Source: Oracle.

Last month, Oracle (ORCL 0.22%) shocked the investing world as longtime Chairman and CEO Larry Ellison announced a huge corporate shakeup, vacating the CEO spot in favor of co-chief executives Mark Hurd and Safra Catz. Between the shift in the C-suite and the company's disappointing financial results for the quarter, most analysts paid little attention to Oracle's announcement that it had authorized a stock repurchase plan under which it could spend as much as $13 billion on its shares. Given the software giant's struggles in the industry, though, some wonder whether buybacks are the best use for Oracle's capital. Let's take a look at Oracle's past share repurchases and whether the new buyback plan is likely to pay off.

Has Oracle done a good job with its past buybacks?

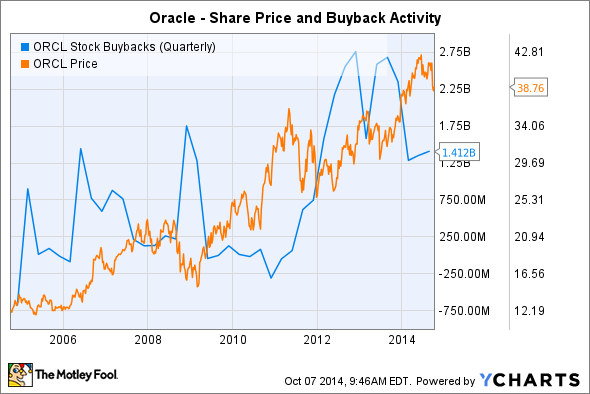

When you look back 10 years, you can see that Oracle has done a pretty good job of timing its buybacks. Major repurchases in 2005 and 2006 took advantage of relatively low share prices immediately before a run-up that resulted in Oracle stock doubling, and the company also took advantage of the 2008 bear market to increase its buybacks as well.

ORCL Stock Buybacks (Quarterly) data by YCharts

Since the financial crisis, Oracle has also been sensitive to its share price in timing buybacks. Huge increases to buyback activity in 2012 came at a time of weakness for the stock. In fact, this most recent repurchase authorization is a departure from past practice as it comes when the stock has been strong.

Should Oracle actually spend its money on buybacks?

A big stock buyback can help drive share prices up in the short run. But if they lead to less money being available for internal growth, then buybacks can backfire.

Recently, Oracle has faced some major challenges. Growth in revenue has slowed to a standstill in recent years, in stark contrast to software rival Microsoft (MSFT 0.37%) and its stronger sales growth since 2010. Moreover, even though Oracle still sports high gross margins, they've also largely stopped climbing, even as IBM (IBM 1.05%) has pushed its own margins higher by refocusing its efforts on more lucrative business segments.

Oracle headquarters in Redwood City, California. Credit: Wikimedia Commons.

One obvious area that Oracle could emphasize is its presence in cloud computing. The cloud segment is one of Oracle's fastest-growing market niches, but it also gets just a tiny amount of its overall revenue from the cloud. Compared to the pace at which IBM and Microsoft have shifted their attention to cloud-based solutions, Oracle has been slowing coming out of the starting block. By acquiring hospitality- and retail-industry technology provider MICROS Systems for about $5 billion, Oracle hopes to jump-start its cloud business. Buybacks don't appear to be hampering Oracle's acquisition efforts.

Moreover, despite an increase in debt over the past couple of years, Oracle still has a healthy balance sheet with plenty of cash and short-term investments on hand. Even with a large buyback program, Oracle should still have a full range of potential strategic options at its disposal should the right opportunities arise.

Should Oracle boost its dividend?

Another option Oracle would have to return capital to shareholders would be to pay a dividend. With a current yield of just 1.3%, Oracle looks stingy from an income perspective compared to Microsoft, IBM, and other large tech companies.

Still, Oracle has made big strides on the dividend front since making its first payout in 2009. Since then, the company has more than doubled its quarterly dividend payments. Yet one thing the company hasn't embraced is the practice of regularly increasing its dividend every year. Ellison's huge stake in the company explains some of that reluctance, given the tax impact of dividends on his portfolio. Yet at least small dividend increases would be enough to satisfy many investors.

Will Oracle's buyback pay off?

The key to remember with this latest buyback authorization is that Oracle doesn't have to repurchase shares if it doesn't want to. If the stock keeps climbing, Oracle might be better off leaving its authorized funds untouched, especially in light of the overall market's shakiness. If a broad correction hits Oracle shares, though, following through on the buyback at that point could be hugely profitable.