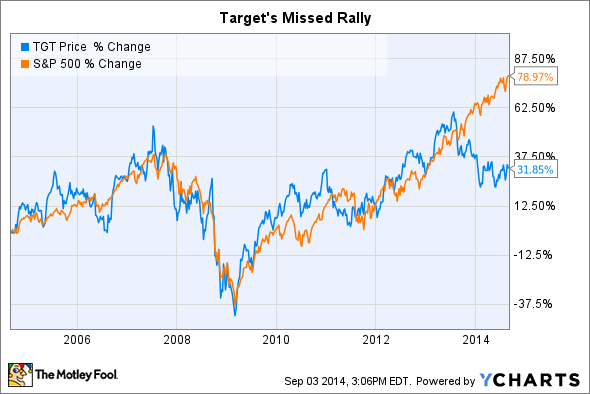

By the shape of the stock chart, investors apparently aren't expecting much from Target (TGT +1.50%) as we head into the crucial holiday shopping season. The retailer's shares have been trailing the market since last fall, leading to a significant break from the broader S&P 500 recently.

There are some good reasons for that underperformance since late last year. Target last month sliced its annual earnings guidance for a second time after posting weak second-quarter results. Sales in the United States will rise by as much as 1% in 2014, the company said, as compared to the 3% annual growth that investors are used to seeing. And that's at the high end of management's forecast. Profit should be even softer thanks to a rough selling environment at home and a costly expansion into Canada that hasn't gone to plan.

On the other hand, investors who want to bet on a Target rebound won't have to pay much for that opportunity. Sure, the stock looks expensive on a price/earnings basis. Sporting a P/E of 25, Target has leapt away from Wal-Mart (WMT 0.09%)'s valuation and is even approaching that of Costco (COST +0.76%), the champion of retailing these days.

WMT P/E Ratio (TTM) data by YCharts.

But using a price/sales valuation, which strips out those profit-sapping Canada losses, Target doesn't look nearly that expensive. In fact, the retailer is cheaper than it has been in years on that basis, roughly even with Wal-Mart and Costco.

TGT PS Ratio (TTM) data by YCharts.

Still, for a more complete look at these retailing heavyweights, we also need to consider sales growth and profitability. Here is how they stack up against each other by all four metrics.

| Metric | Target | Wal-Mart | Costco |

| Comparable-store sales | 0% | 0% | 5% |

| Gross margin | 30% | 25% | 11% |

| Price/earnings | 25 | 16 | 27 |

| Price/sales | 0.5 | 0.5 | 0.5 |

Source: company financial filings.

You can see that Costco is the only retailer in our group that is posting solid sales growth. Profitability is much lower, though, thanks to Costco's membership-based business model. In contrast, Target and Wal-Mart haven't seen any sales improvement in the U.S. over the past year, and that sluggishness is expected to continue through 2014. Target's higher profitability has traditionally made it a more expensive stock, but that has changed a bit since its data breach struggles last year, and since the Canada expansion went from bad to worse.

The case for Target

However, as of last month there is new leadership at the helm, and Target CEO Brian Cornell is cooking up big changes in Canada and a fresh growth plan in the United States. Some bright spots are also starting to show up in the business, including a return to modest sales growth in July and less cautious spending behavior on the part of Target's customers.

These changes should make the stock an attractive option for investors who don't like Wal-Mart's lower profitability and would rather not pay a big premium for Costco's consistent growth.