Cloud Peak Energy (CLD) focuses exclusively on the Powder River Basin (PRB). Peabody Energy (BTU) is among the largest players in the region and in the world. There's a good reason to like the PRB exposure of these two coal miners, even if new regulations put a damper on coal use at domestic utilities.

What's the PRB?

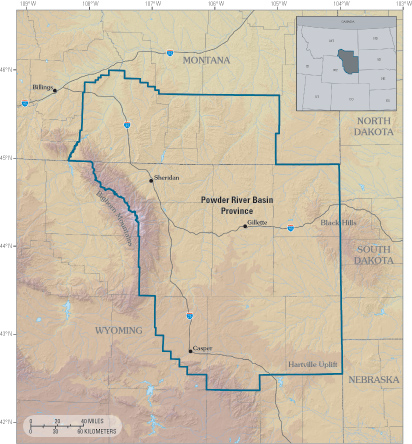

The Powder River Basin is a coal region that spans Wyoming and Montana. From a geographic perspective, that's a good location because it's closer to Asia than East Coast mining regions like the Illinois Basin. That means there's still a growing market for PRB coal a relatively short boat ride away, since demand for energy in Asia is continuing to increase.

Peabody explains how big an opportunity there is: Global electricity demand is projected to increase by nearly 70% between 2010 and 2030. The miner believes that coal demand will benefit from a near 50% rise over that span. Bringing that a little closer, Peabody estimates that about 250 gigawatts of coal power will be installed by 2016. To fuel those new power plants 750 million tonnes of new coal production will be needed. Most of that demand will come from Asian nations like China and India.

(Source: USGS, via Wikimedia Commons)

The thing about coal, however, is that all coal isn't made equal. Coal is graded around carbon content and moisture, among other things. PRB coal scores highly on key measures. For example, some PRB coal, "has about 0.3 percent sulfur... compared with more than 1.2 percent sulfur in most of the coal in the Illinois Basin." The fact that the PRB was formed in freshwater swamps is largely responsible for the difference. It also means that PRB coal is relatively clean.

So as the utility industry has been looking to clean up its act because of increasing government regulations, PRB coal has stepped up to help that process along. The region accounts for around 40% of domestic coal supply. And while the heat content of PRB coal is below that of other regions, its price, at a recent $13 a ton or so, is a fraction of other areas like the Illinois Basin, which fetches around $46 a ton.

That's why it's important that PRB coal is also relatively easy to get at. While other regions make extensive use of costly and dangerous underground mining, surface mines are used in the PRB. The three mines that Cloud Peak operates all use surface mining. It's one reason why the company proudly relates in its annual report that, "According to MSHA data, in 2013, we had one of the lowest employee all injury incident rates among the largest U.S. coal producing companies."

(Source: Greg Goebel, via Wikimedia Commons)

The company's PRB focus has also allowed it to remain profitable, on an annual basis, through the domestic thermal coal downturn. To be fair, Cloud Peak lost about a quarter a share in the first quarter. However, severe weather was partly to blame because it caused delivery delays. You can't make money if you can't ship your product. Most other competitors, including Peabody, have been bleeding a lot more red ink.

More than just a regional big wig

While Cloud Peak is a pure play on the PRB, Peabody Energy is the largest player in the Southern PRB. Its three Wyoming mines sold 134 million tons of coal last year (representing about 60% of its coal production). Cloud Peak sold 86 million tons. Clearly, Peabody has a scale advantage.

It also has an "in" in key foreign markets like China where it has a 50/50 joint venture with a large coal importer. However, its extensive Australian operations also provide key contacts throughout the region that PRB-focused Cloud Peak simply doesn't have.

The darkest days

Coal is facing its darkest days right now, and it's not going to improve overnight. That said, the PRB is well situated even though the fuel is out of favor. Cloud Peak and Peabody's exposure to this coal region should put them in good position to prosper over the long term no matter the outcome of new utility regulations.