After increasing 1.3% for April, wholesales sales grew an additional seasonally adjusted 0.7% to $453 billion for May, according to a Commerce Department report (link opens a PDF) released today.

While wholesale trade is used as an indicator of economic strength, investors pay close attention to durable goods as a potential sign of more sustainable confidence (or lack of confidence). For May, durable goods sales edged up 0.2% month-over-month, but April's 1.6% boost was a tough act to follow. A 1.1% increase in automotive sales was the main reason May durable goods sales growth managed to stay in the black.

Nondurable goods sales increased 1.1%, the same as in April. May's growth came primarily from a substantial 6.6% jump in farm products.

Investors also keep a close eye on inventories. If factories are expanding their supplies, it could be a sign that wholesalers expect demand to pick up in the near future. For May, overall inventories grew 0.5%, just below analysts' 0.6% expectations. That was the weakest pace in five months as companies kept their supplies in line with slower sales.

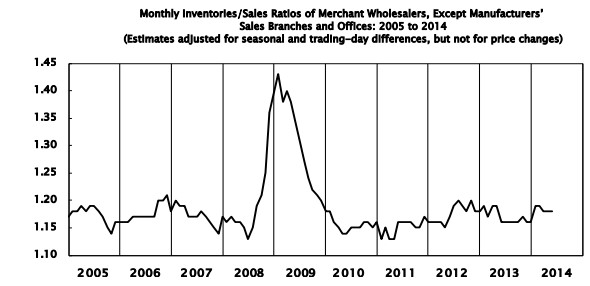

To understand the rate at which goods are being made and sold, economists compute an inventories/sales ratio. Since sales and inventories expanded relatively similar amounts for May, the inventories/sales ratio stayed steady at 1.18.

Source: Census.gov

-- Material from The Associated Press was used in this report.