General Electric's (GE 0.66%) largest ever acquisition proposal for Alstom (AOMFF +4.88%) has finally received acceptance from the latter's board. The icing on the cake came when the French government showered its blessing, giving undisputed support to the $16.9 billion deal after the revised proposal mollified the bureaucrats' concerns. Siemens (SIEGY 0.95%), though, hasn't given up on its plans for future expansion and operations. Here's the latest update from the corporate drama that unfolded over the past couple of months.

A complete package

Alstom's board offered unanimous support to GE's revised bid, declining Siemens counteroffer. It recommended its shareholders to vote in favor of GE's proposal. The rail and energy group was impressed with the upgraded offer that not only served the interest of its stakeholders, but conserved and addressed most of the key issues put forward by the government.

Very high-speed train Euroduplex-Alstom Transport. Source: Alstom.

According to the modified offer, GE would set up three equal joint ventures with Alstom and sell its railway signal unit to the latter for $825 million. The first joint venture would utilize the combined assets of the two companies to form a grid unit. The second would combine Alstom's off-shore wind and hydro unit. And the third venture would integrate the highly sensitive nuclear power facilities with high-margin steam turbine business. The French conglomerate would put $3.5 billion into the joint venture. Other than this, the two companies also intend to take up several joint projects in the future.

Ling Ao nuclear power plant. Source: Alstom.

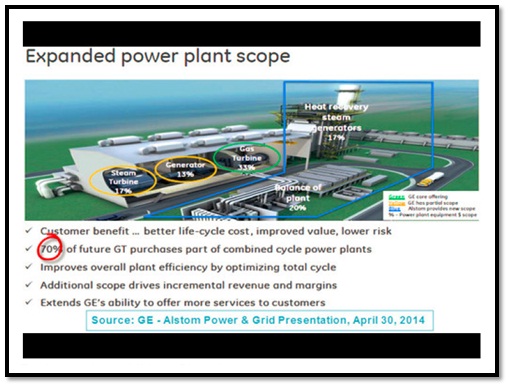

GE forecasts that 70% of upcoming gas turbine orders would be related to combined-cycle gas turbine power plant, an area where Alstom excels. The gas and steam turbines would run together and increase efficiency, helping GE provide superior turnkey solutions to buyers. This is a big threat to Siemens, which could lose several orders to GE-Alstom.

Source: Bloomberg Industries, GE-Alstom Power & Grid Presentation.

The French government would acquire 20% stake in Alstom from company shareholder Bouygues, which would give them a controlling stake and address security issues. President Francois Hollande and Bouygues are negotiating the share price. While Bouygues insists a price of 35 euros a share, the government is bargaining for 28 euros. Though the regulators have given the go-ahead signal, the official approval is subject to the fulfillment of the government's pact with Bouygues at an agreeable price.

If free of further obstacles, the deal should be concluded by 2015. The deal would give GE access to Alstom's power and energy assets, and solidify its industrial base. GE's management forecasts that combination synergies could boost industrial's earnings proportion to total earnings to 75% by 2016. Siemens regrets not having passed Alstom's parameter.

Is it all over for Siemens?

But the story is far from over, as Siemens isn't done. "It is not over yet," says CEO Joe Kaeser. Along with ally Mitsubishi Heavy Industries, the German conglomerate would be more than eager to resume talks with Alstom and the French government, in case the Alstom-GE deal falls through for any reason. Through Siemens' railroad alliance with Alstom, the company planned to widen Europe's connectivity and build a global outreach. He blames Alstom's chief executive Patrick Kron for rebuffing the deal.

Kaesaer still believes Siemens' offer was better than GE's revised proposal for the joint entity's future perspective and growth. In fact, the American conglomerate's amended offer is quite complex, with multiple alliances compared with the original proposal, that would have given it complete control. Under the joint venture structure, with more management layers, allocating capital resourcefully across various segments would be another challenge. Reducing margin gaps of GE and Alstom, and achieving the expected synergy of $1.2 billion would be difficult under the joint venture arrangement. Alstom already struggles in cash generation, and this arrangement could further dampen free cash flow.

Rejection hasn't deterred the German company's determination, as it continues its pursuit with some other partners. Siemens also plans to concentrate on its current restructuring plan to trim $1.36 billion in costs, streamline the process, improve competitive strength, and increase profitability. Kaeser said that while GE and Alstom would invest years in making the tie-up reap benefits, Siemens would use the time in the best possible way to add to its competitive edge.

Foolish takeaway

It's true the joint ventures with Alstom have made things a little more complicated for GE than the prior proposal. However GE would gain Alstom's world-class energy assets, which is a great trade-off for the former. So, if deal terms had to be improved for winning the French engineering group for the kind of synergies and competitive edge that GE expects to gain, it could be worth it.