Which company will make a winning hand for Foolish investors now? Photo: Melco Crown

Quarter after quarter of massive revenue growth continues to prove why investors making bets in gaming companies like Las Vegas Sands (LVS 2.86%) and Melco Crown (MPEL 3.04%) have been winning. However, between these two highly performing companies, which is the best bet now?

Let's first dive deeper into two trends that will continue to drive profits for these two companies over the next few years, mass-market gaming and the casinos coming in 2015. Then we'll look at their current valuations and make a play on Las Vegas Sands or Melco Crown.

More and more Mainland Chinese coming to Macau means huge gains for these companies. Source: Government of Macao Special Administrative Region, Statistics and Census Service

The mass-market bet

While companies in Macau used to focus mostly on VIPs, the high rollers of the gaming industry, a focus on the mass-market segment of the industry will drive future growth.

According to research by the McKinsey group, by 2022 more than 75% of China's urban consumers will earn between $9,000 and $34,000 per year, while 4% of the total Chinese population fell within that range back in 2000. Macau's gaming population consists mainly of mainland Chinese tourists, and these two companies have each benefited from this influx of visitors.

With advancements like a new bridge from Hong Kong to Macau, a better rail system that links separate parts of the island for faster transportation to and around the island, and a digital passport that allows Chinese citizens entry and exit into and out of Hong Kong and Macau, there is reason for bullishness on increased visits.

These are five trends that Las Vegas Sands executives pointed out to drive growth from 2014-2019.

Source: Sands 2013 year end earnings presentation

With increased wealth and leisure travel spending by mainland Chinese, along with better transportation, these companies are betting even bigger on the mass market by adding rooms and family attractions such as live shows and better retail experiences. Melco Crown has already made its bet on the mass market, and currently derives more than two-thirds of its EBITDA from this segment.

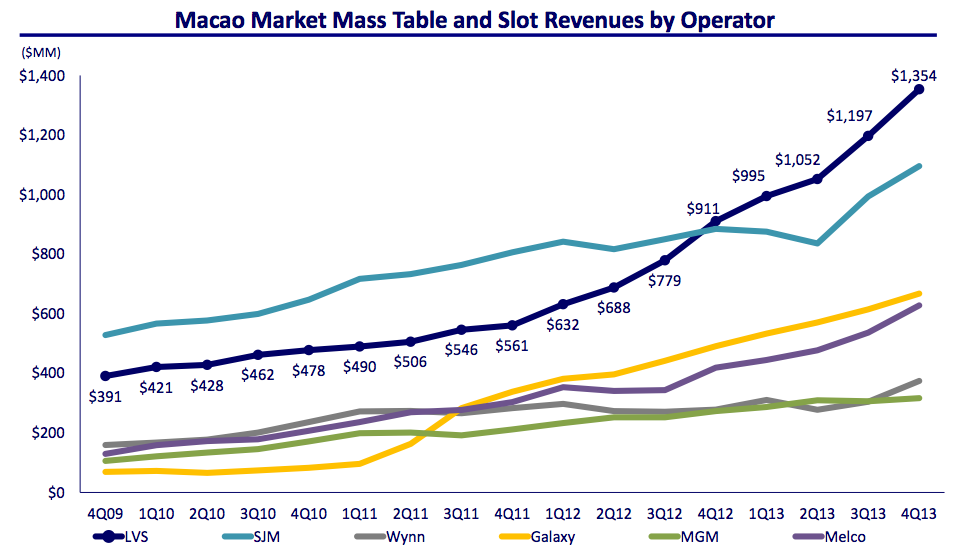

However, Las Vegas Sands is doing this best with an estimated 22% market share in Macau. Mass-market table revenue was up 58% for Sands in the fourth quarter 2013 over the same period last year, according to the company's 2013 year-end results. This continued to put Sands at the top of the industry in mass-market growth as it captured more of it than any other Macau operator over the last five years.

Source: Sands 2013 earnings presentation

One major way in which the companies are supporting the growth of the mass market is with new casinos opening on the Macau strip next year. The coming casinos are the next reason to bet on these two companies, though once again, one is doing it better than the other.

The coming casinos

The main area in Macau spurring new growth and profits is the Cotai strip. The area has seen near-constant development as casino companies build bigger and better resorts, most of which will open in the next year or two.

Melco Crown's CEO Lawrence Ho has continued to drive growth in this quickly expanding company. Photo: Bloomberg

Melco Crown's Studio City casino, a cinematically-themed integrated resort on the Cotai strip, is set to open in summer 2015. With 500 gaming tables, more than 1,500 slot machines, a five-star hotel, a shopping mall, and more, the company hopes that this resort will drive an influx of mass-market visitors.

Analysts have said that Studio City will be the "best situated" resort on the Cotai strip, as it will be directly adjacent to the Lotus Bridge that connects the strip to mainland China and on a proposed stop for the new intercity light rail coming next year.

However, even more exciting is Las Vegas Sands' new casino that will open at the same time. The casinos on the strip owned by Sands, such as The Venetian Macao and the Sands Cotai Central, have already posted solid growth and revenue. Sands Cotai Central for example reported a 61% jump in revenue and a more than 250% surge in operating income during 2013.

The coming Parisian resort on Cotai, the biggest of the coming casinos. Photo: Las Vegas Sands

Now, the company's newest resort,The Parisian, promises to be even more spectacular than its two predecessors. This $2.7 billion Integrated Resort will include over 3,000 hotel rooms and suites, around 450 table games, 2,500 slots, a retail mall, and a replica of the Eiffel Tower at 50% scale. More property on the strip will mean more revenue. This will become even more true as the number of mass-market gamers strolling the Cotai strip increases in the coming years.

A smart bet: Diving into earnings and estimates

Both companies have reported pretty incredible first-quarter revenue growth this year, following already robust 2013 final numbers. Melco Crown, a pure Asian gaming bet from Hong Kong with no US holdings, posted first-quarter 2014 net revenue and adjusted property EBITDA increases of 19% and 31% year over year, respectively. Analysts have set an average price target for Melco Crown near $50.

Las Vegas Sands managed to do even better. The company's first-quarter 2014 revenue of a record $4.01 billion, up over 21% year over year, was also the highest in the industry. The company's huge bet on Macau paid off with nearly 50% EBITDA growth at its operations there.

|

Melco Crown |

Las Vegas Sands | |

|---|---|---|

|

Total Q1 Net Revenue |

19% Growth YoY |

21.4% Growth YoY |

|

Q1 China EBITDA |

31% Growth YoY |

49% Growth YoY |

|

Share Price (July 4) |

$34 |

$75 |

|

P/E (TM) |

23 |

25 |

|

Dividend yield |

1.5% |

2.7% |

With the highest revenue growth in the first quarter of 2014 in the whole industry, and a stock price of around $77 with an analyst target in the high $90s, Las Vegas Sands could be very profitable for Foolish investors who are willing to make the bet now.

Foolish final bet

Las Vegas Sands crushed this quarter thanks to its revenue growth which mostly came from Macau. However, consider that Las Vegas Sands actually reported relatively poor results for its operations in the US. Because Asia is the sole profit driver for both companies, it might make sense to be bullish on an Asian pure-play that is competing to be the top gaming company in the region. Melco Crown is that company.

However, for profitability, a proven track record in winning the mass market, and incredibly profitable casinos on the Cotai Strip, Las Vegas Sands still appears to be the smartest bet.