The controversial Keystone XL pipeline project has ended up before the Nebraska Supreme Court, where the seven-person body will address an earlier decision by a lower court that allows the governor to approve the project instead of the Public Service Commission.

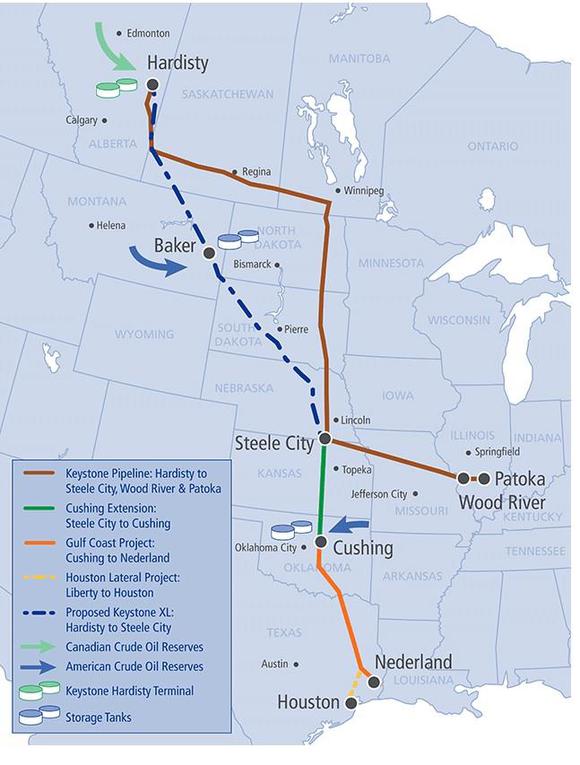

The 1,179 mile pipeline, to be built by TransCanada (TRP +1.45%) at a cost of $5.3 billion, would transport 830,000 barrels/day (bpd) from Alberta to refineries in the Midwest and the Gulf Coast. In the process, it would reduce dependence on oil imports from volatile countries such as Venezuela and the Middle East by as much as 40%.

Source: keystone-xl.com.

Because the pipeline crosses an international border, the U.S. State Department must approve plans to build the pipeline. Despite the fact that a State Department Environmental Impact Statement released on March 1, 2013 found "there would be no significant impacts to most resources along the proposed Project route," environmentalists continue to oppose the project, citing concerns over potential contamination of water resources along the proposed route and increased usage of Canada's famous tar sands (estimated to hold up to 2.5 trillion barrels of oil).

Speaking about her concerns regarding climate change (tar sands production releases far more CO2 than regular oil production) Jane Kleeb, an anti-pipeline activist told Fox News, "Why should we allow Canada to continue to mine this kind of fossil fuel, which we know is only going to harm the climate?"

On the other hand, Nebraska Attorney General Jon Bruning argues, "This pipeline has been so over studied and over analyzed, and we've looked over every single square inch of dirt that it's going to cross over... I think it's time to build it."

Joining Mr. Bruning are Governor Dave Heineman, labor unions, and even the Oracle of Omaha himself, Warren Buffett. The CEO of Berkshire Hathaway (NYSE: BRK-B), which bought the nation's second largest railroad, Burlington Northern Sante Fe (BNSF), for $44 billion in 2009, told CNBC, "I think probably the Keystone Pipeline is a good idea for the country."

Buffett's competing interests

Burlington Northern is the second largest railroad in America, second only to Union Pacific (UNP +0.64%), which Berkshire once owned 2% of, but was forced to sell to gain regulatory approval for the BNSF deal.

Berkshire has been minting money from BNSF's increased transport of of crude oil, now up to 600,000 barrels/day worth, a tenfold increase since just 2010.

This is because, according to a February 2014 Congressional research report, it costs $10-$15/barrel to transport oil by rail vs $5 via pipeline.

As this chart from the Energy Information Administration shows, the use of rail for transporting oil has exploded in recent years, thanks primarily to a 20-fold increase in oil production from North Dakota's Bakken shale. According to the North Dakota Pipeline authority, 60%-70% of North Dakota's crude is transported via rail because of insufficient pipeline infrastructure.

Who's cashing in?

Other than Berkshire's own BNSF (which runs about a third of America's oil trains), Union Pacific, Canadian National Railway (CNI 0.50%), Norfolk Southern (NSC +0.16%), and CSX (CSX +0.06%) are all profiting from the crude-by-rail boom, which has seen the annual number of carloads soar from just 50,000 to as many as "a million carloads a year in the next year or two," according to Toby Kolstad, president of the consulting firm Rail Theory Forecasts.

In fact, CSX saw its annual number of oil train car loads increase 360%, from just 10,000 in 2012 to 46,000 in 2013, while Union Pacific saw its carloads increase 58-fold in just three years, from 2,400 to 140,000.

Meanwhile, Norfolk Southern is profiting by moving oil from the Bakken through its rail system that's focused primarily on the mid-Atlantic and Northeast markets. "We offer the shortest and most direct route to the East Coast [...] Our crude network is very resilient due to the existence of multiple tracks and large, evenly distributed rail yards," said a company spokesman.

Berkshire is also profiting through its ownership of Union Tank Car, which builds oil tanker cars. Trinity Industries (TRN +0.55%) and American Railcar Industries (NASDAQ: ARII), the two largest tank car manufacturers, are reporting record orders. Trinity, for example, has a backlog of 41,265 tank cars worth $5.1 billion, while American Railcar reported second-quarter earnings and revenues were up 36% and 49%, respectively, on the back of insatiable demand for railcars.

This is because "people who want to ship oil can't get them," according to Mr. Kolstad. "They're desperate to get anything to move crude oil."

The downside of crude-by-rail

Unfortunately, that desperation to move oil is resulting in a great many accidents, with no less than seven oil train derailments between July of 2013 and April of 2014, which killed 47 people.

According to a report from the U.S. State Department, transporting oil by rail is 287 times as dangerous and results in 85 times as many deaths as pipeline transportation.

Mr. Buffett is acutely aware of the problem and has pledged BNSF will purchase 5,000 new tank cars this year with improved safety features that exceed the latest industry standards. The rest of the industry is responding with more safety inspections and slower speeds. Meanwhile, the U.S. Department of Transportation is proposing new regulations beginning in October of 2015 that would require thicker steel on tanker cars and retrofits of existing ones.

Why Buffett thinks pipelines are good for America

Given that numerous studies have found that pipelines are preferable to rail, in terms of safety, cost, and environmental risk (both to the climate and the Ogallalla aquifer) it's easy to see why Buffett supports the Keystone XL pipeline.

After all, the economic benefits of such infrastructure are vast. For example, according to research and analysis firm IHS, investment in America's energy industry is expected to be $890 billion through 2026, which could add as much as .75% annually to US GDP growth.

Meanwhile, analyst firm McKinsey estimates that the energy sector could add 1.7 million new, high-paying jobs by 2020 alone.

With August's jobs numbers coming in 36% below analyst expectations, the benefits of expanding America's energy infrastructure and the job growth it would create, are something President Obama, policy makers, and environmentalists should keep in mind.

Pipelines alone can't solve the problem

Some may still be wondering, "but why would Buffett be in support of a controversial pipeline that is direct competition with his interests?" The answer to that is two-fold.

According to Scott Sheffield, President and CEO of Pioneer Natural Resources, America may soon be producing 14 million barrels/day of oil, 4.5 million barrels more than the EIA predicts we'll produce in 2016.

The simple fact is that building sufficient pipelines quickly enough to transport that ocean of crude isn't feasible, not when pipelines such as Keystone and Kinder Morgan's TransMountain pipeline continue to face strong political, legal, and environmental opposition.

Another thing to consider is that Buffett's interests, while seemingly in conflict with pipelines through Berkshire's owning of BNSF railroad, actually leave him heavily invested in pipelines as well. For example, through the Kern River Gas Transmission company and Northern Natural gas, subsidiaries of Berkshire Hathaway Energy, Berkshire owns 16,400 miles of pipelines. These are gas pipelines, not oil, however Wall Street analysts such as Robert W. Baird & Co think that Buffett could be interested in purchasing midstream MLPs, such as Plains All American Pipeline (PAA +2.29%) and its general partner Plains GP Holdings (PAGP +2.00%), adding to Berkshire Hathaway's growing energy empire.

Plains All American owns 16,900 miles of oil pipelines, and should Buffett purchase it (or any other oil pipeline companies), the last think he wants to do is publicly decry new pipeline construction, since it would hamstring Berkshire Hathaway Energy's future growth potential.

Foolish takeaway

Warren Buffett's support of the Keystone XL pipeline stems from his knowledge that the American energy revolution is a major boon to the economy and is large enough to keep pipelines and oil trains busy for years to come. In addition, Berkshire's substantial current and potential future interest in pipelines show us why Buffett would support their continued expansion.