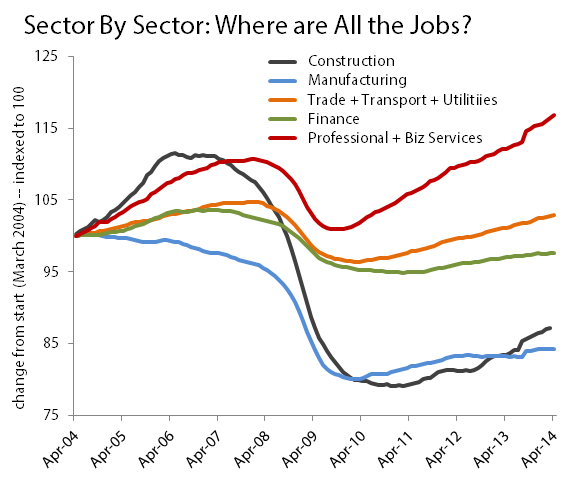

However, that doesn't mean construction is the real driver of job growth. Its total private-sector figure of 6.05 million employees doesn't come close to the 18.99 million professional-services employees, and it's less than a fourth the size of the massive trade, transportation, and utility sector. These two sectors continue to boast the largest monthly growth in actual jobs, as you might expect in sectors that make up such a large part of the economy:

Source: ADP.

Nor does it mean that construction has really staged a comeback. The sector has added 202,000 jobs in the past year, but there are still nearly 1.7 million fewer private-sector construction jobs today than there were at the peak of the homebuilding boom in mid-2006. The only sector to show long-term strength continues to be the professional-services sector:

Source: ADP.

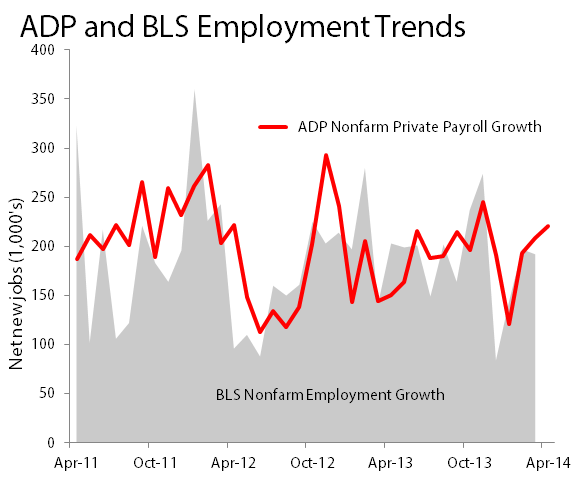

The markets and the economy must now look ahead to the authoritative Bureau of Labor Statistics employment report, which will be released this Friday. There has been some grumbling of late that ADP's jobs data is not a reasonable proxy for the BLS report, but a quick comparison of the two reports' non-farm job growth figures shows us what to expect:

Source: ADP and U.S. Bureau of Labor Statistics.

While ADP has become fond of revising its numbers to pull closer in line with the BLS data, it's not fair to ding its economists without noting that the BLS also issues multiple revisions before finalizing its data. Last month, ADP recorded 17,000 more new jobs than the BLS, and over the past year the average difference has been about 34,000 jobs in one direction or another. We can probably expect roughly 200,000 new jobs in the BLS's nonfarm employment tally for April, which means that the arduous path toward a new all-time nonfarm employment peak should still reach its finish line by June.