Fiat Chrysler's Jeep brand has driven company sales higher in 2014. Source: Fiat Chrysler Automobiles.

This year has started off slow for Ford (F 0.68%), and General Motors (GM 1.91%) is limping through its turnaround while juggling this year's massive recall debacle. It might shock you that while the two larger Detroit automakers have struggled with sales during the early part of 2014, sales at the newly combined automaker Fiat Chrysler Automobiles (NASDAQOTH: FIATY) are surging.

By the numbers

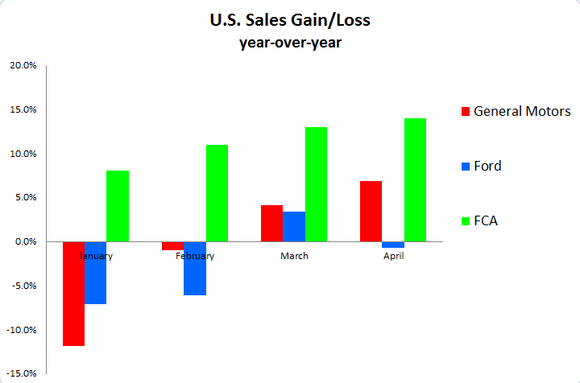

Fiat Chrysler Automobiles, or FCA, still trails Ford and General Motors in terms of overall sales volume. But look at the sales increases the company has posted this year:

Graph by author. Source: Individual company sales reports.

The difference is just as pronounced as you would guess when looking at year-to-date sales totals. Ford has had the roughest start to 2014, with sales down 2.1% through April compared to the same time period last year. General Motors eked out a 0.1% gain in year-over-year sales through April. FCA, on the other hand, posted a substantial 12% gain during the first four months of 2014.

So what's the scoop on FCA's surge? Not surprisingly, the company's success is pinned on full-size trucks and SUVs, as has been the case with Detroit automakers in the past.

FCA's Ram truck has also posted a strong year of sales. Source: Fiat Chrysler Automobiles.

Ram and Jeep

Sales of the Ram pickup truck jumped 17% last month, compared to last year's April, which made last month the truck's best-ever April sales performance and its 48th consecutive month of year-over-year sales gains. Sales of the Ram pickup were also up an even stronger 23% for the year. This is hugely important for potential investors, when FCA eventually goes public on the New York Stock Exchange, because the full-size pickups bring in a large portion of American automakers' profits.

Not only have consumers been buying the Ram truck, critics have had many positive things to say. The Ram 1500 and Ram 2500 were named "Top Rated Vehicles" by Edmunds.com last month and were also named "Most Loved Vehicles in America" by Strategic Vision earlier this year. The Ram 1500 was also named "Best Pickup Truck" in 2014 for the second straight year at MotorWeek's Drivers' Choice Awards.

While the Ram is enjoying much success in 2014, the competition is taking notice and will adjust appropriately. General Motors has boosted incentives for its Silverado and Sierra full-size trucks over the last two months to help reverse its sales slide. Also, loyal truck buyers are waiting for Ford to unleash its all-new 2015 F-150 later this year; it could shake up sales in the market significantly.

FCA's success in 2014 isn't limited to just its Ram brand, however. Strong Jeep sales are defying critics, who have rated the brand poorly in the past.

Jeep sales were up 52% year-over-year in April, which was the brand's best-ever month of sales. This isn't just a one month wonder, either, as Jeep sales have risen 46% through Aprilwith the charge being led across its entire vehicle lineup. The Jeep Compass posted its best-ever month of sales last month, while the Jeep Wrangler and Patriot each set their best-ever April sales number.

What's impressive about Jeep's sales increase through April is that it's FCA's largest brand in terms of sales and accounts for nearly a third of the company's overall U.S. sales. When an automaker's largest brand is posting year-to-date sales gains of nearly 50%, it's a very good sign.

Foolish takeaway

I'd expect sales of the red-hot Ram truck to slow in the coming months as competitors increase incentives to regain lost market share, and as Ford launches its next generation F-150. However, if sales keep on this pace, the Ram could very well challenge General Motors' Chevy Silverado for America's second-best-selling truck, although it would still trail the Ford F-Series by a large margin.

One last positive takeaway for potential FCA investors: Through April it had gained more U.S. market share than any other major automaker. When comparing the first four months of 2014 to the corresponding period of 2013, FCA's market share in the U.S. increased 100 basis points to 12.7%. To put that in perspective, Ford's market share over that same time frame declined from 16.2% to 15.4%, while GM's declined from 18.1% to 17.6%.

While there are many questions regarding FCA's five-year plan to significantly boost sales, 2014 has clearly been a strong step forward for Detroit's third-largest automaker.